| For some investors, Procurri Corporation takes some getting used to. Headquartered in Singapore, its business is not the easiest to understand because, to begin with, there's no direct comparable on the Singapore Exchange.  Sean Murphy, Chairman and Global CEO of Procurri. NextInsight photoIt might, however, be worthwhile to try to appreciate it. It's a global business (which covers over 100 countries), it's scalable, and its profit margins are excellent. Sean Murphy, Chairman and Global CEO of Procurri. NextInsight photoIt might, however, be worthwhile to try to appreciate it. It's a global business (which covers over 100 countries), it's scalable, and its profit margins are excellent.Such attributes are probably key to why Novo Tellus PE Fund 2, L.P. was attracted as an investor. In March 2019, Novo Tellus and its co-investor A.C.T Holdings became the largest shareholder of Procurri, with a 29.6% stake. Novo Tellus had purchased the stock from DeClout at 33 cents a share. Novo Tellus managing partner Loke Wai San said then: "Procurri possesses many of the qualities we look for in high-potential companies. Sean and his co-founders have built a profitable global company with S$200 million in turnover in just over 6 years by starting with a clear vision for the future of enterprise IT infrastructure, and then applying their decades of sector experience to build a platform capable of serving the highest valued channels and enterprise customers worldwide. "Today, Procurri helps some of the largest IT channels and enterprise customers save IT costs, extend the lifespan of IT investments, and migrate securely to future cloud architectures." |

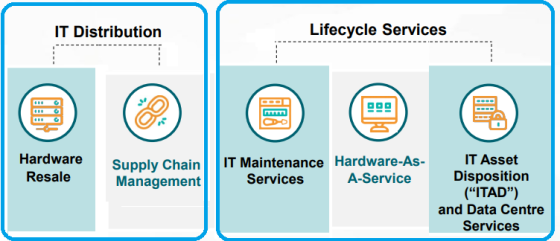

Procurri has two business segments: The Lifestyle Services segment essentially provides a wide range of maintenance services to corporates with respect to their IT hardware.

The gross margin for 1H2019: 56.6% (1H2018: 59.3%).

CFO Vincent ChooThe other segment is IT Distribution, which as the name suggests, is about buying IT hardware and re-selling it.

CFO Vincent ChooThe other segment is IT Distribution, which as the name suggests, is about buying IT hardware and re-selling it.

Not surprisingly, the gross margin was lower in 1H2019 at 28.8% (1H2018: 26.7%).

Lower, yes, compared to Lifecycle Services but still much higher than what many other types of business are able to achieve.

The blended group margin was: 37.9%.

Sean Murphy, Chairman & Global CEO of Procurri, highlighted the potential of a new division, IT Asset Disposition (ITAD), which now has only 14 employees.

There is growing recurring revenue and the potential for mega deals like the one in 2Q2018 which catalysed the creation of the ITAD division.

That deal brought in US$7.4 million in revenue and US$3.4 million gross profit in 2Q2018.

The work included Procurri taking in data centre equipment, wiping off the data, and reselling parts such as chips and hard drives.

There is a tailwind for this business as corporates migrate their data to the cloud and require trusted service providers like Procurri to "sanitise" sensitive data before recycling the hardware to third parties.

Here's how Procurri fared:

| SGD '000 |

1H2019 |

1H2018 |

Change |

|

Revenue |

108,777 |

112,780 |

(3.5) |

|

Gross Profit |

41,223 |

40,428 |

2.0 |

|

Gross Profit margin |

37.9% |

35.8% |

2.1 points |

|

EBITDA |

11,077 |

9,990 |

10.9 |

|

Pre-tax profit |

4,631 |

5,190 |

(10.8) |

|

Net profit |

3,078 |

2,245 |

37.1 |

| While Procurri has no direct comparable on the SGX, two very recent transactions involving its competitors can guide investors as to what Procurri's valuation can aspire to: • In July 2019, Carlyle Group agreed to sell its majority stake in Evernex to 3i. The valuation is 13X EBITDA, according to Mr Murphy. • In July 2019, private equity firm GCGR agreed to sell its stake in Park Place Technologies also for, coincidentally, 13X EBITDA. In comparison, Procurri (33 cents) currently trades at 4-5X EBITDA. On a price-earnings basis, it's 15X. |

For more info, see the Powerpoint presentation material here.