The interview with Cheah Cheng Hye took place in February, and this article was published in the April edition of Pulses.

IT’S NOT often, if at all, that a fund manager declares that his company has made mistakes in a third of its investment decisions. But that’s what Mr Cheah Cheng Hye, 54, said -- and in a matter-of-fact way -- during a recent teleconference with Singapore journalists from his Hong Kong office.  Cheah Cheng Hye was born in Penang, worked in Singapore and made his fortune in HK.

Cheah Cheng Hye was born in Penang, worked in Singapore and made his fortune in HK.

Photo: Company“We are far from infallible. I’ve done a study of our decision-making process going back to 1993 and found that one third of the time, we made mistakes. One third were good moves and one third were neutral.”

He may sound like a fund manager which any investor looking for a place to park his money should quickly cross off his list. After all, error rates of that proportion are unheard of in any other industry.

But in equity investing, it is stellar performance if you make lots of money on the decisions that turned out fine and lost not too much on those that went sour.

That is the case for Mr Cheah, co-founder of Value Partners. The asset management firm is listed on the mainboard of the Hong Kong Stock Exchange and had a market capitalization of about HK$4 billion as of early February this year. In 2007 and 2008, it was rated as the second largest hedge fund manager in Asia by Alpha Magazine.

Not for nothing has Mr Cheah, who owns 36 per cent of Value Partners and is its chairman and chief investment officer, been billed as the ‘Warren Buffett of the East’ by some media in Hong Kong

It has attracted money from all over the world. The United States and Europe account for 40 per cent of the US$3.2 billion assets under management. Hong Kong accounts for about 50 per cent while China and the rest of Asia, 7 per cent.

In terms of client categories, about 82 per cent of all the assets under management came from institutions such as insurance companies, banks and conglomerates. The predominance of institutional clients helps explain why net redemption for Value Partners’ funds was only 4 per cent in the first nine months of 2008.

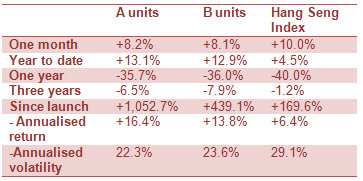

The sparkling performance numbers: Value Partners has delivered a 16 per cent per annum compounded gain to its clients since 1993 when it was founded. In the last 10 years, including the disastrous 2008, the gain was 20.3 per cent a year compounded.

On a yearly basis, Value Partners Classic Fund has made money in 12 out of the last 16 years of its existence. Last year was one of those four terrible years. The fund lost 47.9 per cent net – and that’s after selling down some stocks ahead of the crisis turning full blown.

Mr Cheah said: “We sold down China shares towards the end of 2007 because we couldn’t find any good ideas but we didn’t anticipate such a big global financial crisis was coming. We were shocked.”

Last year aside, why is that intense analysis of reams of financial statements, lots of visits to companies and interviews with management can still lead an investor like Value Partners to make wrong conclusions about some stocks?

In Mr Cheah’s words: corporate governance. Yes, this has been one sticking issue plaguing China stocks, especially the mainland-listed ones. S-chips in Singapore have not been spared either.

Said Mr Cheah: “If you isolate the mistakes of Value Partners, the single largest reason we find is our poor judgment of management’s integrity and quality. We thought the guy was honest but he turned out to be a crook.”

Value Partners’ track record has not improved in recent years. “Unfortunately no. But it’s not deteriorating either. It’s as bad or as good as before,” said Mr Cheah in yet another moment of his endearing tell-it-like-it-is way of talking.

“We really try hard to improve. I have even appointed myself as the QC (quality control) guy. If my fund managers want to buy beyond a specific amount, they need my approval. But it doesn’t seem to help. It could be like illnesses – the causes are many and if you fix a flu, the next thing that happens may be a stomach ache.”

He agreed to a suggestion that there’s randomness in the market, adding: “Yes, and the bad guys also come up with new ways to fool you!”

| ♦ Turned out to be a crook |

“If you isolate the mistakes of Value Partners, the single largest reason we find is our poor judgment of management’s integrity and quality. We thought the guy was honest but he turned out to be a crook… “We are talking about a generation of people who are in their 40s and 50s now and are captains of industry. They came out of the Cultural Revolution when values collapsed. These are people who don’t necessarily want to play by the book.” -- Cheah Cheng Hye |

At a deeper level, there is something about how Chinese society has evolved that helps to explain further the relatively low level of corporate governance in China, particularly in the small and mid-cap stock segments which Value Partners invests in.

