|

In the past year, the COVID-19 pandemic disrupted the world economy and sparked high volatility across major global stock markets. |

| Strong growth in the fourth quarter of 2020 leads to a quarterly high |

|

Stock price |

US$7.46 |

|

52-wk range |

US$4.83- |

|

Market cap |

US$388 m |

|

PE |

-- |

|

Dividend yield |

-- |

|

Shares outstanding |

44.46 m |

|

Source: Bloomberg |

|

Looking back at Huize’s 2020 performance, each of the first three quarters saw more than 40% year-on-year growth in total gross written premiums.

In Huize’s fourth quarter 2020 unaudited estimated results announcement released recently, the total gross written premiums facilitated on Huize’s platform are expected to be approximately RMB1 billion, setting a new quarterly high and a year-on-year increase of 55.7%.

The first-year premium is expected to be approximately RMB610 million, representing a year-on-year increase of 39.3%.

Total operating revenue is expected to increase by 47.1% year-on-year to reach at least RMB380 million, exceeding Huize’s previously announced guidance of RMB330 million to RMB350 million.

| Leveraging the Internet and technology to reach younger gerneration |

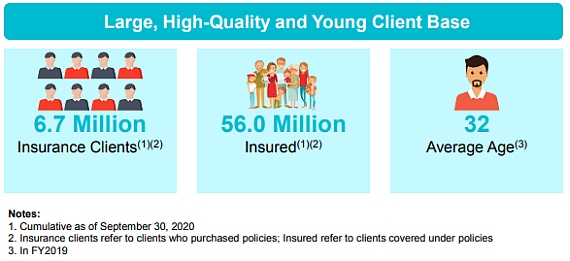

Huize’s target clients are Internet natives, highly educated, actively informed, and the average age of its existing insurance clients is 32 years old.

Huize has been focusing on the distribution of long-term insurance products with a higher price per policy and longer service lifecycle.

By extending the service lifecycle, Huize is able to meet the risk protection needs of the clients at different life stages. Thus, Huize’s client retention and repurchase rate has greatly increased, which enhances long-term and sustainable profitability.

Moreover, Huize cooperates with insurance companies to customize and launch cost-effective products to retain existing clients and attract new clients.

| The growing acceptance of online insurance platform, accelerated by the covid-19 pandemic, is creating unprecedented business opportunities for Huize. Among the industry participants, Huize has been one of the early movers with an operating history of 15 years, collecting deep clients insights to facilitate precision marketing, pricing and risk management. |

In 2020, Huize entered the 3.0 era of its development, which it labels as Smart Insurance.

Huize believes the major driving force is going to be the development of AI applications to further enhance efficiency in the distribution value chain. It has started to invest heavily in R&D and has begun to deploy AI technology on its platform.

For example, in May 2020, Huize launched the AI Proposal application, driven by the utilization of algorithms, big data analysis and machine learning technologies.

The application can quickly process customer inputs to not only identify and recommend those products which are the most suitable to clients, but also shorten the waiting time.

Huize’s consultants are now able to spend the time previously reserved for product recommendation research on providing clients with more in-depth explanation regarding specific guarantee classes, policy features and other relevant product details, and serving more customers.

As a result, the launch of AI Proposal has not only boosted consultant efficiency and productivity, but also enhanced the service experience for its clients.

By 2024, Huize’s gross written premium is expected to reach RMB12 billion, which is four times the current scale. Market sentiments for Huize’s prospects are growing. More than that, many well-known brokerages such as Citi, China Everbright and AMTD International, have initiated coverage with Buy ratings for Huize. Analysts are optimistic about this next-generation online insurance service provider focusing on long-term health insurance. On Monday, Huize’s stock price surged 14.59% to US$7.46 and the trading volume hit a more than three month high of US$3.68 million. Huize’s current market cap stands at US$388 million. |