ISOTeam (“ISO”) caught my attention. Despite sitting on a record order book, ISO has tumbled approximately 44% from an intra-day high of $0.385 on 10 Apr 2018 to near a four-year low at around $0.215 on 10 Jan 2019.  CEO Anthony Koh. NextInsight file photoThe decline was attributable in part to its 4QFY18 surprise loss announced in Aug 2018 (financial year ends in June). Nevertheless, my gut feel is that 4QFY18 should mark the trough in earnings and results should improve on a quarter on quarter basis in the next few quarters. CEO Anthony Koh. NextInsight file photoThe decline was attributable in part to its 4QFY18 surprise loss announced in Aug 2018 (financial year ends in June). Nevertheless, my gut feel is that 4QFY18 should mark the trough in earnings and results should improve on a quarter on quarter basis in the next few quarters.As this company is a potential turnaround play, I arranged a 1-1 meeting with Mr Anthony Koh, Executive Director and CEO, and Mr Richard Chan, General Manager (collectively, “Management”), last month. |

Description of ISO

ISO has grown from a company doing repairs and redecoration (“R&R”) & addition and alteration (“A&A”) projects in 2014 (when I first met them) to a multi-disciplinary company which provides complete solutions to the built environment.

Key takeaways from the meet-up

1. 4QFY18 loss was due to several factors, some of which are unlikely to be repeated

ISO reported a 4QFY18 net loss of S$2.0m in Aug 2018. Overall, FY18 net profit dropped 71% from S$6.4m in FY17 to S$1.9m in FY18. This drop was mainly attributable to the following factors, some of which are likely to be one off:

a) Resistant to change in bidding strategy for R&R projects resulting in fewer projects won;

In FY18, there were fewer R&R projects put up by town councils for public tender with more L2-grade jobs in the $1-2m range, which is a highly competitive space with many smaller players competing on prices. Amid the heightened competition, ISO was initially resistant in changing its bidding strategy so as to maintain its gross margins for R&R projects at above 20%.

With the loss incurred in 4QFY18 (Apr – Jun), management has decided to change their bidding strategy by lowering their gross margin requirement by a few percentage points. Nevertheless, they believe that such change is necessary and beneficial for the group as a small sacrifice in margins is likely to bring about a significant increase in volume of R&R projects secured.

This change in strategy is apparently successful as ISO announced on 19 Nov 2018 that it has clinched seven R&R projects worth S$10.8m. On 9 Jan 2019, ISO announced a further three R&R contract wins amounting to S$9.8m.

b) Start-up investments in 1st HIP project;

ISO has incurred some start-up costs for its 1st HIP project, such as buying 80 sets of temporary toilets ($5K for each toilet), construction equipment, container office, platform etc. Some of these are one-time investments which can be used for other projects. Furthermore, with the experience of its 1st HIP project, it is likely that they may get better margins for subsequent HIP projects;

c) Some projects previously incurred losses but have either broken even or stabilised;

Overseas projects in Myanmar and Malaysia incurred some losses in FY18. ISO has since reduced the headcount and altered its strategies. In Myanmar, ISO is working with Singapore developers who want to develop projects in Myanmar. With Singapore developers, it is easier to do business and payment collection is easier too.

In Malaysia, ISO has also significantly reduced its headcount. Together with its joint venture partner, they plan to change strategy to develop boutique projects (i.e. develop a small piece of land with 50-80 units and sell à its partner’s forte) or / and manage foreign worker dormitory (ISO’s forte). As of now, both Malaysia and Myanmar businesses have stabilised.

ISO’s SG bike is one of three bike companies (the other two are Chinese firms Mobike and Ofo) to be awarded full licences by LTA. ISO has seen encouraging signs from SG bike. In fact, it broke even in Oct 2018.

Together with its partners, ISO intends to roll out family bikes in 1Q2019 in parks to capture another segment of the market. SG bike may perform better in 2019 as Ofo seems to be having problems with cash flow, customer refunds etc. Furthermore, GrabCycle, one of the three companies to be awarded a sandbox licence, has decided to give up its licence.

In short, although it is unfortunate that ISO posted a 4QFY18 loss in Aug 2018, management views it as a “timely wake-up call” to all ISO workers to do their part to reduce cost, while not affecting quality. In this aspect, management is confident that all of their interests are in line with ISO’s shareholders to reduce cost, improve earnings while not affecting work quality.

