| Just last Friday (7 June), UOB Kay Hian analysts raised their core earnings estimates of LHN Group by 30%/30%/28% for FY24/25/26 respectively. That's quite a hefty increase. They did so after accounting for "higher-than-expected co-living margins (in 1HFY24) and LHN’s upcoming co-living project launches," they said. UOB KH now expects LHN's FY2024 (ending Sept 2024) profit to come in at $23.7 million. It is within the vicinity of the forecasts already made by 2 other covering brokers: Maybank Kim Eng ($24.5 million) and Phillip Securities ($26.1 million). The average: $25 million. |

|

Broker |

Target price for stock |

Net profit forecast |

|

Maybank KE |

43 c |

$24.5 m |

|

UOB KH |

40 c |

$23.7 m |

|

Phillips Securities |

42 c |

$26.1 m |

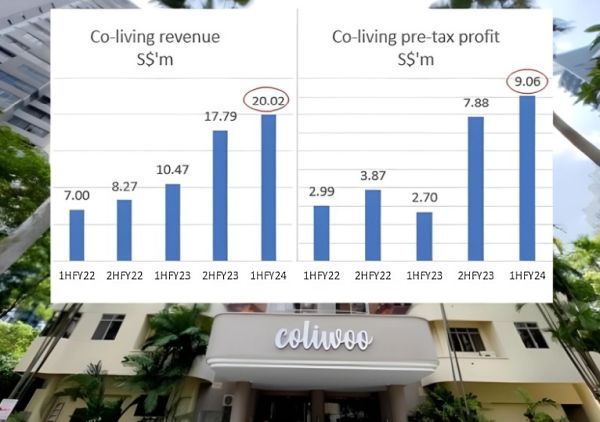

Co-living revenue accounted for 37% of LHN group revenue in 1H FY24 (ended March 2024). Compared to its other business segments, co-living is a relatively high margin business, accounting for 51% of group adjusted pre-tax profit.

Co-living revenue accounted for 37% of LHN group revenue in 1H FY24 (ended March 2024). Compared to its other business segments, co-living is a relatively high margin business, accounting for 51% of group adjusted pre-tax profit.

In "co-living", as the business is called, multiple people (usually strangers to one another) live in a communal setting. In Singapore, co-living has picked up with LHN Limited emerging as the No.1 player. Its business is branded as Coliwoo.

LHN (market cap: S$140 million) manages and furnishes the spaces, providing a variety of amenities such as Wi-Fi and kitchens, and cleaning services and utilities.

LHN's core business of renting out residential spaces is not a volatile business. It thus lends itself to fairly accurate estimates by investors.

Furthermore, there is disclosure of assets purchased or leased and, subsequent to their retrofitting, the timing of their becoming operational.

Using analysts' forecast profits, the PE is around 5-6X.

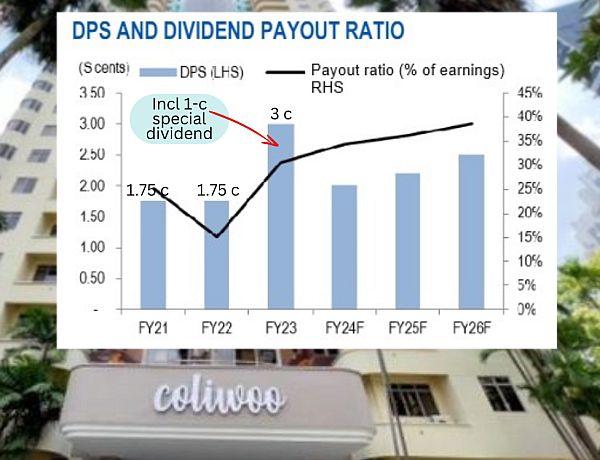

For its half-year ended March 2024, LHN declared an interim dividend of 1 cent/share.

Assuming another 1 cent/share for 2HFY24, the yield translates to 6% based on the recent stock price of 33 cents.

LHN's dividend payouts have been consistent and growing (see chart below): Chart: UOB KH

Chart: UOB KH

| What to expect in 2HFY24 (March-Sept 2024) |

Analysts say there is a robust project pipeline for the Coliwoo portfolio to support LHN's growth.

In 2HFY24 ...

• Coliwoo’s new co-living properties, 286 & 288 River Valley, are expected to be operational.

• Two lodging facilities to accommodate roughly 700 healthcare professionals are also expected to begin operations.

They are located at 100 Ulu Pandan Road and 60 Boundary Close which are designed, retrofitted and operated by LHN under a contract with the Ministry of Health Holdings.

The 2 facilities represent a total of around 351 keys.

| What to expect in FY25 (Oct 2024-Feb 2025) |

• The GSM building and co-living apartments at 48 & 50 Arab Street and at 260 Upper Bukit Timah Road are expected to be launched, contributing approximately 275 keys in total.

• There's an upcoming one-time profit from the sale of 49 food processing industrial units in an industrial building at 55 Tuas South Avenue 1 that LHN is redeveloping.

|

Overall, the co-living sector in Singapore is relatively new and experiencing high growth. It is a more affordable and more convenient alternative to hotels and apartments. |

See also: LHN: Profit tripled, and there's more in the pipeline. Has stock price factored all that in?