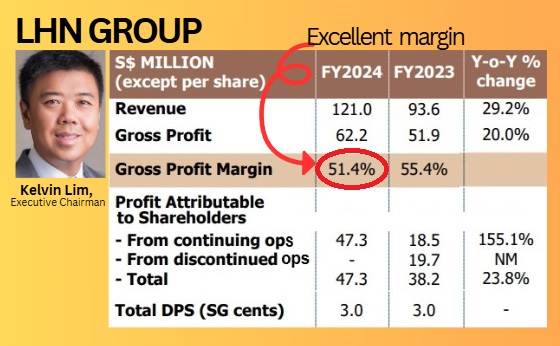

• After trading sideways for the longest time (more than 2 years), LHN stock price took off in the past 4 weeks -- from 34 cents to an intra-day high of 50 cents. Why?  • The stage was set when LHN announced on Nov 15 a profit alert, saying it expected FY24 (ended Sept 2024) pre-tax profit would come in at no less than S$50 million. • As it turned out, all 3 business segments showed strong revenue growth. Bottomline reached S$47.3 million (+155%). This includes net fair value gain of S$14.7 million associated with investment properties and those of joint ventures (FY2023: fair value losses of S$8.7 million).  • Why the excellent 51% gross margin? LHN has its fingers in quite a spread of businesses but in the end, it's "space optimisation" that is the star of the show, accounting for the bulk of its profit. It's essentially property management -- and Coliwoo is the largest co-living operator in Singapore by number of keys. Expanding rapidly since 2019, Coliwoo has 13 locations up and running and will soon add 3 more assets. Rents range from S$2,500 to S$4,000 per month with tenants sticking around for 9 months on average, according to Phillip Securities. • Briefly, LHN's other businesses include managing carparks, providing cleaning services for properties, and operating EV charging points and solar installations. • Notably, LHN has one large industrial property development project whose units have recently been put on sale. Profits will be booked in FY2025, with a total of $10 million pre-tax profit expected, of which 60% ($6 million) will be attributable to LHN. |

With the above backdrop, we compare below Phillip Securities' latest report with Maybank's on LHN's FY2024 performance ....

|

| Differences |

- Revenue and Earnings: The Maybank report emphasizes an 85.5% year-over-year increase in co-living revenue to SGD52.4 million.

The Phillip Securities report notes a 51% increase in the number of keys year-over-year.LHN

Share price: 50 c

Target:

55-56 c - Target Price and Valuation: The Maybank report raises its target price to SGD0.55 with a forward P/E of 7x, whereas

Phillip Securities sets a higher target price of SGD0.56 with a forward P/E of 6.5x. "The stock trades at a forward PE of 5.1x, dividend yield of 5.4% and 27% discount-to-book value"

"The stock trades at a forward PE of 5.1x, dividend yield of 5.4% and 27% discount-to-book value"

-- Paul Chew, Phillip Securities - Strategic Focus: The Maybank report discusses LHN's shift towards an asset-light model by selling properties.

"As part of its long-term strategy to move towards an asset-light model, LHN has put up three of its properties for sale for a combined SGD120m. The successful sale of these properties will also enable the group to lower its current gearing of 59.6%."

Phillip Securities highlights expansion into healthcare accommodation as part of LHN's growth strategy.

"FY25e earnings will be supported by the 350-bed (or 700 healthcare professionals) contract secured in January 2024." - Geographical Challenges: Phillip Securities discusses losses in Hong Kong car parks affecting facilities management, which is not mentioned in the Maybank report.

Full Maybank report here while Phillips' is here.

See also LHN's PowerPoint deck here.