WORLD PRODUCTION of natural rubber is growing at around 1% or 2 % a year but for Goodpack, there is a big market out there for transporting rubber using its steel boxes.

Called Intermediate Bulk Containers (IBCs), these boxes are environmentally friendly as they can be re-used for as long as 15 years.

They are enabling Goodpack to gain market share from those who transport rubber using wooden crates, which are discarded after being used a few times.

Singapore company Goodpack now controls about 40% of the natural rubber market, and has begun to target the synthetic market which it has just 6% of.

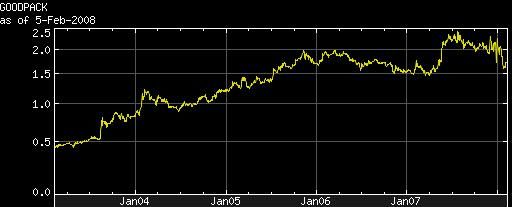

So despite the 1-2% growth in global rubber production, Goodpack has consistently reported rising sales and profits by expanding its market share. The latest set of results, for the half-year ended Dec ’07, was no different (see chart and table).

| Half-year FY ’07 (ended Dec ’06) | Half-year FY ’08 (ended Dec ’07) | % change | |

| Revenue (US$ m) | 34.0 | 45.0 | +32.5 |

| Net profit (US$ m) | 11.0 | 14.6 | +32.1 |

| Basic EPS (US cts) | 2.74 | 3.17 | +15.7 |

| Net profit margin (%) | 32.4 | 32.4 | - |

Signing up Sinochem and Sinopec in China

Photo by Sim Kih.

In pursuing market share, Goodpack (market capitalisation: around S$750 milliion) has now won two new high-profile customers - Sinopec and Sinochem – in China where demand for rubber has grown, largely for making automotive tyres.

In 2006, China imported 1.6 million tonnes of natural rubber (up 14.6% year on year) and 1.3 million tonnes of synthetic rubber (up 19.2% year on year).

Sinopec is China’s largest producer and supplier of oil products and major petrochemical products such as synthetic rubber, synthetic fibre and rubber resin.

Sinochem is one of China’s leading producers of chemical raw materials, agricultural chemicals, rubber products and metallurgy.

For a start, Goodpack will provide IBCs for packing synthetic rubber for Sinopec and packing synthetic and natural rubber for Sinochem.

The IBCs will transport natural rubber from a country where it is produced to Sinochem’s factory in China. For Sinopec, the IBCs transport its synthetic rubber to a customer for use as a raw material.

Currently, Goodpack is offering its solutions to selected rubber production sites of Sinopec and Sinochem.

“But we envisage extending our offering to all their production sites in future,” said Goodpack chairman David Lam.

Not only that, Goodpack will seek to transport more of other products such as juices, pastes, and edible oils in China. Goodpack has become one of the largest shippers of apple juice out of China, the world’s biggest producer of the juice.

The business opportunities for Goodpack are increasing as China becomes more environmentally-conscious.

Half-year results

As sales rose 32.5% for the half-year ended Dec ’07, net profit rose in tandem at 32.1%.

Of course, costs and expenses have gone up with a rise in business volume, as reflected in the table below, but overall net profit margin has been unchanged at 32.4%:

| Half-year FY ’08 US$ |

Half-year FY ’07 US$ | Reasons given by management | |

| Logistics & handling costs | (16,124) +57.2% | (10,260) | Increase in business volume; high initial positioning and handling costs in serving new customers in synthetic rubber market. |

| Employee benefits expense | (3,520) +17.8% | (2,988) | Recruitment of additional staff for new subsidiaries |

| Depreciation & amortisation | (5,127) +38.6% | (3,700) | Increase in number of IBCs |

| Other operating expenses | (3,151) +42.6% | (2,210) | More marketing activities |

Goodpack full-year FY ‘07 |

|

| Price (S$) Jan 31 ‘08 | 1.62 |

| Mkt Cap S$m | 746.24 |

| Sales S$m | 106.62 |

| PE (Curr Yr Est) | 19.4 |

| EBIT growth % | 83.3 |

| Operating Margin % | 36.8 |

| Asset Turnover | 0.5 |

| ROE % | 22.5 |

| Return on Invested Capital % | 29.8 |

Source: Bloomberg, 31 Jan 2008

Among the figures in the above Bloomberg table, it is worth highlighting Goodpack's return on invested capital which was a sterling 29.8%. Its return on equity was impressive too at 22.5%.

Goodpack expects sales to continue to grow, especially in Europe and China.

The overall market is for it to carve out as it is very difficult for a competitor to emerge now, given Goodpack's 1.6-million IBCs and counting.