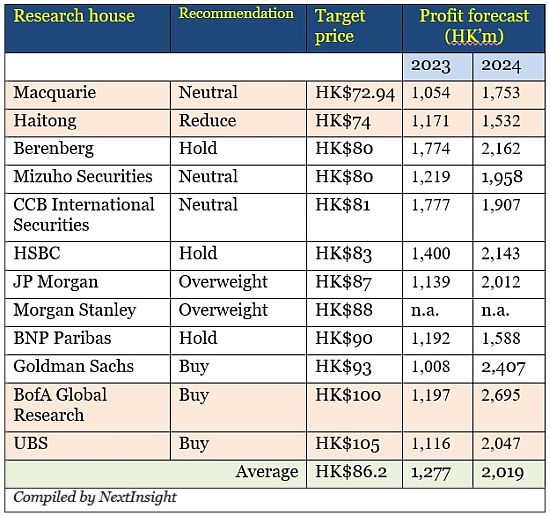

| When an industry like the semiconductor industry is going through a cycle, it's not surprising to see a wide range of investor views on the outlook. Is it too early to call a trough/peak? How fast will earnings recover/decline? The usual questions. Analysts peer hard and discuss the various evidence for ASMPT's outlook in their reports after the recent 2Q earnings. Not surprisingly, they have come up with widely-differing target prices -- so different that you wonder if they are talking about different stocks. You see target prices as low as HK$72.94 and as high as HK$105. That's a ~50% difference between one extreme and another. Instead of target prices, which may be derived from analysts' somewhat subjective application of metrics, consider their profit forecasts. While profit numbers vary as well, there is a general consensus: There's a jump coming -- a very large one -- in ASMPT's earnings in 2024. See the table below: |

Listed in HK and headquartered in Singapore, ASMPT is a well-known developer of equipment used in various stages of semiconductor chip production and assembly.

Our article reporting on the 2Q earnings call highlighted the CEO outlining the significant demand for ASMPT solutions from Generative AI.

That would rapidly become an important driver of growth while other business segments see normalisation or subdued growth. (See: GenerativeAI revolution is coming. Which S'pore company has the tools to help create/assemble the chips)

Let's see what analyst reports at both extremes of price targets say:

• BofA Securities titled its report "ASMPT -- Key equipment name for AI chip packaging; expect recovery in 2024; reiterate Buy."

"Thus, a recovery in 2024 seems imminent, plus the advanced packaging demand driven by AI will provide further upside to both sales and margin." BofA Securities used 2.5x P/B to derive its target price of HK$100, up from HK$85 (which was based on 2.1x P/B). 2.5X P/B is the 2023-24 average, which is still close to 2015/19 lows, reflecting the 2H demand risks, it said. The higher 2.5X P/B was considered justified "due to the better 2024 business outlook and AI as a new demand catalyst." |

| • UBS has a HK$105.00 price target on 21x 2024E PE (was 19x). It is positive about opportunities from Advanced Packaging (AP)and electric vehicles/advanced driver assistance systems (EV/ADAS). "We think AP is set to be a key area of investment for the semis industry over the next three to five years as front-end chip manufacturing is subjected to rising challenges. We expect ASMPT to be one of the beneficiaries given its broad product portfolio, execution track record and customer service. "Automotive could be another key revenue driver of ASMPT due to the increasing complexity of car assembly due to EV/ADAS. We believe the higher mix towards AP and EV/ADAS could drive both long-term revenue and profit upside." |

| • Macquarie considered the lower-than-expected 2Q23 performance: Operating Profit and Net Income were 18% below consensus. Positive: Gross Margin stable despite a 25% revenue contraction (since four quarters ago). Further negatives: 2Q bookings declined, book/bill is declining. And ASMPT's 3Q guidance for revenue declined 11% QoQ and 23% YoY. That left Macquarie disappointed: "We had expected 3Q revenue guidance to be flat QoQ and the YoY pace of decline to start improving. This isn't the case, we now expect Semi revenue growth to resume 1Q24." As a result, Macquarie brandished its knife: » Forecast 2023 revenue cut 6% Net income cut 30% » Forecast 2024 net income cut 19%. Macquarie expects ASMPT to boom a lot more in 2025, raising its forecast net income then by 25%. |

| • Haitong headlined its report: "Prolonged Downturn". That's as gloomy as it gets. It noted the 1H23 situation: Inventory digestion has been slower than expected while the anticipated consumer demand recovery did not materialize.

"Although we are positive on ASMPT’s long-term growth, driven by advance packaging demand, we expect share price to be under pressure due to the normalizing SMT (surface mount technology) business and near-term demand weakness." Accordingly, Haitong revised down its 23/24E earnings forecast by -30%/- 28%. Hence, (if you are shareholder), ouch! Target price HK$72.94. |