NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Olam -- sell

- MoneyWater

- Topic Author

- Visitor

-

13 years 3 months ago #12134

by MoneyWater

Replied by MoneyWater on topic Re:Olam -- sell

If an analyst calls a SELL on a stock, and the stock price plunges, will the analyst get sued? MW is entitled to state their opinion, and profit from it. I don't see why there is a need for Olam to take legal action. If there is no wind, there is no wave. As what Block says, Olam should address the concerns rather than being defensive.

Please Log in to join the conversation.

- Kiasu

- Topic Author

- Visitor

-

13 years 3 months ago #12144

by Kiasu

Replied by Kiasu on topic Re:Olam -- sell

2 points to note:

1. MW should come out with their so-called report if they do have one. This would clarify if they are right with their strong accusations or if it's the real norm with commodity-based accounting. Pse read what other analysts worldwide have to say ab such accounting, nothing new. However, these analysts can only guess what MW was trying to say or accuse, esp so when there is no MW report. Instead, MW came out with an open letter to the management. So, they do find some fault with their own analysis?

2. If you r the boss of a company and your competitor came out and say your company has a big accounting problem and will fail soon. (Competitor becos your failure is his success). The next day, all your customers and lenders disappeared. What will you do? This is a very sensitive subject and very different from the sell call by any analyst. Note it is about accounting issue, which have a big impact on the integrity and reputation of the whole management, including their auditors (and the latter r big names too)!

Just my 2 cents worth.

1. MW should come out with their so-called report if they do have one. This would clarify if they are right with their strong accusations or if it's the real norm with commodity-based accounting. Pse read what other analysts worldwide have to say ab such accounting, nothing new. However, these analysts can only guess what MW was trying to say or accuse, esp so when there is no MW report. Instead, MW came out with an open letter to the management. So, they do find some fault with their own analysis?

2. If you r the boss of a company and your competitor came out and say your company has a big accounting problem and will fail soon. (Competitor becos your failure is his success). The next day, all your customers and lenders disappeared. What will you do? This is a very sensitive subject and very different from the sell call by any analyst. Note it is about accounting issue, which have a big impact on the integrity and reputation of the whole management, including their auditors (and the latter r big names too)!

Just my 2 cents worth.

Please Log in to join the conversation.

- Oh Lam

- Topic Author

- Visitor

-

13 years 3 months ago #12153

by Oh Lam

Replied by Oh Lam on topic Re:Olam -- sell

Please Log in to join the conversation.

- Oh Lam

- Topic Author

- Visitor

-

13 years 3 months ago #12154

by Oh Lam

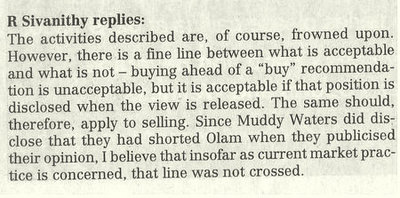

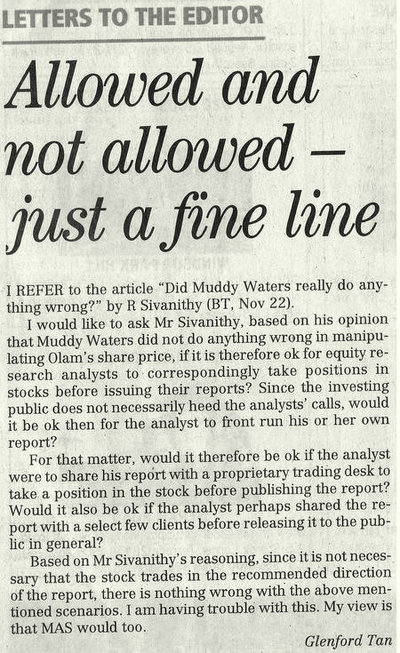

Replied by Oh Lam on topic Re:Olam -- letter to BT

Please Log in to join the conversation.

- Alicia

- Topic Author

- Visitor

-

13 years 3 months ago #12156

by Alicia

Replied by Alicia on topic Re:Olam -- letter to BT

Good points raised by Glenford Tan.

I think he is the same guy who works in BNP Paribas.

globalmarkets.bnpparibas.com/public/stat...mmons/contact_us.htm

I think he is the same guy who works in BNP Paribas.

globalmarkets.bnpparibas.com/public/stat...mmons/contact_us.htm

Please Log in to join the conversation.

- Moneywater

- Topic Author

- Visitor

-

13 years 3 months ago #12161

by Moneywater

Replied by Moneywater on topic Re:Olam -- sell

Re to Kaisu post, the onus is for the the customers / suppliers to verify that the information is real, rather than acting blindly based on untrue information from a competitor. The relationship with between a company and its customers / suppliers will not be as thin as a veil that can be broken by some unfound information. Coming back to the Olam case, Olam needs to have confidence on the workings of the stock market, as well as the wisdom of its investors. The commencement of a legal suit is unnecessary and overdone, and makes me more worried.

Please Log in to join the conversation.

Time to create page: 0.228 seconds