DBS Vickers analyst: Mervin SONG, CFA

• Acquires Archer Daniels Midland Company’s global cocoa business for EV of US$1.3bn (S$1.7bn)

• Olam is now the third largest cocoa processor with exposure to growing US$16bn mid-stream market

• 11-15% accretion to FY16-18F core earnings

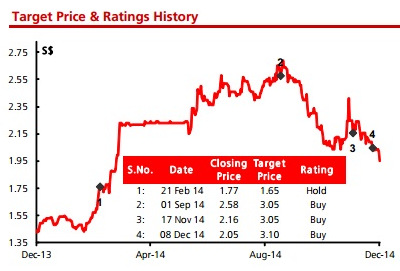

• Maintain BUY, TP revised to S$3.15

Acquires ADM’s cocoa business. Olam announced the acquisition of Archer Daniels Midland Company’s global cocoa business for US$1.3bn. This implies an EV/EBITDA multiple of 9.5x (based on 5 year average adj. EBITDA) and prospective EV/EBITDA of 6.5-7.2x (based on FY18 EBITDA after full integration).

The valuation compares favorably to the 14.3-23.5x EV/EBITDA multiple Petra Food achieved when it sold its cocoa ingredients business to Barry Callebaut in 2012. Olam is also acquiring the processing assets at a 24-39% discount to replacement cost.

Strategic expansion of cocoa platform. Post this transaction, Olam will be among the top 3 global cocoa processors with a 16% global market share in the US$16bn processing market, where demand growth is expected to accelerate from 3% p.a. to 3.4-4.3% in the coming decade.

In addition, as a integrated player with substantial presence in the sourcing and now the processing segment of the cocoa value chain, Olam should derive higher profits through greater scale and better procurement. This should translate to 11-15% accretion to FY16-18F core profits, with an uplift in medium term cashflows and ROEs (0.8-1.3%) leading us to also revise our DCF-based TP to S$3.15 from S$3.10.

|

|