- Posts: 4

- Thank you received: 0

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

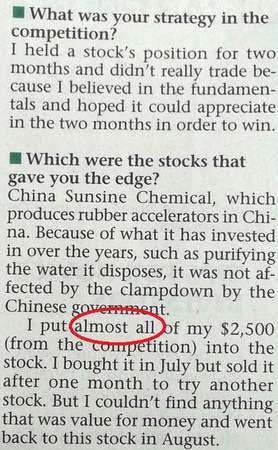

China Sunsine Chemicals

11 years 3 months ago #21191

by boonbibi

Replied by boonbibi on topic China Sunsine Chemicals

The company has just announced expansion of production capacity and I think the potential has not been factored in.

Also, the company may attract a higher PE soon. At 51c, it is only 5 times PE.

The perception of the co. as one of those crappy s-chip will slowly diffuse as more and more people trust that that the co. is really a world leader in rubber accelerator serving many international tyre companies.

The company is growing its product lines and expanding production capacity at very little incremental cost. Latest annoucement by company mentioned RMB3.5 mil for 4000 tonnes of MBTS annual capacity.

Another product line DCBS has been reactivated because the co. is able to reduce pollutive wastewater in the production. Investment is RMB9 mil for additional 8000 tonnes annual capacity.

The price (exclude tax) of MBTS now is about RMB 20500.That is RMB 82 mil sales a year for RMB 3.5 mil investment.

news.oilchem.net/x/553/110/4/2/4866075.htm

I am hopeful that more and more analysts will start to cover the stock.

Sale is increasing and PE may increase too.

Also, the company may attract a higher PE soon. At 51c, it is only 5 times PE.

The perception of the co. as one of those crappy s-chip will slowly diffuse as more and more people trust that that the co. is really a world leader in rubber accelerator serving many international tyre companies.

The company is growing its product lines and expanding production capacity at very little incremental cost. Latest annoucement by company mentioned RMB3.5 mil for 4000 tonnes of MBTS annual capacity.

Another product line DCBS has been reactivated because the co. is able to reduce pollutive wastewater in the production. Investment is RMB9 mil for additional 8000 tonnes annual capacity.

The price (exclude tax) of MBTS now is about RMB 20500.That is RMB 82 mil sales a year for RMB 3.5 mil investment.

news.oilchem.net/x/553/110/4/2/4866075.htm

I am hopeful that more and more analysts will start to cover the stock.

Sale is increasing and PE may increase too.

Please Log in to join the conversation.

11 years 3 months ago #21222

by Joes

Replied by Joes on topic China Sunsine Chemicals

To provide an update on the Company’s performance, the Company will hold a results briefing on Thursday, 13 November 2014 at 3.00 pm at FTSE Room, 9th Floor, Capital Tower, 168 Robinson Road, Singapore 068912.

Our Financial Controller, Mr Tong Yiping, will chair the briefing. Shareholders, investors, analysts and media friends are welcome to join us in this briefing. To register for the briefing, please send an email with name, contact and the name of company to jennie@ChinaSunsine.com by 5 November 2014.

infopub.sgx.com/FileOpen/CS_Notification...cement&FileID=320756

Anyone going? Pls share info after that. Ask tough questions. this one is S-chip! Kamsia

Our Financial Controller, Mr Tong Yiping, will chair the briefing. Shareholders, investors, analysts and media friends are welcome to join us in this briefing. To register for the briefing, please send an email with name, contact and the name of company to jennie@ChinaSunsine.com by 5 November 2014.

infopub.sgx.com/FileOpen/CS_Notification...cement&FileID=320756

Anyone going? Pls share info after that. Ask tough questions. this one is S-chip! Kamsia

Please Log in to join the conversation.

11 years 3 months ago #21241

by Joes

Replied by Joes on topic China Sunsine Chemicals

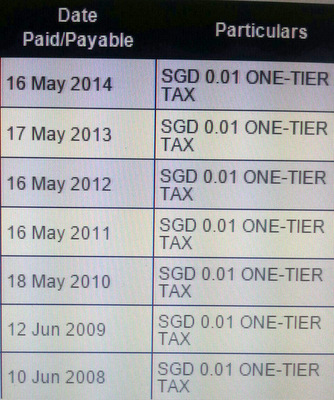

Real or not ? the profit so high!

The acid test is in the size of the dividend payout but that will only come after 4Q results.

The acid test is in the size of the dividend payout but that will only come after 4Q results.

Please Log in to join the conversation.

11 years 3 months ago #21245

by min1xyz

Replied by min1xyz on topic China Sunsine Chemicals

Please Log in to join the conversation.

Time to create page: 0.239 seconds