- Posts: 1089

- Thank you received: 25

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

2nd Liner Prop Stocks

12 years 5 months ago #15938

by Joes

Replied by Joes on topic 2nd Liner Prop Stocks

my friend fundtech loves LION TECK CHIANG:

Importantly, the company is consistently generating operating profit (less revaluation gains) over last few years, thus even if we taper profit expectations for the next fiscal year the NAV will likely go toward $1.60-1.70. OCF and FCF are positive, which will lead to an increased net cash position in next few years, assuming no major capex. (see earlier post on full-year results snapshot)

LTC has lots of landbank in Malaysia held at low land costs:

- Under "Properties under development", they have ~150 ha of land in Selangor which they are progressively developing and then put up for sale. Average cost is $2.2/psf.

- Under "Completed properties held for sale", they have ~17 ha in Melaka, JB and Selangor. Average cost is $8.8/psf.

- the company is progressively selling these properties.

Not the sexiest stock around, but I reckon its diversified businesses (Malaysia property, steel business, S'pore industrial rental and property) will generate decent outperformance of the STI over next few years. Importantly, the P/B valuation is low at 0.52 while operations are cash generative, should provide decent margin of safety. Also, the beta for the stock is less than 0.5, so it may not track day-to-day market movements and is much less volatile.

Importantly, the company is consistently generating operating profit (less revaluation gains) over last few years, thus even if we taper profit expectations for the next fiscal year the NAV will likely go toward $1.60-1.70. OCF and FCF are positive, which will lead to an increased net cash position in next few years, assuming no major capex. (see earlier post on full-year results snapshot)

LTC has lots of landbank in Malaysia held at low land costs:

- Under "Properties under development", they have ~150 ha of land in Selangor which they are progressively developing and then put up for sale. Average cost is $2.2/psf.

- Under "Completed properties held for sale", they have ~17 ha in Melaka, JB and Selangor. Average cost is $8.8/psf.

- the company is progressively selling these properties.

Not the sexiest stock around, but I reckon its diversified businesses (Malaysia property, steel business, S'pore industrial rental and property) will generate decent outperformance of the STI over next few years. Importantly, the P/B valuation is low at 0.52 while operations are cash generative, should provide decent margin of safety. Also, the beta for the stock is less than 0.5, so it may not track day-to-day market movements and is much less volatile.

Please Log in to join the conversation.

12 years 5 months ago - 12 years 5 months ago #16178

by Rich

Replied by Rich on topic 2nd Liner Prop Stocks

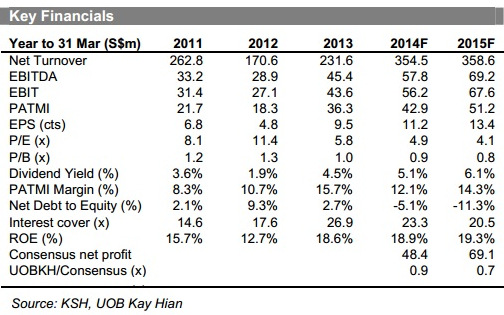

It's odd that people want to sell / shortsell KSH Holdings, given that:

1. Its 1Q profit was excellent : S$11,420,000 (+ 164.7%) yoy.

2. Upcoming interim dividend surely will be higher than the 1.35 cent paid out a year ago.

I expect....1.75 cents.

3. Final dividend also should be higher than the 1.15 cts paid in Aug 2013. Let's say...1.5 cents akan datang.

Total = 3.25 cents = ~6.7% yield on the stock price (48 cents )

The 3.25 cents is higher than UOB Kay Hian's forecast but consider that UOB KH is predicting 11.2 cents earnings per share. Surely 3.25 cents dividend is something KSH can afford to pay out !

1. Its 1Q profit was excellent : S$11,420,000 (+ 164.7%) yoy.

2. Upcoming interim dividend surely will be higher than the 1.35 cent paid out a year ago.

I expect....1.75 cents.

3. Final dividend also should be higher than the 1.15 cts paid in Aug 2013. Let's say...1.5 cents akan datang.

Total = 3.25 cents = ~6.7% yield on the stock price (48 cents )

The 3.25 cents is higher than UOB Kay Hian's forecast but consider that UOB KH is predicting 11.2 cents earnings per share. Surely 3.25 cents dividend is something KSH can afford to pay out !

Last edit: 12 years 5 months ago by Rich.

Please Log in to join the conversation.

12 years 5 months ago #16205

by sumer

Replied by sumer on topic Chip Eng Seng: Time line

Time line of CES' developments:

Now: Prive, its EC project (40% stake) has TOP. No profit has been booked previously because of accounting rules. Lump sum profit will be booked in Q3 results.

Now: Existing building at site of Tower Melbourne is being torn down. CES has gotten in to Melbourne earlier than Hiap Hoe, with TM about 80% sold and its earlier 33M project fully sold, proving it had been able to sell its Melbourne apartments despite big supply in the city.