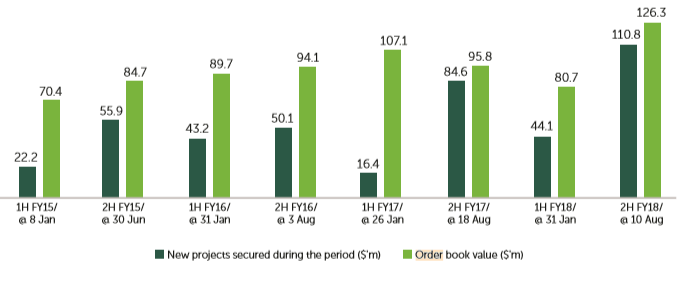

2. Record order book may get stronger…

With reference to its annual report (see Chart 1 below), its order book size is usually on average S$93.6m. However, it has recently been winning contracts. In less than two months, ISO announced S$72m worth of contracts from 19 Nov 2018 through 9 Jan 2019! As of 9 Jan 2019, ISO’s order book has reached S$143m, the highest since the Group’s inception more than twenty years ago. This is approximately 1.7x its FY18 revenue.

Chart 1: ISO’s order book trend

Source: Company’s annual report 2018

Management is positive that the order book can be maintained, or even increased due to the following trends / developments:

a) Bright HIP project outlook

ISO bidded for 2 HIP projects, one of whose result was announced on 2 Jan 2019. ISO won its 2nd HIP project worth S$26.3m (its first HIP project clinched on Jan 2017 was around S$17.5m). My understanding is that the other HIP contract encompasses three to four precincts, hence the contract size may be larger.

Besides the project size being larger, the number of HIP projects is likely to increase significantly due to two new developments. Firstly, HIP I has been expanded to include HDB blocks that were built prior to 1997. Management believes this will open up opportunities for another 230,000 flats, equivalent to approximately 30 HIP projects a year!

Secondly, the introduction of HIP II for flats which are 60-70 years old will open up another large pie in the long term. As the flats will be older then, there may be more areas to upgrade which may naturally result in larger contracts.

b) Visible increase in R&R projects

Management observes that there is a visible increase in R&R projects up for tender. At a dialogue held as part of a welcome dinner at the inaugural Bloomberg New Economy Forum in Singapore in Nov 2016, our Prime Minister Mr Lee said it is always possible to bring the general election forward (earlier than Jan 2021).

In the past, there seemed to be an increase in R&R projects, or other projects, up for tender ahead of elections. As ISO works with all 16 town councils in Singapore, this stands them in good stead when it comes to project bidding.

ISOTeam is an early mover and leading contractor in installation of dolar panels. It works closely with partners such as HDB and Sunseap to harness innovative technology. Photo: Company ISOTeam is an early mover and leading contractor in installation of dolar panels. It works closely with partners such as HDB and Sunseap to harness innovative technology. Photo: Company c) Sunseap spells opportunities for ISO Based on an article in The Edge, Sunseap is building one of the world’s largest offshore floating photovoltaic (OFPV) systems to be located north of Woodlands Waterfront Park, along the Straits of Johor. Based on a 9 Jan 2019 announcement, Sunseap has awarded the S$11.3m project to ISO, comprising of the supply, design and installation of Offshore Grid-tied Solar Photovoltaic Systems. This is a milestone for both Singapore and ISO. The success of this project (to be completed by Sep 2019) is expected to open up similar opportunities locally and around the region.  |

d) Largest single contract win $46.5m from IR group may herald other projects of such nature

In May 2018, ISO announced that it was awarded its single largest contract amounting to $46.5m from a leading integrated resort group with expected completion in Mar 2019. If they can successfully complete such a large contract on time, it may open doors to other contracts of such nature.

3. Cost savings of S$500K-S$1M on a steady state basis

ISO has just consolidated all its operations under one roof by shifting to Changi North in Apr 2018. Cost savings, stemming from venue rental, dormitory costs, reduction in operational and administrative expenses, are likely to be seen from FY19F onwards with greater savings likely in FY2020 as ISO continues to streamline its operations. Cost savings may be S$500K – S$1M on a steady state basis.

