Excerpts from Maybank KE report

Analyst: Gene Lih Lai, CFA

As demand drivers appear intact, we believe a key earnings risk is if global supply chain disruptions result in any unforeseen components shortages. Maintain BUY and ROEg/COE-g TP of SGD2.82 (3x blended FY20-21E P/B). |

|||||

| Guidance kept; Intel deliveries >90% on time |

On 19-Mar, AEM announced that its sales guidance of SGD360-380m for FY20 is unchanged.

Further, AEM introduced 1Q20 sales guidance of a record SGD135-145m, and is cautiously confident that 1H20 will be an all-time high despite some shifts in the delivery of its sales orders due to the Covid-19 situation.

On 20-Mar, key customer Intel highlighted that it is delivering more than 90% of its chips on time.

This is consistent with Intel’s early March message that operations are “relatively normal”.

| Robust balance sheet and solid cash generation |

|

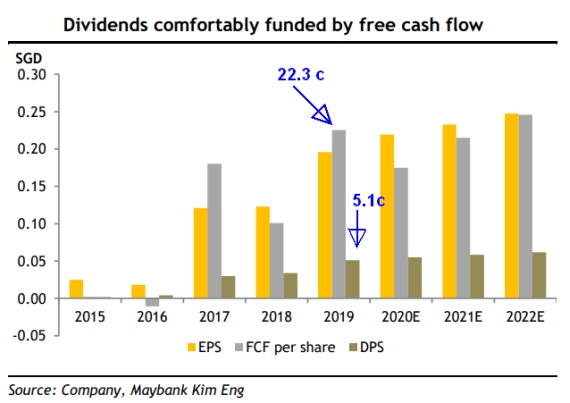

Free cash flow |

|

|

AEM’s balance sheet is robust with net cash to equity of 80%. Strong cash generation is driven by high profitability and working capital efficiency.

Since 2017 (ramp-up of HDMT test handlers), cash conversion cycle has been around 15 days or less.

Intel has also kept a tight range for its days of payables outstanding (~40-50 days), even throughout the GFC, suggesting it is a good paymaster.  In 2019, AEM's free cash flow amounted to S$60.9 million (22.3 cents a share). This was after spending $5 million in capex.

In 2019, AEM's free cash flow amounted to S$60.9 million (22.3 cents a share). This was after spending $5 million in capex.

While we caution further volatility in the share price, we believe this may present buying opportunities. |

Full report here.