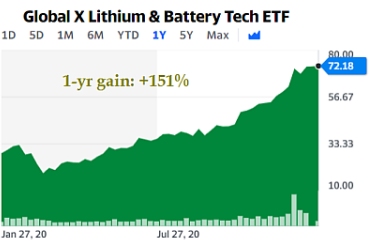

Global sales of electric cars have been rising strongly, triggering a run in stock prices in the electric vehicle space.  Source: Yahoo!In particular, mining stocks -- lithium, cobalt, nickel, high purity alumina, rare earths, etc -- have benefited greatly. Source: Yahoo!In particular, mining stocks -- lithium, cobalt, nickel, high purity alumina, rare earths, etc -- have benefited greatly.A lithium ETF (chart) has surged 151% in the past year. ETFs are not constructed to run so hard, or fall hard. The Global X Lithium & Battery Tech ETF owns a basket of 40 stocks exposed to the full lithium cycle, from mining and refining the metal, through battery production. In the case of car makers, everyone knows Tesla has shot to the stratosphere. So has BYD, the Chinese company that Warren Buffett has invested in. (See: Warren Buffett's Berkshire Hathaway has scored a 30x gain on its BYD investment. Here's the story of its bet on the Chinese electric-vehicle company.) The PE valuation of BYD looks elevated, reflecting the future potential of the EV industry. But it scares the daylight out of the conventional value investor. |

For what it is worth, here are excerpts from the latest UOB Kay Hian report on BYD.

Analyst: Ken Lee

We held an investor conference call with BYD yesterday. During the call, BYD expressed optimism on the 2021 outlook, hinting at 2021 sales growth target of 40% on the back of a strong product line-up for EVs. 2021 external battery sales will be driven by DiDi D1. BYD Semiconductor is slated for listing in 2H21, and we estimate its valuation at not less than that of A-share listed StarPower Semiconductor. Maintain BUY. Target price: HK$320.00. Our target price implies 110x 2021F PE. WHAT’S NEW • 2021 sales growth target hinted at 40%. BYD did not give a precise sales target. But management is highly ambitious on 2021 electric vehicle (EV) sales, and thus before end20, they had procured parts and components for total delivery of 600,000 units of vehicles for 2021 (including both internal combustion engine (ICE) cars and EVs), up 40.5% yoy, vs our estimate of 581,000 units (+36% yoy). Segment-wise, management thinks our 2021F EV sales volume of 341,000 units (+80% yoy) will be attainable, as it targets its PHEV models to sell 200,000 units in 2021. Full report here. |