As Mr Cheah put it: “We are talking about a generation of people who are in their 40s and 50s now and are captains of industry. They came out of the Cultural Revolution when values collapsed. These are people who don’t necessarily want to play by the book.”

It’s something that could go away, or diminish, over time. “As they get richer and have more at stake – in terms of reputation and wealth – they would be less and less naughty. They want to be more and more respectable, which means our stock investing risks go down.”

The corporate governance challenge is not absent but is far less pressing when it comes to investing in China companies listed in Hong Kong. “It is a well regulated market. People have learnt the hard way that it makes no sense to ‘play a fool’ with Hong Kong regulators, as they will come down hard on you,” said Mr Cheah.

Whether it’s China stocks or any other stocks, should equities figure in one’s investment portfolio in these treacherous times? “The average investor should only put a proportion of his money into equities. I believe that the potential risk-versus-opportunity situation today does not encourage an all-equity approach,” said Mr Cheah.

“For myself, I would want to have a spread of money in cash, tangible assets like gold, and equities spread across different classes and geographic regions. No one can predict with any certainty what the world will be like two to three years from now.”

Value Partners has made good money on the China story in the last 16 years, and the story continues to be seductive to Mr Cheah.

“For the proportion of your money that is invested in equities, I believe it should be in China-related stocks. I look at the map of the world and I’m unable to find any other major equity market that excites me or fills me with hope. This is a market I know very well: I have devoted 20 years of my life to it.”

And among the important things that he is sure of, it is that the renminbi is going to resume its rise. “It will go up because America wants it to go up and because it’s in China’s self-interest for it to go up. You don’t want to go out of your way to annoy the US and if it’s not against your self-interest, why not let it rise? This is also one of the ways that China can help stimulate domestic consumption.”

To nudge home his point, Mr Cheah added: “I’ll buy you lunch if the renminbi is not higher next year than where it is today.”

The China story looks strong for the medium term at least, though the global financial crisis is not likely to go away anytime soon, he said. “You will see numbers for China getting more encouraging. The worst may be over. China can afford to spend its way out of the present problem.”

The over-stocking of raw materials in China in the middle of last year to fuel an economic boom has now given way to drawn-down inventories. Imports of iron ore and coal are picking up again.

“China stocks have now discounted miles of bad news, real or otherwise. If you accept that China is going to grow 8 per cent this year, there are many businesses that will benefit from it. We are active buyers. We are surprised that it’s difficult to get sufficient supply of stocks at certain levels. It’s a bullish thing to note.”

In the longer-term, China has to reinvent is economy from being export-dependent to being underpinned by domestic demand. The country’s policy direction is pushing China banks to lend out more money, which could sow the seeds of bad loans in two or three years from now, according to Mr Cheah.

Even as it keeps an eye on the far future, Value Partners continues to do a lot of legwork to uncover gems of stocks. Last year was no different. “In the last couple of years, we have done about 2,000 company visits a year – excluding phone calls. We have done this in good and bad times. We have 18 full-time professionals, whose average age is in the early 30s. As far as I know, we do more company visits than any China team in the world.”

Value Partners deems itself to be a value investor seeking stocks with low price-earnings ratios and high dividend yields of at least five per cent. Whichever industry it finds such stocks, it will buy them.

“We don’t limit our stock picks to any industry. Our job is to buy the 3Rs – the right business run by the right people and selling at the right price. At the moment we are finding the 3Rs in a broad spectrum of businesses across China.”

According to Bloomberg data, among the S-chips that Value Partners owns are China Lifestyle (35 million shares), Pacific Andes (91.4 million shares) and China Essence (22.8 million shares) as at the time of writing in mid-February.

Value Partners looks prudently managed: It has over HK$500 million parked in fixed deposits, zero debt, and its fixed overhead expenses are covered by management fees that it collects by more than two times over.

Value Partners is an actively managed fund that charges a management fee and performance fee. Mr Cheah suggested that investors who are ‘fee-sensitive’ could turn to index funds invested in China stocks and passively track China market indices.

