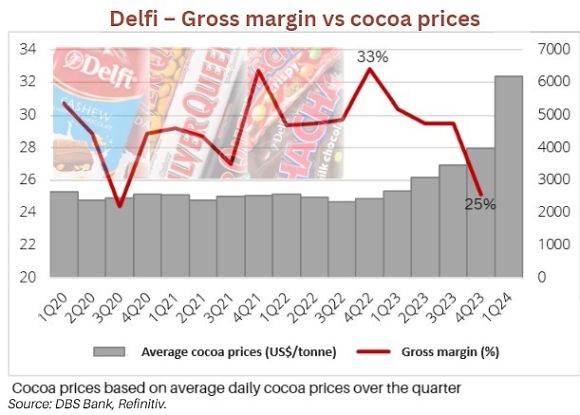

| • It's a breakout that compares well with Nvidia, the wonder AI stock. Cocoa prices have surged and surged -- they are up more than 2X since the start of 2024 and about 4X since 2023, reaching US$10,000/tonne. • Myriad reasons: Cocoa supply from West Africa, the world's key supplier, has been affected by factors going back to when the pandemic resulted in less planting. In addition, Western sanctions have indirectly affected Russian exports of fertilisers, and there was bad weather ... while consumer demand for chocolates recovered after the pandemic. • The cocoa price surge is lending a bitter taste to chocolate producers, portending a sharp slimming of their profit margins. It is also spurring measures such as raising selling prices, shrinking product sizes, etc.  • DBS Research has a commentary on the situation, and a look at the potential impact on Singapore-listed choc producer Delfi (market cap: S$560 million). The impact had started quite a while back -- Defli stock has been declining from $1.44 in May 2023 to around 91 cents currently. |

Excerpts from DBS report

|

• Recent surge in cocoa prices to an all-time high (YTD +133%) is a potential headwind for chocolate producers:

|

• Cocoa is as a key ingredient for Mondelez, world’s second-largest confectionary company

| » Its chocolate segment (e.g., Cadbury, Toblerone) made up 30% of FY23 revenue, while both ingredients are key to its confectionary products like Oreo, Chips Ahoy under its Biscuits and Baked Snacks segment (49% of FY23 revenue) » Management’s guidance of a high single-digit percentage increase in cost of goods sold in FY24F is attributable to expected increases in “cocoa and sugar as well as another uptick in labor costs” |

• Singapore stock Delfi also sees both cocoa and sugar as key input costs

| » Recent share price weakness – which dragged the stock to its 52-week lows – may reflect pessimism from 1) soaring cocoa prices, and 2) soft consumer sentiment in Indonesia » Gross margins may be under pressure if 1) the company is unable to pass on these cost increases to consumers, and/or 2) favourable hedges on cocoa/sugar roll off over time » Technical view: While the stock is oversold and trading 30% below Bloomberg consensus TP of $1.29, we see a rebound capped at $0.95-0.98, with downside risk towards $0.80 |