| According to IMAS 2021 Investment Managers’ Outlook Survey, there is cautious optimism amongst fund managers as respondents bank on a robust Asian economic recovery ● Increase in government spending and easing Central Bank policy are expected to push growth significantly higher in 2021; ● US-China tensions less pressing concern for the global economy and markets; ● ESG investments continue to spur investor interest and is expected to be a significant driver over the next three years; ● Investment strategies are expected to be centred around emerging market equities and alternative asset classes over private markets.  Sharing key findings of the survey in a virtual session: Susan Soh, Chairman of IMAS | Rajeev De Mello, Chairperson, Development Committee, IMAS. Sharing key findings of the survey in a virtual session: Susan Soh, Chairman of IMAS | Rajeev De Mello, Chairperson, Development Committee, IMAS. |

Investment Management Association of Singapore (IMAS) 2021 Investment Managers’ Outlook Survey

The annual Survey aims to better understand the biggest challenges and developments, and forecast the most prominent trends in the investment management industry from the viewpoint of top investment professionals.

It identifies key macroeconomics indicators, dominant investment strategies and growth drivers for fund managers in the year ahead. This year’s survey gathered respondents from 58 members who comprised mostly c-level executives of fund management firms based in Singapore.

After one of the shortest and deepest global recessions, the ongoing government spending and easing Central Bank policy, coupled with the roll-out of vaccines, has instilled greater confidence among fund managers and investors.

From the recent Investment Management Association of Singapore (IMAS) 2021 Investment Managers’ Outlook Survey, half of the survey respondents expect economic growth to accelerate going forward.

Both fund managers and investors are cautiously optimistic about economic growth in 2021, with half of survey respondents expecting to see a sharp acceleration in growth in Europe, Japan and the United States (US).

Apart from cautious optimism in 2021, nearly 66% of respondents expect the US Dollar to weaken by more than 5% vs. the Singapore Dollar.

This perfectly aligns with the investor sentiments across the globe where the accommodative stance by the US Federal Reserve, the rise in global growth and the robust Asian economic recovery, have significantly weighed down upon the US Dollar.

Fund managers also cited inflation concerns (22%) and continued US-China tensions (31%) as their key expectations in 2021.

Ms. Susan Soh, Chairman of IMAS, said:

| “Amidst an atmosphere driven by uncertainty, the roll-out of vaccines have revived the global economy, and instilled greater confidence among investors who were reluctant to invest during the pandemic. But broadly, we believe that business growth will improve as we see increased consumer spending by households who have built up savings and are eager to resume normal activities. Besides the pandemic, fund managers in Asia have also been most concerned about US-China tensions. And while the upcoming change in administration in the US should provide some comfort, it will still remain a source of concern – though markedly less than in previous years.” |

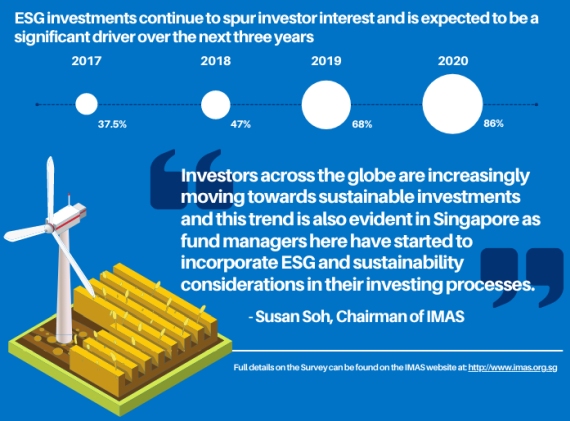

In the same vein of the last couple of years, fund managers experienced a significant rise of investor interest in Environment, Social and Governance (ESG) investments. A significant 86% of IMAS members highlighted ESG investing as a key growth driver, up from 68% in the previous year.

ESG considerations are a fairly recent phenomenon in the Asian context, which pose potential challenges in implementation. One such challenge is the integration of alternative data sources on climate change into the management of global investors’ ESG portfolios.

But that will not stop fund managers, as 67% of the respondents ranked ESG and impact-focused strategies as the top strategy that will grow in popularity in 2021, similar to last year. Fund managers are now more bullish on emerging market equities and alternative class investments in comparison to the 2020 strategy of investments into private markets.

Ms. Soh added:

| “Investors across the globe are increasingly moving towards sustainable investments and this trend is also evident in Singapore as fund managers here have started to incorporate ESG and sustainability considerations in their investing processes. Following the recent publication of the Environmental Risk Management Guidelines for Asset Managers that IMAS co-created with MAS, we will be launching a series of ESG training programmes for the industry to support our nation’s transition to a truly sustainable economy.” |

Full details on the Survey can be found on the IMAS website at: http://www.imas.org.sg.