Excerpts from UOB KH report

Analyst: John Cheong

Tech Manufacturers – Singapore

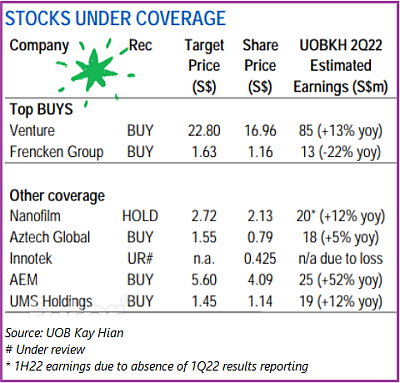

| Focus On Stocks With Diversified Customer Base And Low Production Disruptions We expect earnings weakness for stocks with huge China exposure (Nanofilm, Aztech, Innotek) due to lockdowns in China since late-1Q22. In contrast, stocks with low China exposure and a diverse customer base should deliver more resilient earnings (Venture, Frencken). Pure semiconductor names (AEM, UMS) should deliver healthy earnings but we are cautious of a slowdown in the semiconductor cycle. Our top picks are Venture and Frencken for their diversified customer base and pricing power. |

• Tech-related companies scheduled to release their 2Q22 results between 25 July and 15 August.  Tech companies under our coverage will be releasing their 2Q22 results starting from next week with Aztech scheduled to report on 25 July and Venture on 5 August.

Tech companies under our coverage will be releasing their 2Q22 results starting from next week with Aztech scheduled to report on 25 July and Venture on 5 August.

We categorise the stocks into three groups:

| a) stocks with significant China exposure (Nanofilm, Aztech, Innotek), b) stocks with low China exposure and diverse customer base (Venture, Frencken), and c) pure semiconductor names with large single customers (AEM, UMS). |

Our top picks are Venture and Frencken as we believe their diversified customer base and majority of productions in Malaysia, which have fully relaxed its COVID-19 restrictions, should reduce the negative impact of weaker demand as well as supply chain disruptions.

• Stocks that have majority of their production bases in China could see negative earnings surprises. In late-1Q22, China rolled out its biggest COVID-19 lockdown since the start of the pandemic as Shanghai confined residents to their homes.

Although Shanghai has reopened after two months, sporadic lockdowns are still very common across China. This has caused persistent challenges to the manufacturing supply chain.

Three key challenges include:

| a) higher costs in sourcing for raw materials due to reduced supply and higher logistics costs, b) higher labour costs due to the requirement of closed-loop manufacturing, and c) slowdown in customers’ demand due to difficulties in sourcing materials and slower productions. |

As a result, we think Nanofilm (Shanghai), Aztech (Dongguan) and Innotek (Dongguan and Suzhou), which have majority of their production plants in China, could see negative earnings surprises in their upcoming 1H22 results.

Also, these manufacturers serve customers in the consumer electronics and auto segments, which are discretionary products in nature, and could see reduced demand in a recession.

• Stocks with low China exposure and diverse customer base should deliver more resilient earnings.

We believe Venture should continue to deliver a good set of results in 2Q22 as:

a) it continues to see healthy demand from most of its customers which are diversified across seven domains, and

b) it has a proven capability in managing supply chain disruptions.

In addition, Venture should be able to manage costs and pass on higher prices to customers given its differentiated capabilities.

On the other hand, we expect Frencken to show a marginal decline in its 1H22 earnings due to higher material costs which will drag its gross margin. However, 2H22 earnings should be sequentially better as management is working to mitigate cost inflation pressures by passing on cost increases through operational

initiatives, and is anticipating signs of easing supply chain constraints.

Also, Frencken’s diversified customer base across five segments should provide better earnings visibility.

• Pure semiconductor names should report healthy earnings but we are cautious of a slowdown in the semiconductor cycle.  John Cheong, analystAlthough we expect both AEM and UMS to report healthy earnings growth for 2Q22, we are wary of a slowdown in the semiconductor cycle after two years of strong chip demand that was partially boosted by the supply chain disruptions caused by the COVID-19 pandemic.

John Cheong, analystAlthough we expect both AEM and UMS to report healthy earnings growth for 2Q22, we are wary of a slowdown in the semiconductor cycle after two years of strong chip demand that was partially boosted by the supply chain disruptions caused by the COVID-19 pandemic.

Chipmakers' fortunes rose in the early days of the pandemic as demand for electronics from stuck-at-home consumers and reduced supply due to manufacturing and logistics issues caused semiconductor demand to soar.

Amid the supply crunch, businesses across the chip value chain raced to stockpile chips so they could handle further disruptions. In TSMC’s latest earnings call, it warned that its customers might now draw on those chip reserves rather than place new orders.

TSMC also said it would trim its capex for 2022 by 10% to US$40b. South Korean chipmaker SK Hynix is also considering reducing its 2023 capex by 25%.

On 7 Jun 22, Intel CFO said that he expected the US chipmaker's 2Q22 earnings to take a hit due to customers working through stockpiled inventory instead of placing new orders.

In addition, demand for electronics is softening as PC shipments in 2Q22 fell 12.6 yoy, according to consulting firm Gartner. The crypto crash could be another drag on the chip market as crypto miners cease operations.

Shipments of graphics cards fell 19% yoy in 1Q22, according to consulting firm Jon Peddie Research.

Full report here.