AEM Holdings Ltd (AEM SP): Rekindled interest in Semicon

- BUY Entry – 4.64 Target – 5.07 Stop Loss – 4.45

- AEM Holdings Limited is a Singapore-based company, which offers application specific-intelligent system test and handling solutions for semiconductor and electronics companies serving computing, fifth generation (5G) and artificial intelligence (AI) markets.

Its segments include Equipment systems solutions (ESS), System Level Test & Inspection (SLT-i), Micro-Electro-Mechanical Systems (MEMS), Test and Measurement Solutions (TMS) and Others. Source: Company

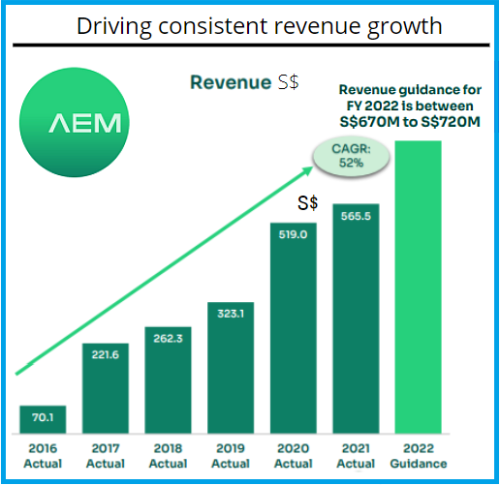

Source: Company - 2H21 performance reached a record high. During the period, revenue increased by 52.2% YoY to S$373.2mn due to strong uptake of AEM’s new generation equipment and tools, and net profit increased by 47.5% YoY to S$62.4mn.

The group’s full FY21 revenue increased by 9% YoY to S$565.5mn, mainly driven by the revenue contribution from the Test Cell Solutions business segment. However, net profit after tax declined by 5.6% YoY to S$92.1mn as the group stepped up investment in R&D activities to stay ahead of the competition through innovation.

In FY2022, the group expected revenue to be between S$670mn to S$720mn and capex to be around S$10mn. The group also expects some margin compressions in view of higher supply chain costs and an increase in R&D spending.2022: Another year of revenue growth, low capex

Revenue (forecast)

S$670 -$720m

Capex (forecast)

S$10 m

- Expansion into Europe. Rood Microtec and AEM announced a strategic cooperation in December 2021. The collaboration will open doors for AEM’s wafer level test solutions engineering team to install and exhibit the Aiolos wafer level test handlers at the Rood Microtec Facility in Nordlingen.

Equipment is also set up for 200mm wafer frame probing of a wide range of semiconductor devices. Through this partnership, AEM will have a broader opportunity to showcase its system demonstrations to customers in Central Europe. - Increase of shareholdings from Temasek. Temasek Holdings, AEM Holdings’ largest shareholder, has increased its stake after an indirect subsidiary bought more shares in the market.

As indicated via an SGX filing on March 9, Temasek’s indirect subsidiary Venezio Investments paid $5,647,480.02 for 1,416,900 shares. That works out to an average of $3.9858 each. With that Venezio has increased the number of AEM shares held to 30,998,500, or 10.02%, from 9.56%. - Positive consensus forecast. According to Bloomberg consensus estimates, AEM currently has 4 BUYS, 0 HOLD and 0 SELL, with a 12M TP of S$6.41, representing an upside of 35.2% as of yesterday’s closing price.

Source: KGI report