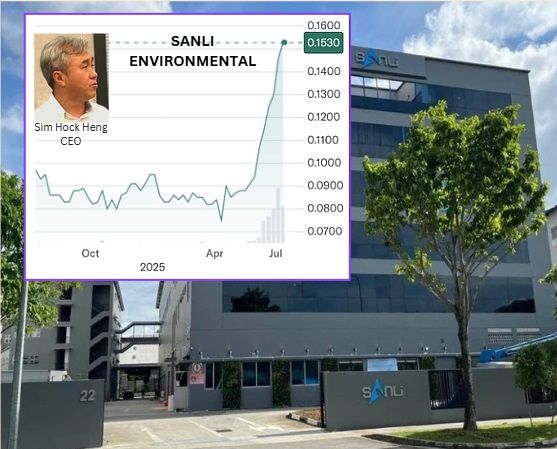

Once a quiet stock, Sanli Environmental has really been on a roll in the past three months. |

| Successful $4 M Share Placement |

This week, Sanli marked a significant milestone with its first-ever share placement since its 2017 listing, raising S$4 million through the issuance of 33.3 million new shares at S$0.12 each.

The placement was fully subscribed, drawing in prominent institutional investors such as Lion Global Investors and Asdew Acquisitions.

Sanli’s CEO, Mr. Sim Hock Heng, commented:

| “This is our first share placement exercise since our listing in 2017, hence it represents a meaningful milestone for the Group and we are heartened by the strong vote of confidence from investors in our business model and growth potential.” |

The funds raised will be used primarily for general working capital, supporting ongoing engineering projects, and potentially reducing existing borrowings to further strengthen the company’s balance sheet.

| Landmark $105 M Contract |

Sanli’s business momentum has now accelerated -- it said it has secured a major S$105.3 million contract from PUB, Singapore’s National Water Agency.

The contract covers mechanical, electrical, instrumentation, control, and automation (MEICA) works for a new NEWater plant within the Tuas Water Reclamation Plant, part of Singapore’s Deep Tunnel Sewerage System (DTSS) project.

Sanli had previously won two contracts worth a total of S$236 million under the DTSS project.

Mr Sim said:

| “We are pleased to be awarded this latest contract under DTSS Phase 2, which we believe is not only as a reaffirmation of our MEICA capabilities to execute complex water infrastructure works reliably, but also as a strategic opportunity to deepen our involvement in high-impact, public sector projects that enhances Singapore’s water resilience.” |

With this win, Sanli’s order book has reached a record S$333.9 million, providing strong visibility for future revenue.

For perspective, Sanli's revenue in FY2025 (ended March) amounted to S$158 million (+21% y-o-y).

Mr. Sim further noted:

| “Working on our earlier two contracts in Tuas WRP has allowed us to accumulate significant onsite knowledge, enhancing our operational expertise with a highly coordinated project delivery approach and we look forward to the timely completion of this project.” |

For more, see SANLI: Targets Growth In Thai Solar Market & High Entry Barrier Chemical Production |