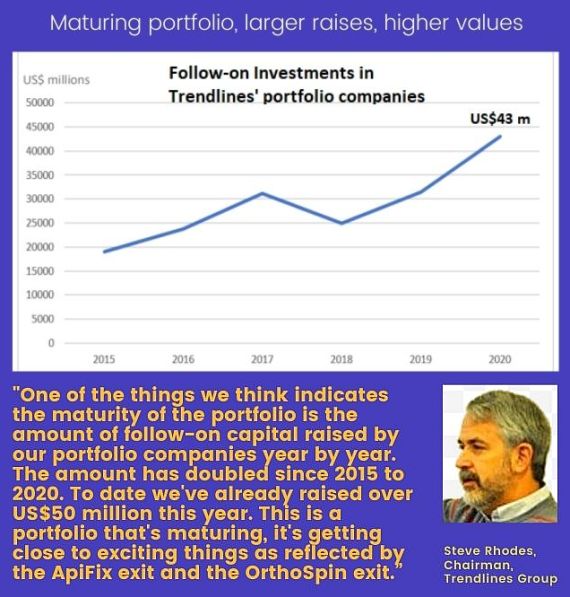

| In 2020, The Trendlines Group made its largest sale of a portfolio company (ApiFix) since its IPO on the Singapore Exchange in November 2015. Early this month (Nov 2021), it announced an even bigger exit -- the 100% sale of its 26.9%-owned portfolio company, OrthoSpin Ltd. It's the 10th exit and it fetched a total consideration of US$79.5 million in cash, and sets Trendlines up to pay a dividend for the first time.  Todd Dollinger, ChairmanAt a 3Q2021 business update yesterday, Trendlines Chairman Todd Dollinger signalled that a couple more large exits are on the horizon: Todd Dollinger, ChairmanAt a 3Q2021 business update yesterday, Trendlines Chairman Todd Dollinger signalled that a couple more large exits are on the horizon: "We have 62 companies in our portfolio and very importantly, 20 of those are advanced-stage companies, companies that have really started to prove themselves in the world and companies that we look forward to doing great things in the near term." |

Trendlines is an investment group headquartered in Israel which invents, discovers, invests in, and incubates innovation-based medical and agricultural technologies.

Co-Chairman Steve Rhodes added: "We're in a different place than we were five or six years ago. Today, we have a portfolio that has many more mature companies. We have some 20 advanced companies that we think could be candidates in the not distant future for exciting developments as well."

|

|

For more, watch the video of the 3Q2021 update here.