• AI has been relentlessly in the news. And AI is coming to your PCs. For example, big-name manufacturer Lenovo currently has a slew of AI PCs available for purchase on its website. • AI PCs are projected by Boston Consulting to comprise an astounding 80% of the world's PC market by 2028. This is a big business opportunity for not just PC makers but the likes of chip producer Intel that makes the majority of chips in PCs. And, if Intel does well so will AEM Holdings for whom Intel is its key customer for semiconductor backend testing. • As Hong Kong-listed Lenovo rides the AI wave out of a post-pandemic slump in PC sales, it is also seeking to penetrate the Middle East and Africa market (MEA). It has just announced a strategic partnership with Alat.  • Alat. The name may be unfamiliar to many. Alat was formed in Feb 2024 as a company under the Saudi Public Investment Fund. Its objective is to transform Saudi Arabia into a global hub for technology manufacturing focusing on advanced technologies and electronics. • There are several key benefits for Lenovo from its issue of US$2 billion zero-coupon convertible bonds to Alat. Find out more in UOB KH's report below.... |

Excerpts from UOB Kay Hian report

Analyst: Johnny Yum

Lenovo Group (992 HK) Partners Up With Alat To Expand Business Opportunities in MEA

| Lenovo announced a strategic partnership with Alat, which involves a CB issuance of US$2b, and the establishment of a regional supply chain in Saudi Arabia for the MEA market by Lenovo. The deal is very positive for Lenovo’s mid-long-term growth as it helps Lenovo strengthens its position in a fast-growing market, although the sizable dilution (around 19%) from this round of fund raising may impact investor sentiment in the near term. Maintain BUY and target price of HK$13.50. |

WHAT’S NEW

• Lenovo to introduce Alat as a strategic investor through the issuance of a zero coupon Convertible Bond (CB), an investment vehicle under Saudi Arabia's Public Investment Fund (PIF).

| Lenovo | |

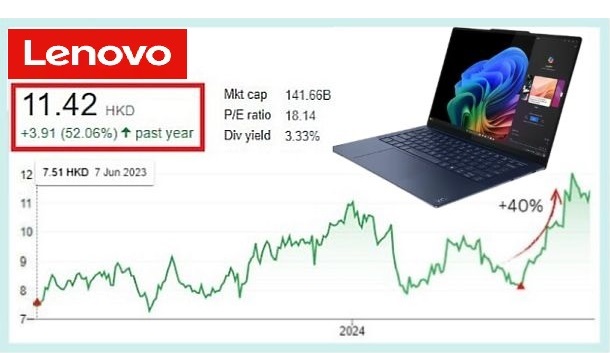

| Share price: HK$11.42 | Target: HK$13.50 |

Lenovo and Alat formed a strategic collaboration framework through the deal, and the terms state that Lenovo will expand its business in the Middle East and Africa (MEA), by setting up a regional headquarters in Saudi Arabia, along with a new manufacturing facility (and likely supply chain as well) locally which will initially focus on the production of PCs and servers for the MEA region.

• The details of the CB are as follow:

| a) The CB has a conversion price of HK$10.42, and a size of 1,499,328,214 shares. The exercise price is equivalent to an 11.8% discount to its last closing price of HK$11.82, and the CB issued amounts to 12.1% of existing share, and 10.8% of total enlarged shares once fully converted. b) The CB's reaches maturity three years from the issue date. The conversion period is at the very end of the three-year period - from the 30th calendar day prior to the maturity date to two business days prior. If there are any outstanding CBs not yet converted, Lenovo will redeem the unconverted CB at 100% of the principal amount. |

• The proceeds will be utilised in the following manner:

| a) to repay the high-interest debts to optimise Lenovo's finance structure; b) around US$300m will be spent on building the manufacturing hub in Saudi Arabia; and c) there are some potential inorganic growth deals (M&A) that Lenovo is looking at. |

| "Lenovo also stated that given Alat’s ample capital, it can continue to assist in Lenovo’s financing needs going forward, especially when it comes to the development in MEA region, which implies that there are more room to optimise its debt structure further down the road." |

STOCK IMPACT

• Business potential from MEA is huge. According to Lenovo, revenue from the MEA market registered an 11% yoy growth last year (vs the company’s revenue growth of -9.7% yoy amid an industry downcycle), and contributed to US$1.3b-1.4b, or about 2% of total revenue.

Management now expects the region’s growth to accelerate to high-double digit yoy going forward, driven by a combination of the region’s faster demand growth for consumer electronic products, and assistance from Alat in the penetration of large enterprises in the region.

We also believe that acquiring major AI server orders from MEA could be a major catalyst for Lenovo as it can potentially help the company catching up with its more established server OEM peers, such as Dell.

• Exploration of a new major region can also help hedge against US-China tension. Given that US remained the largest revenue contributor at 34% of total revenue in FY24 for Lenovo, there had been looming concerns of geopolitical risks given the tension between US and China.

The exploration of a new business region will help hedge against some of the geopolitical risks going forward.

• The zero-coupon CB can help lower interest cost by US$100m in 2024, according to management. As of end-FY24, the company had ~US$5.6b outstanding in interesting bearing loans.

Under our preliminary assumptions, every US$1b reduction in debt will result in Lenovo's FY24 earnings inreasing by ~4.1% (or ~US$53m).

Lenovo also stated that given Alat’s ample capital, it can continue to assist in Lenovo’s financing needs going forward, especially when it comes to the development in MEA region, which implies that there are more room to optimise its debt structure further down the road.

• Initial reception seems mixed due to dilution. The CB and Warrants will not pose an immediate dilution, as the respective conversion period and exercisable timing of the CB and Warrant is nearly three years from now.

However, the market’s view on this round of fund raising is relatively mixed, especially for the minority shareholders, as the potential dilution for the two deals is still very sizable at a total of 19.3%.

As such, although the deal is very positive for the company’s longer-term growth, we believe it is likely that we may receive some negative reactions initially in the near term.

EARNINGS REVISION/RISKS

• None for now. We will be adjusting its share price after assessing the growth potential of the MEA market.

Also note that most of the dilution arrives in FY28, as such it should not impact our estimates much in FY25-27.

• Maintain BUY and target price of HK$13.50. We believe the dilution risk will pose limited impact to our FY25 earnings-based target price, as we expect limited warranty exercise during the period. Our positive view on Lenovo's positioning in the AI PC-driven replacement cycle from end-24 onwards is further enhanced after the deal, as we believe Alat will be able to provide meaningful contribution to its business expansion to a fastgrowing MEA market. Our current target price is based on 16.0x FY25F PE, which is based on peers' average PE. |

Full report here.