| Some readers may recall TK Group achieving one of the highest gains in a "stock challenge" (See: 28 Stocks, 11 Investors: Massive Gains for Who at Year-End Finish Line?) This Hong Kong-listed company happened to organise this week a virtual investor briefing, which we dialled in to. Here are takeaways: |

First up, the money stuff. The company achieved HK1 billion in 1H2024 revenue (+17.8% y-o-y).

|

Stock price |

HK$2.14 |

|

52-wk range |

$1.25 – $2.60 |

|

PE (ttm) |

8.7 |

|

Market cap |

HK$1.78 b |

|

P/B |

1.06 |

|

Dividend |

9.5% |

|

1-yr return |

53% |

|

Source: aastocks.com |

|

TK expects 2H to be positive.

As at 30 June 2024, the Group had sales orders on hand of HK$1,066.6 million (+24.3% y-o-y)

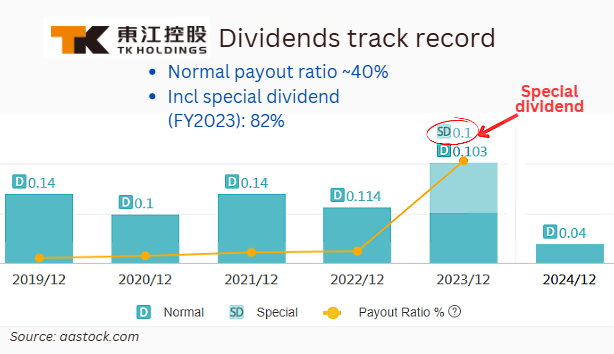

Now, will dividends rise? TK has a track record of a dividend payout of about 40% of profits.

It kept to this payout ratio in its 1H2024 interim dividend which was a bumper 4HK cents/share because of a jump in net profit (1H2023 dividend: 2.8HK cents).

The thing is, aside from a final dividend to be announced, will the company propose a special dividend as it did for FY2023 (10 HK cents)?

We'll know when TK reports its FY2024 results on 17 March.

TK is sitting on a nice pile of cash (HK$1 billion, as at end June 2024) and had no bank borrowings.

Cashflow in 1H2024 was good, with account receivables collected in just under 60 days.

TK stock at HK$2.05 trades at almost 10% yield based on FY2023 dividends.

TK stock at HK$2.05 trades at almost 10% yield based on FY2023 dividends. Let's break down the business a bit. TK operates in six different sectors, including the ever-popular smartphones, wearable devices, commercial telecom equipment, healthcare, smart homes, electronic atomisers, and automobiles.

While the automobile sector might see a slight dip, the rest are all set to grow.

Expansion on the horizon! In 2025, TK's planning to pump up its production capacity in Vietnam, Suzhou, and Shenzhen.

We're talking about a massive new factory in Vietnam (+15,000 sq m, bringing the total to 20,000 sq m) and some serious upgrades in Suzhou and Shenzhen.

All this expansion will cost around HK$180 million. That's a big investment, but it shows they're confident about the future.

But there's a catch. All this expansion won't translate into immediate sales growth.

There's a bit of a lag time, and depreciation costs for the new assets will eat into the bottomline.

Longer-term investors can expect a spurt of revenue / profit growth from all that capex from 2026 perhaps.

There's a bit of a lag time, and depreciation costs for the new assets will eat into the bottomline.

Longer-term investors can expect a spurt of revenue / profit growth from all that capex from 2026 perhaps.

|

The Q&A. Someone pointed out that gross margins in Vietnam (~18%) are lower than in China (~23%).

The company acknowledged it but explained that setting up capacity in Vietnam is a necessary move for its customers in the face of geopolitical risks and tariffs. TK is optimistic about growing demand from new and existing customers, including the medical sector. And then came the question about everyone's favourite topic - tariffs! The company isn't too worried about increased tariffs on goods from China.

What they're keeping an eye on is the potential for tariffs on products from Vietnam. Speaking of Vietnam, someone asked about its contribution to the company's overall capacity. Currently, Vietnam accounts for less than 3%, and the rest in China.

Here's some growth drivers: TK has scored some big-name new customers, including Meta for AR glasses.

Finally, addressing the recent share price rollercoaster, the company believes a positive analyst report initially boosted the price. |