Those who want to invest directly in equities should go for large-cap stocks because these are more liquid than small caps. There is also far less likelihood of big companies being led by crooked management.

Cheah Cheng Hye. Photo: http://citywireglobal.com/

Cheah Cheng Hye. Photo: http://citywireglobal.com/

Cheah Cheng Hye: His inspiring story

Being successful in spotting gems of stocks has made Mr Cheah far wealthier than he could possibly have dreamed of when young. After his father died when he was 12, he and his two brothers had to support their mother. “We were the poorest of the poor,” he said.

While attending Penang Free School, a top-notch institution, he sold pineapples by the roadside in his free time. He quit school after his 0-level because he could not afford to continue his education, not unlike many of his peers.

Mr Cheah worked as a reporter at The Star in Penang before moving to Singapore to the now defunct Singapore Monitor. His journalistic career next took him to, among others, Far Eastern Economic Review and the Asian Wall Street Journal in Hong Kong.

His standout moments included breaking the news in 1983 that Hong Kong was planning to peg its currency to the U.S. dollar, and covering the fall of Philippines president Ferdinand Marcos in 1986 and revealing that the country’s central bank had been tampering with its financial records.

Former journalist in Singapore

One day, his life took a major turn when he was introduced to Mr Hsieh Fu Hua, then the head of Asian investment bank Morgan Grenfell, and now CEO of the Singapore Exchange.

It was one of many lucky breaks in his life. “I didn’t have any master plan or ambition. The downside for me as a result of going to Morgan was low as I could always return to my journalist job.’

| ♦ Expert in learning how to learn |

“I am an expert in learning how to learn. I learn things very quickly. I am self-motivated and I see life as an adventure for my intellect and career. I have a permanent restlessness and a desire to conquer new fields.” -- Cheah Cheng Hye |

But he reckoned he could wing it as there is a huge overlap between financial journalism and equities market analysis. With that, he joined Morgan in 1989 as head of research, focusing on mid and small caps. For the technical stuff he was not good at, he let younger and more qualified subordinates to handle.

“As a former journalist, I had an advantage over people who were purely financial people. I learnt to put events in a historical, political and social context. Many people with CFAs or MBAs are narrow in that they tend to interpret reality through quantitative and statistical analysis.”

Another lucky break led him to something really big in his life. He had acted as a consultant to the family business of Mr Yeh V-Nee, now 49. The two went on to join forces and launch Value Partners in 1993 with US$3 million from their savings and contributions from friends and former clients.

He may attribute a lot of his success to lucky breaks, but Mr Cheah has a trait that helped a lot too. “I am an expert in learning how to learn. I learn things very quickly,” he said. “I am self-motivated and I see life as an adventure for my intellect and career. I have a permanent restlessness and a desire to conquer new fields.”

If there’s one area he hasn’t quite succeeded in, it’s learning Mandarin. “My Mandarin is no good. I have a vocabulary of probably only 2,000 words. I took tuition but have seldom stayed more four or six months in any particular class before dropping out.

”I’d need someone’s help to translate anything that’s elaborate. In recent years, thankfully, it has become more common for me to encounter people in China who are eager to speak English.”

One thing he had little time to talk about was his lifestyle. Ms Chrissy Teng, the managing director of Value Partners’ office in Singapore, offered some insights, saying that Mr Cheah, who likes golf, is married with two sons aged seven and nine.

He is into meditation to relieve any stress he might experience and to help him maintain clarity of thought. For the last 10 years, he has meditated for an hour almost daily before going to sleep. On plane journeys, and that’s pretty frequent, he would meditate too.

Reflecting his deep desire to learn, his signature from high school days has been a stylized form of the word ‘learn’.

Mr Mark Lee, a director of Hong Kong-based Aries Consulting which organised the teleconference, observed: “Mr Cheah is unassuming. He does not try to impress. At least that’s my impression after I was with him in his office for more than an hour. That day, he was wearing a "Crocodile" brand sweater. Probably his style is to go for value for money, instead of expensive fashion.”

For his part, Mr Cheah said that unlike most people who sought to make as much money as possible, he “had always come from the opposite angle - that you must be passionate about what you do and be very good in it. The money will come naturally.”

This article appeared recently in Pulses magazine and is reproduced here with permission.