Sep 13: Completion of purchase of San Centre. CES said it would refurbish building and rent it out for recurrent income. Perhaps it will monetize it at a later date?

Nov 13: Q3 results due out will incorporate lump sum profit from 100%-sold Prive.

Q4 13: Launch of Junction 9 and 9 Residences in Yishun. Market response will be keenly watched, especially that for the retail space.

End-2013: My Manhatten is expected to TOP. Cash inflow on TOP from this rather profitable project will be captured in full-year results, due in Feb 2014.

2014: Its EC project Belysa will TOP. No profit has been booked yet, so it will be a lump sum amount. Its DBSS project Belvia will also TOP in 2014. Again no profit has been booked. Profit from Belvia expected to be substantial.

2014: 100PP will TOP, perhaps in Sep 2014. More than 50% of the units have been sold.

2015: Alexandra Central expected to TOP. The big profits from the retail space sold here will be booked, again lump-sum; hotel will start to generate income. TOP of Junction 9 and 9 Residences also expected in 2015 or 2016.

2016: TOP of Tower Melbourne, as reported in one Aussie website.

Other developments (not sure about time line):

Launch of its Victoria Street (Melbourne) project (1,000 apartments) and its Perth project in Scarborough (in CEL Australia website).

Slow sales at Fulcrum, where less than 15% of units are sold. Perhaps company would do something to push for quicker sales. In any case, CES is not holding a lot of unsold Singapore properties. So the risk of it being severely affected by the slowdown in the residential market here is very low.

The above timeline shows the clear visibility of earnings for CES from FY 2013 to 2015. With earnings consistently high and a good history of generous dividend payout, I am expecting DPS of 3-4 cent for each of the next 3 years.

On the charts, however, there appears to be a breakdown. This has probably attracted traders and shareholders to short it down for now. Shorts probably targeted KSH and CES because they are liquid prop counters, and projecting that news headlines on prop sales are going to be negative going forward, it’s probably a good “macro” reason to short. I notice that illiquid counters like Roxy, Heeton and Superbowl are not falling as much, if at all.

On a macro level, I do not expect 2nd liner property stocks to be as badly driven down as they were in 2007/8 as most of them are now on much solid footing, having pre-sold bulk of their stock - few have substantial unsold units to worry about.

Nevertheless, stock prices are a function of many factors, and fundamentals are only one of them. Ultimately, it’s about demand and supply of scrip in a particular counter, and this could be due to speculation, overall market sentiment, shorting, etc.

Now: Prive, its EC project (40% stake) has TOP. No profit has been booked previously because of accounting rules. Lump sum profit will be booked in Q3 results.

Now: Existing building at site of Tower Melbourne is being torn down. CES has gotten in to Melbourne earlier than Hiap Hoe, with TM about 80% sold and its earlier 33M project fully sold, proving it had been able to sell its Melbourne apartments despite big supply in the city.

Sep 13: Completion of purchase of San Centre. CES said it would refurbish building and rent it out for recurrent income. Perhaps it will monetize it at a later date?

Nov 13: Q3 results due out will incorporate lump sum profit from 100%-sold Prive.

Q4 13: Launch of Junction 9 and 9 Residences in Yishun. Market response will be keenly watched, especially that for the retail space.

End-2013: My Manhatten is expected to TOP. Cash inflow on TOP from this rather profitable project will be captured in full-year results, due in Feb 2014.

2014: Its EC project Belysa will TOP. No profit has been booked yet, so it will be a lump sum amount. Its DBSS project Belvia will also TOP in 2014. Again no profit has been booked. Profit from Belvia expected to be substantial.

2014: 100PP will TOP, perhaps in Sep 2014. More than 50% of the units have been sold.

2015: Alexandra Central expected to TOP. The big profits from the retail space sold here will be booked, again lump-sum; hotel will start to generate income. TOP of Junction 9 and 9 Residences also expected in 2015 or 2016.

2016: TOP of Tower Melbourne, as reported in one Aussie website.

Other developments (not sure about time line):

Launch of its Victoria Street (Melbourne) project (1,000 apartments) and its Perth project in Scarborough (in CEL Australia website).

Slow sales at Fulcrum, where less than 15% of units are sold. Perhaps company would do something to push for quicker sales. In any case, CES is not holding a lot of unsold Singapore properties. So the risk of it being severely affected by the slowdown in the residential market here is very low.

The above timeline shows the clear visibility of earnings for CES from FY 2013 to 2015. With earnings consistently high and a good history of generous dividend payout, I am expecting DPS of 3-4 cent for each of the next 3 years.

On the charts, however, there appears to be a breakdown. This has probably attracted traders and shareholders to short it down for now. Shorts probably targeted KSH and CES because they are liquid prop counters, and projecting that news headlines on prop sales are going to be negative going forward, it’s probably a good “macro” reason to short. I notice that illiquid counters like Roxy, Heeton and Superbowl are not falling as much, if at all.

