Excerpts from Lim & Tan Securities report

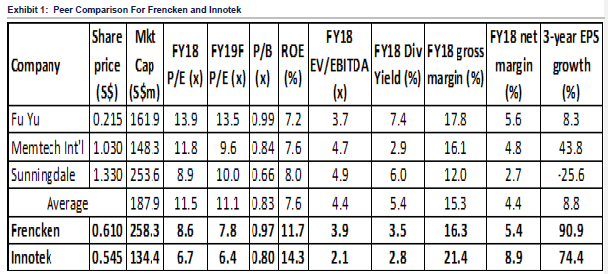

| Recommending a BUY on Innotek target price of S$0.945. As seen below, Innotek’s valuations are the most attractive with both P/E and EV/EBITDA ranking as the cheapest within its sector peers. Financial metrices such as ROE and profit margins for Innotek are the best among its industry group as depicted in Exhibit 1. We believe this gap reflects the lack of market confidence in the sustainability of Innotek’s turnaround efforts.  |

As management continues to execute on its growth strategies going forward, such as new customer acquisitions, geographical expansion, new product introductions and further production improvements, we believe the market will start to take notice and rerate the stock closer to its peer group valuations.

After having restructured and turned around Innotek from 2016-2018, management is now targeting to grow the company in 2019.

Going forward, we are expecting Innotek’s net earnings to grow by 4.0% yoy to S$21mln in FY19 and expand by another 4.8% yoy to S$22mln in FY20.Lou Yiliang, CEO.This growth will be underpinned by Mr Lou’s plan to further reduce its production headcount to under 2,000 and the engagement of factory automation to improve profitability.

We understand that its adoption of a new incentive scheme to reward production workers by production volume has helped to improve profitability and would continue to do so going forward.

Automotive and Office Automation to drive growth. We understand that Innotek had recently secured three new customers for its Automotive segment and that new automobile projects secured by the Group had started mass production in 2019.

|

“With more than 50% of its market cap backed by cash, proactive capital management can help unlock value via special dividends, share buybacks or accretive acquisitions. |

Notwithstanding the current uncertainty in China’s automotive industry, the Group’s newly acquired major customers have expressed confidence in the quality and functionality of its products.

Therefore the Group expects stability of its automotive business which will contribute steadily to the revenue in the future.

Meanwhile, the transfer of production from China to Southeast Asia by the Group’s Japanese office automation (“OA”) customers is still ongoing. Several of them have imposed more stringent requirements on existing Chinese suppliers, including adopting a centralized and careful selection of suppliers.

The Group’s OA business is still growing steadily this year, underscoring the Group’s capability to respond to customers’ strict requirements on product quality and delivery time.

The Group intends to increase its market share by shifting from single component supply to assembly works. Mansfield (Thailand) was officially opened in June 2018 and scheduled to start mass production in first half 2019.

This new plant in Thailand is expected to be an integral part of the supply chain and will continue to supply products to the Group’s customers in Thailand with the support of Mansfield Dongguan.

| ♦ Key risks |

| Margin pressures expected in the short-term. While Innotek had recently released a set of commendable 1Q19 results which saw net profit surge to S$3.9mln from net earnings of S$117k in1Q18, management had warned of margin pressures. Innotek had verbally guided that its high profit margins in 1Q19 is not sustainable. Economic slowdown in China. As Innotek had mentioned, China’s economic slowdown amidst ongoing concerns of a Sino-US trade war is expected to keep overall business and consumer sentiment on edge in the foreseeable future. This will continue to impact a number of industries in China in 2019, including automotive, which is an important source of revenue for the Group. Although the Chinese government is taking active measures to expand domestic demand, it remains to be seen if it can help to reverse the overall economic downturn in the short term. |