- Posts: 770

- Thank you received: 23

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

BIG4 GLOVEMAKER:- RIVERSTONE

5 years 8 months ago #25352

by pine

Replied by pine on topic BIG4 GLOVEMAKER:- RIVERSTONE

The long-term holders of Riverstone are now thrilled at seeing the stock hit $2.40. There are some core metrics of Riverstone's dynamics that apply to Medtecs, imo. The 2Q profit of Medtecs should reflect :

1. Ramp-up in revenue

2. Higher ASP.

3. Most important: Higher operating leverage leading to much higher profit margin. Therefore, net profit will be much higher than 1Q US$3.7 million. Dyodd

1. Ramp-up in revenue

2. Higher ASP.

3. Most important: Higher operating leverage leading to much higher profit margin. Therefore, net profit will be much higher than 1Q US$3.7 million. Dyodd

Please Log in to join the conversation.

5 years 7 months ago #25406

by Kapitan

Replied by Kapitan on topic BIG4 GLOVEMAKER:- RIVERSTONE

Is it too early to say Riverstone has peaked, can't go higher, than $3.00?

I guess not. The latest target price of DBS is $3.90, and my guess is it will be revised higher when the 2Q results come out & give clarity to the near- and medium-term outlook. Already, DBS reported that Riverstone's orderbook is full all the way until mid-2021. I won't be surprised if Riverstone goes above $4.00! dyodd

I guess not. The latest target price of DBS is $3.90, and my guess is it will be revised higher when the 2Q results come out & give clarity to the near- and medium-term outlook. Already, DBS reported that Riverstone's orderbook is full all the way until mid-2021. I won't be surprised if Riverstone goes above $4.00! dyodd

Please Log in to join the conversation.

5 years 6 months ago - 5 years 6 months ago #25423

by Kapitan

Replied by Kapitan on topic BIG4 GLOVEMAKER:- RIVERSTONE

Riverstone is above $4!

Net profit margin has widened in 2Q20, as expected.

Net profit:

1Q19 : RM30 m

1Q20 : RM47 m

2Q19 : RM33 m

2Q20: RM90 m

Net profit margin has widened in 2Q20, as expected.

Net profit:

1Q19 : RM30 m

1Q20 : RM47 m

2Q19 : RM33 m

2Q20: RM90 m

Last edit: 5 years 6 months ago by Kapitan.

Please Log in to join the conversation.

5 years 5 months ago #25468

by min1xyz

Replied by min1xyz on topic BIG4 GLOVEMAKER:- RIVERSTONE

Please Log in to join the conversation.

5 years 5 months ago - 5 years 5 months ago #25490

by Kapitan

Replied by Kapitan on topic BIG4 GLOVEMAKER:- RIVERSTONE

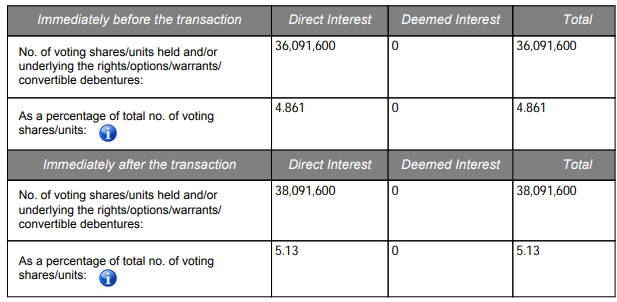

EMPLOYEES PROVIDENT FUND BOARD OF MALAYSIA has become a substantial shareholder of Riverstone.

Bought 2 million shares on 17 Sept = SGD 6,576,000.00. (ie S$3.288 / share).

(Cheaper than the price that instis that took up placement by cofounder Lee at S$3.95 on 3 Sept. Maybe EPF was one of them, LOL).

Bought 2 million shares on 17 Sept = SGD 6,576,000.00. (ie S$3.288 / share).

(Cheaper than the price that instis that took up placement by cofounder Lee at S$3.95 on 3 Sept. Maybe EPF was one of them, LOL).

Last edit: 5 years 5 months ago by Kapitan.

Please Log in to join the conversation.

Time to create page: 0.305 seconds