Excerpts from UOB KH report

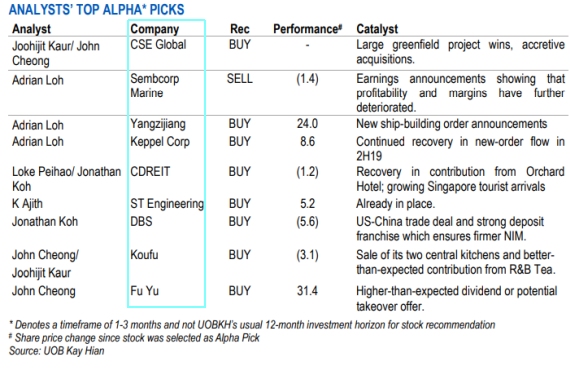

| STRATEGY – SINGAPORE Alpha Picks: Outperformed In 2019; Adding CSE Global  Lim Boon Kheng, MD of CSE. NextInsight file photoOur alpha picks outperformed the broader market in 2019 by 3.2ppt. Lim Boon Kheng, MD of CSE. NextInsight file photoOur alpha picks outperformed the broader market in 2019 by 3.2ppt. In Dec 19, our portfolio’s return of 1.5% mom surpassed the FSSTI’s gain of 0.9% with notable outperformers being Yangzijiang and Fu Yu. For Jan 20, we add CSE Global to our portfolio and stick to the rest of our picks. |

WHAT’S NEW

• Alpha picks outperformed FSSTI in 2019. On an equal weighted basis, our alpha picks clocked in a decent gain of 8.2% in 2019, outperforming the FSSTI which recorded a smaller gain of 5.0%.

This was mainly attributable to our portfolio’s performance in 1Q19 (+5.3%) and 4Q19 (+7.4%).

• Reviewing picks in December. Our portfolio recorded an increase of 1.5% mom in December, surpassing the FSSTI’s gain of 0.9% mom.

Notable outperformers within our portfolio include Yangzijiang (+8.7% mom) and Fu Yu (+8.5% mom) which was partially offset by the underperformance of ST Engineering (-4.6%) and our short call on Sembcorp Marine (+4.8% mom).

ACTION

• Adding CSE Global to our January portfolio. We add CSE Global as we believe the group is likely to end the year with a strong order backlog.

This, coupled with the earnings accretions from recent acquisitions, particularly Volta, sets CSE up for a strong 2020 in our view.

In addition, the stock offers a generous dividend yield of 4.9% at current prices.

| CSE Global – BUY (Joohijit Kaur & John Cheong) |

| • Healthy orderbook and earnings-accretive acquisitions should lift earnings in 2020. Strong 3Q19 order wins (+38% yoy excluding Volta’s order wins) will likely have CSE posting an order backlog of S$300m-320m at end-19 – the highest since 2012. In addition, we expect recent acquisitions to drive growth and earnings in 2020, particularly its acquisition of Volta from which we conservatively forecast net profit contribution of S$3m for 2020. • Beneficiary of Smart Nation initiatives in Singapore. With the government’s emphasis on Smart Nation initiatives and the inclusion of digital defence as part of the overall Total Defence framework, CSE will be able to capitalise on future government tenders in this space. CSE managed to secure approx S$60m from security related government contracts in 4Q18; further wins in this area will add to CSE’s growth momentum in 2020. • Attractive dividend yield at 4.9%. The group has adopted an absolute DPS payout of 2.75 S cents/share since 2014 and intends to maintain dividend at 2.75 S cents/share for 2019, translating into a generous dividend yield of 4.9%. Share Price Catalyst • Event: Large greenfield project wins, accretive acquisitions. • Timeline: 3-6 months. |

Full report here.