|

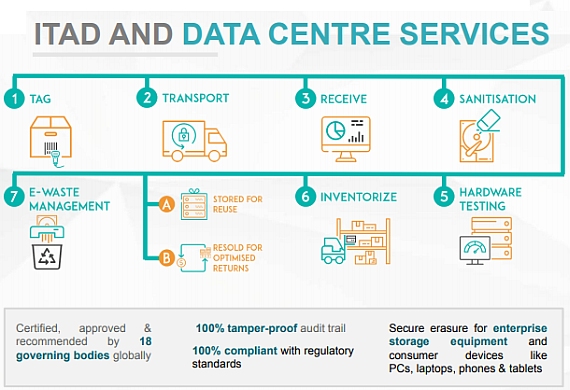

There's one business segment of Singapore-listed Procurri Group that looks particularly promising: It's ITAD, which is short for IT Asset Disposition.

|

Procurri, in a landmark opportunity, has entered into a partnership with mega distributor Ingram Micro, which has an ITAD business for consumer products such as laptops, desktops and mobile phones.

|

Stock price |

21 c |

|

52-week range |

21 – 50 c |

|

Market cap |

S$62 m |

|

PE (ttm) |

16 |

|

Dividend yield |

-- |

|

Year-to-date |

-24% |

|

Shares outstanding |

293 m |

|

Source: Yahoo! |

|

Procurri, on the other hand, has enterprise business experience, especially revolving around data centres.

Ingram Micro is allowing Procurri to set up shop in one of its key distribution hubs, whereby Procurri will help process data centre equipment and remarket it subsequently.

Correspondingly, Procurri in the ordinary course of business will pass consumer-related business that it encounters to Ingram.

The partnership has just gotten started, following an announcement in Dec 2019.

“It has been a scale-up year for us as the cloud gets more mainstream. In December 2019, we clinched a partnership deal with Ingram Micro to fortify our growing ITAD services. Additionally, we made the necessary investments to build our own ITAD in-house capabilities to place Procurri in the best possible position for these opportunities. Looking ahead, in 2020, we expect to solidify and strengthen our existing infrastructure, and fine-tune our internal systems to enhance our three complementary world class businesses of third-party maintenance, IT asset disposition, and infrastructure resale under one efficient and robust platform to extend our competitive advantage as a global aggregator of IT services and enterprise hardware.” “It has been a scale-up year for us as the cloud gets more mainstream. In December 2019, we clinched a partnership deal with Ingram Micro to fortify our growing ITAD services. Additionally, we made the necessary investments to build our own ITAD in-house capabilities to place Procurri in the best possible position for these opportunities. Looking ahead, in 2020, we expect to solidify and strengthen our existing infrastructure, and fine-tune our internal systems to enhance our three complementary world class businesses of third-party maintenance, IT asset disposition, and infrastructure resale under one efficient and robust platform to extend our competitive advantage as a global aggregator of IT services and enterprise hardware.”-- Sean Murphy (photo), Procurri’s Chairman and Global CEO |

CFO Vincent ChooAs Procurri embarked on a scale-up strategy phase, it made heavy investments to boost its ITAD in-house capabilities.

CFO Vincent ChooAs Procurri embarked on a scale-up strategy phase, it made heavy investments to boost its ITAD in-house capabilities.

These expansionary efforts coupled with several low margin IT Distribution deals in 4Q2019 to move aged inventories and avoid stock write-down created temporary pressure on margins for 4Q2019.

• IT Distribution saw a 3.3% YoY decline in revenue to S$149.8 million in FY2019 due to lower revenue contributions from the Asia Pacific region,

• Lifecycle Services segment continued its upward trajectory in all regions, achieving a 9.3% growth YoY to S$71.5 million for FY2019.

Overall, the Group’s total revenue increased by 0.5% YoY to S$221.3 million in FY2019.

| SGD '000 |

2019 |

2018 |

Change |

|

Revenue |

221,289 |

220,236 |

0.5 |

|

Gross Profit |

80,103 |

80,503 |

(0.5) |

|

Gross Profit margin |

36.2% |

36.6% |

(0.4 ppt) |

|

EBITDA |

17,345 |

19,739 |

(12.1) |

|

Pre-tax profit |

4,737 |

10,077 |

(54) |

|

Net profit |

3,775 |

5,337 |

(29.3) |

Administrative expenses rose by S$4.5 million to S$54.4 million for FY2019, mainly due to an increase in staff cost, depreciation of right-of-use assets and reclassification of indirect tax expenses from income tax expenses to administrative expenses.

Selling expenses also increased by S$1.8 million to S$18.0 million in FY2019 following the higher pay-outs in the Americas and EMEA.

As a result of the above, Procurri recorded S$3.8 million in net profits for FY2019, compared with S$5.3 million for FY2018.

The Powerpoint presentation is here.