In addition, ISO is exploring the possibility of closing down, or streamlining certain business units because of duplication in capabilities. They are also exploring avenues to improve productivity through job redesign and retraining, as well as investing in talent by upgrading the skills of workers who have performed well.

4. Possibility of disposal gains

Based on its annual report 2018, management plans to unlock value by selling two properties at Kaki Bukit and Serangoon. Such sales if they materialise, may result in an approximate S$3m gain.

5. Recurring income from energy-saving solutions

ISO announced on 25 Sep 2018 that it had entered into a collaboration agreement with Thai company Centerlise, to exclusively distribute and install Centerlise’s air centre hardware and equipment as well as its software systems locally. Based on ISO’s press release, Centerlise’s advanced algorithm cloud-based software automatically finetunes air conditioning and water systems, resulting in up to 30% in utility savings while maintaining optimum performance.

Its application is compatible with any building with central air conditioning or chiller plants. Management believes that energy-saving solutions are highly relevant in this time and age amid climate change, and has seen some encouraging response from potential customers.

ISO is not the only one interested in this segment. Based on a Bloomberg article dated 13 Dec 2018, KKR is putting in as much as S$45M in Barghest Building Performance (BBP), a Singapore provider of energy-saving solutions. (Management cites BBP as one of its direct competitors in the energy-saving space).

Going forward, this field is likely one of the areas where global private equity firms such as KKR, TPG and Bain Capital LP may focus on for their impact investing strategies. (Impact investing, in simple terms, is investing with the aim of achieving both financial return and social benefit)

6. Sunseap – potential IPO in 2019?

ISO invested S$5 million into Sunseap via its Series C preference shares in May 2017. Based on an article published in South China Morning Post on 9 Aug 2017, Sunseap plans to do an IPO as early as 2019. Should Sunseap IPO in 2019, ISO may be able to get good returns from its investment.

Valuations seem undemanding

In view of its bright industry prospects and potential new revenue streams, valuations seem undemanding for ISO based on Price to Book (“P/BV”). ISO is trading at 1.0x P/BV vis-a-vis its 5-year average P/BV of around 1.9x. My personal view is that PE may not be an accurate representation as 4QFY18 registered a shocking loss which resulted in FY18 net profit being extremely low.

Risks

As usual, there are many risks involved, especially in small caps. In my opinion, some obvious risks are execution risk, illiquidity risk and time horizon.

1. Execution risk

Execution is key to bring about the desired effects, ranging from project delivery, execution in new business segments, success in streamlining operations and reducing cost etc. Any serious hiccups in either of these areas may have an adverse effect on the company.

2. Illiquidity risk

Based on its latest annual report 2018, the top 20 shareholders have about 82.8% of ISO’s outstanding shares. Ave 30D volume amounted to around 49,000 shares only. This is not a liquid company where investors can enter or exit quickly. Against the backdrop of our volatile market, ISO may swing quite a bit if there are sudden sellers or buyers.

3. Time horizon

In my opinion, even if 4QFY18 marks the trough in operating performance, it may take some time for ISO (probably a couple of quarters) to generate good results on a year on year comparison. Nevertheless, my guess is that there is likely sequential (i.e. quarter on quarter) improvement in results, barring seasonal effects like Chinese New Year.

4. Valuations may be high if PE is used

ISO is trading at 32.1x PE. However, it depends on which valuation measure one uses. My personal view (I may be wrong) is that PE may not be such an accurate representation as 4QFY18 registered a shocking loss which resulted in FY18 net profit to be extremely low.

The above list of risks is not exhaustive

To keep my write-up concise, the above list of risks is not exhaustive. Readers are advised to refer to the analyst reports HERE and ISO’s website HERE. You can also refer to ISO’s prospectus for more information on the risks etc. In addition, you can also contact ISO’s investor relation August Consulting if you have any queries regarding the company.

|

Conclusion My personal view is that amid its strong order book, bright outlook for its business segments especially HIP, R&R projects, collaboration with Sunseap and Centerlise, it is likely to be a turnaround play in FY19F with more evidence of improvement likely to be seen in 2HFY19F. Nevertheless, readers have to be cognisant of (just to cite a few) illiquidity risk, execution risk etc. |

P.S: I am vested in ISO and have informed my clients in Dec when ISO was trading around $0.195.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE