- Posts: 36

- Thank you received: 1

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Severely Undervalued Stocks

4 years 5 months ago #25871

by Joom

Replied by Joom on topic Severely Undervalued Stocks

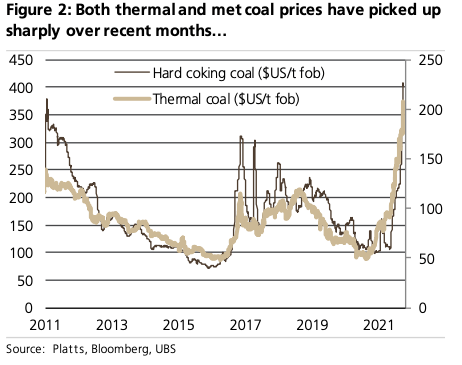

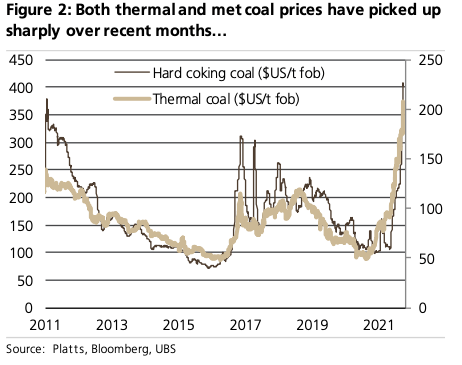

Coal futures for delivery in Oct, Nov and Dec 2021 have breached US$80 / tonne.

www.cmegroup.com/markets/energy/coal/coa...-argus-coalindo.html

Profit for Geo Energy & Golden Energy will be phenomenal. It's a tsunami of cash!

www.cmegroup.com/markets/energy/coal/coa...-argus-coalindo.html

Profit for Geo Energy & Golden Energy will be phenomenal. It's a tsunami of cash!

Please Log in to join the conversation.

4 years 5 months ago #25874

by Joom

Replied by Joom on topic Severely Undervalued Stocks

Coal is booming like crazy.

ICI 4 futures now at US$98/tonne for Oct and Nov 2021 delivery.

www.cmegroup.com/markets/energy/coal/coa...-argus-coalindo.html

ICI 4 futures now at US$98/tonne for Oct and Nov 2021 delivery.

www.cmegroup.com/markets/energy/coal/coa...-argus-coalindo.html

Please Log in to join the conversation.

4 years 4 months ago - 4 years 4 months ago #25878

by Joom

Replied by Joom on topic Severely Undervalued Stocks

Website :

www.cmegroup.com/markets/energy/coal/coa...-argus-coalindo.html

Coal futures for Oct, Nov, Dec 2021: All above US$110 / tonne.

For the first time, Jan, Feb, March 2022: All have crossed US$100/tonne

It's unchartered territory --- Geo Energy & Golden Energy are seeing a flood of cash inflow. What will they do with it ? Dividends should be very much on their agenda

Coal futures for Oct, Nov, Dec 2021: All above US$110 / tonne.

For the first time, Jan, Feb, March 2022: All have crossed US$100/tonne

It's unchartered territory --- Geo Energy & Golden Energy are seeing a flood of cash inflow. What will they do with it ? Dividends should be very much on their agenda

Last edit: 4 years 4 months ago by Joom.

Please Log in to join the conversation.

4 years 4 months ago #25879

by Joom

Replied by Joom on topic Severely Undervalued Stocks

Australian thermal coal miners are having a roaring time.

Monsters of Rock: Some coal stocks are rising 10pc at a time

stockhead.com.au/resources/monsters-of-r...sing-10pc-at-a-time/

Monsters of Rock: Some coal stocks are rising 10pc at a time

stockhead.com.au/resources/monsters-of-r...sing-10pc-at-a-time/

Please Log in to join the conversation.

4 years 1 month ago #25917

by Joom

Replied by Joom on topic Severely Undervalued Stocks

GEMS has a market capitalisation of IDR51T in Jakarta.

Golden Energy (SGX listed) owns 62.5% of GEMS -- stake worth almost SGD3b. But Golden Energy now capitalised at only $640 million.

Meanwhile, Golden Energy has an ASX subsidiary, Stanmore. Now enjoying high metalurgical coal price in 2H 2021.

Conclusion: Expect huge profits to be reported by Golden Energy for 2H 2021. Now stock price only 29 cents. Target 60 cents.

Golden Energy (SGX listed) owns 62.5% of GEMS -- stake worth almost SGD3b. But Golden Energy now capitalised at only $640 million.

Meanwhile, Golden Energy has an ASX subsidiary, Stanmore. Now enjoying high metalurgical coal price in 2H 2021.

Conclusion: Expect huge profits to be reported by Golden Energy for 2H 2021. Now stock price only 29 cents. Target 60 cents.

Please Log in to join the conversation.

4 years 1 month ago #25918

by yeng

Replied by yeng on topic Severely Undervalued Stocks

Indon domestic power stations not getting sufficient coal as the producers send their coal to overseas buyers at higher prices. Govt announced suspension of exports for 1 month. That's the problem with an artificial non-market mechanism that puts a ceiling on domestic selling price of coal.

If Monday sees Geo and GEAR prices drop, i think it's an opportunity to pick up bargains, since the export suspension cannot be forever.

Let's see.

If Monday sees Geo and GEAR prices drop, i think it's an opportunity to pick up bargains, since the export suspension cannot be forever.

Let's see.

Please Log in to join the conversation.

Time to create page: 0.348 seconds