,

| • ComfortDelGro is enjoying renewed investor attention. Just look at how the stock has done. • On 7 June 2023, an incredibly low day for ComfortDelGro, the stock sank to $1.02, the lowest in more than 15 years. But things have really looked up -- currently, it is at $1.35. • There has been a net inflow of institutional money into the stock in 3Q2023, as the earnings of the S$2.9-billion market cap ComfortDelgro look to be turning up on several catalysts. (See: Which non-STI stocks enjoyed highest net fund inflow in Q3?) • CGS-CIMB's report below fleshes out the prospects, forecasting S$185 million in net profit (+35% y-o-y) for 2023. |

Excerpts from CGS-CIMB report

Analyst: ONG Khang Chuen, CFA

| ComfortDelGro -- A smoother ride |

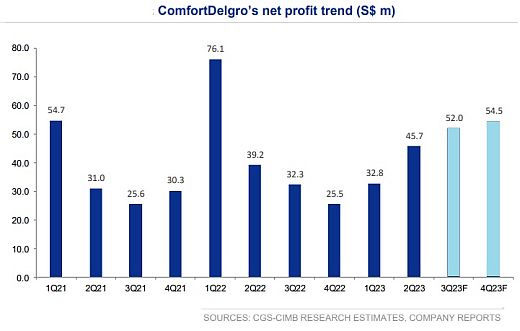

■ We forecast further PATMI recovery in 3Q23F to S$52m (+14% qoq, +61% yoy), riding on 1) taxi platform fee introduction and 2) UK cost pass-through.

■ Reiterate Add with a higher TP of S$1.55 as CD’s earnings recovery picks up steam in 2H23F (+84% yoy). |

||||

| 3Q23: Further earnings recovery taking shape |

We project ComfortDelgro (CD) to record a PATMI of S$52m (+14% qoq, +61% yoy) for 3Q23F, riding on

1) introduction of a platform fee in Jul 2023 for rides booked via its CDG Zig app in Singapore, and

2) continual margin recovery for its UK public bus business.

| STRONGER SHOWING |

“We project ComfortDelgro to record a PATMI of S$52m (+14% qoq, +61% yoy) for 3Q23F riding on 1) introduction of a platform fee in Jul 2023 for rides booked via its CDG Zig app in Singapore, and 2) continual margin recovery for its UK public bus business.” “We project ComfortDelgro to record a PATMI of S$52m (+14% qoq, +61% yoy) for 3Q23F riding on 1) introduction of a platform fee in Jul 2023 for rides booked via its CDG Zig app in Singapore, and 2) continual margin recovery for its UK public bus business.”-- Ong Khang Chuen, CFA |

To recap, we forecast qoq revenue uplift of S$6m for its taxi segment in 3Q23F (likely flowing directly to its bottomline) as it had in Jul introduced a platform fee for rides booked via its CDG Zig app in Singapore.

We also expect CD’s UK operations to return to EBIT positive in 3Q23F as the higher costs absorbed by CD are being gradually passed on to the government with annual indexation of public bus service fees on route anniversary.

| Singapore rail operations likely turned profitable in 1H23F |

Our analysis of SBS Transit’s (CD’s 75%-owned subsidiary) balance sheet found its rail operations in Singapore has turned profitable in 1H23F.

CD’s operating metrics remained healthy with its rail ridership improving and having returned to pre-pandemic level in Aug 2023 (+2% mom, +16% yoy).

Meanwhile, demand for point-to-point (P2P) transport in Singapore continues to grow, with Jul’s average daily number of trips at 613k (+5% yoy) even as fares remain firm at high levels, according to our channel check.

| Positioning for the future |

CD is actively investing in transport-related green energy business. CDG ENGIE (its 49%- owned JV), has secured tenders to install c.5,000 electric vehicle (EV) charging points in Singapore.

CD has also entered into a strategic partnership with Guangzhou Public Transport Group to construct EV charging and battery swapping stations – with the initial project catering to the needs of municipal buses and cars in Guangzhou, China.

CD believes its investments in EV charging infrastructure, coupled with its fleet management capabilities, positions the company favourably to operate an autonomous vehicle (AV) fleet in the future.

It is looking to partner with AV companies to trial robotaxi services in China, with the eventual goal of launching such services in Singapore.

| Reiterate Add with higher TP of S$1.55 |

| HIGHER |

| “... our TP is lifted to S$1.55, still based on 16.2x FY24F P/E.” -- Ong Khang Chuen, CFA |

Reiterate Add as we see CD’s earnings recovery picking up steam in 2H23F with 84% yoy PATMI growth.

With our higher EPS assumptions, our TP is lifted to S$1.55, still based on 16.2x FY24F P/E (0.5 s.d. above CD’s five-year historical average).

Re-rating catalysts include commission rate increases for its taxi segment, and tender wins.

Downside risks include slower margin recovery due to inability to pass on costs, and negative forex translation impact given the strong Singapore dollar.

Full report here