On a macro level, I do not expect 2nd liner property stocks to be as badly driven down as they were in 2007/8 as most of them are now on much solid footing, having pre-sold bulk of their stock - few have substantial unsold units to worry about.

Nevertheless, stock prices are a function of many factors, and fundamentals are only one of them. Ultimately, it’s about demand and supply of scrip in a particular counter, and this could be due to speculation, overall market sentiment, shorting, etc.

The following user(s) said Thank You: Mel

Please Log in to join the conversation.

12 years 5 months ago #16207

by sumer

Replied by sumer on topic 2nd Liner Prop Stocks

Hi Reck, yes I also think that KSH may dish out 1.5ct DPS when it announces its 1H results in November. I like the counter especially because it does not have any value trapped in physical buildings; all its value is in the future earnings of its pre-sold or unsold units.

This may mean that it is more able to pay out good dividends, since there is no value trapped in hotels, offices, etc.

I have been looking at selling patterns at CES and KSH and it's my opinion that there is some shorting going on, although I may be wrong.

This may mean that it is more able to pay out good dividends, since there is no value trapped in hotels, offices, etc.

I have been looking at selling patterns at CES and KSH and it's my opinion that there is some shorting going on, although I may be wrong.

Please Log in to join the conversation.

12 years 5 months ago #16210

by Damien

Replied by Damien on topic Chip Eng Seng: Time line

Hi! Do you think CES is a better company compared to Hiap Hoe? CES profit margins do not seem as good as Hiap Hoe in recent results. In fact, CES EPS has been dropping.What do you think?

Please Log in to join the conversation.

12 years 5 months ago #16218

by sumer

Replied by sumer on topic Chip Eng Seng: Time line

Hi Damien, assuming your questions are for me, here is my take:

CES earnings are volatile quarter to quarter due to the lumpiness of its earnings. In terms of full year profits, it had 2 exceptional years which are not repeatable. So, I am not concerned about its seemingly lower profits now.

I prefer CES to Hiap Hoe at the moment for the following reasons:

1. CES has a very good history of high dividend payout; much better than HH's.

2. It is much better in launching its products and selling them quickly.

3. It sold off its Alexandra Central retail shops rather than kept them. It's expected to do the same for Junction 9 at Yishun next few months. Retail space is very lucrative, if they are cut into bite sizes. HH kept all its retail space at ZP.

4. The habit of keeping assets may lead to value trap, whereas monetization of assets is what is preferred by stock players.

5. CES went into Melbourne first, and even then, it threaded carefully. HH's recent purchase of 3 sites one after another seems rather adventurous; but I will give HH benefit of doubt and wait and see, after all Melbourne land still looks rather cheap. My concern is that if they get it wrong, then there is going to be a lot of assets trapped Down Under.

6. I remember when HH was overly cautious about buying land the past 3 years, CES and Roxy were doing the opposite and this proved to be the right move. That makes me like Roxy and CES management more.

Having said there, there is potential for surprises at HH/SB, with some players betting on a privatisation of SB at least. This may, in turn, lead to a relook at HH.

HH also has a high RNAV of above $1.50, which ultimately could be monetized if ZP is packaged into a REIT or sold off.

In terms of sexiness, I would think CES looks more the part.

CES earnings are volatile quarter to quarter due to the lumpiness of its earnings. In terms of full year profits, it had 2 exceptional years which are not repeatable. So, I am not concerned about its seemingly lower profits now.

I prefer CES to Hiap Hoe at the moment for the following reasons:

1. CES has a very good history of high dividend payout; much better than HH's.

2. It is much better in launching its products and selling them quickly.

3. It sold off its Alexandra Central retail shops rather than kept them. It's expected to do the same for Junction 9 at Yishun next few months. Retail space is very lucrative, if they are cut into bite sizes. HH kept all its retail space at ZP.

4. The habit of keeping assets may lead to value trap, whereas monetization of assets is what is preferred by stock players.

5. CES went into Melbourne first, and even then, it threaded carefully. HH's recent purchase of 3 sites one after another seems rather adventurous; but I will give HH benefit of doubt and wait and see, after all Melbourne land still looks rather cheap. My concern is that if they get it wrong, then there is going to be a lot of assets trapped Down Under.

6. I remember when HH was overly cautious about buying land the past 3 years, CES and Roxy were doing the opposite and this proved to be the right move. That makes me like Roxy and CES management more.

Having said there, there is potential for surprises at HH/SB, with some players betting on a privatisation of SB at least. This may, in turn, lead to a relook at HH.

HH also has a high RNAV of above $1.50, which ultimately could be monetized if ZP is packaged into a REIT or sold off.

In terms of sexiness, I would think CES looks more the part.

Please Log in to join the conversation.

Time to create page: 0.282 seconds