Excerpts from UOB Kay Hian report

| Staying the course; sticking with the fundamentals. Our recent addition, Sunningdale, declined 9.2% m-o-m but it looks oversold. In view of this, a firm US dollar and expected recovery in 2Q18, we reiterate our BUY call on Sunningdale. CSE saw profit-taking in June (-6.5% m-o-m) but is still offering positive returns of 4.9% since being added to our alpha picks. CSE remains our preferred proxy to the firm oil prices as we remove Keppel Corp due to the lack of near-term catalysts for the latter. |

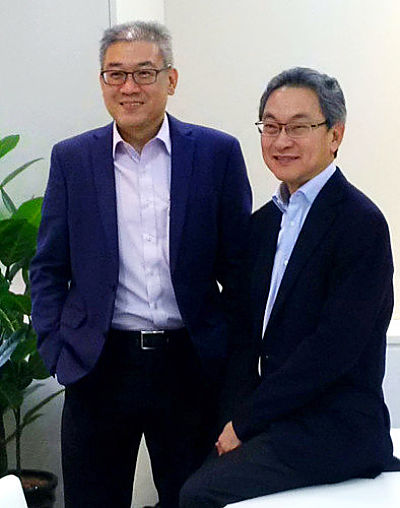

CEO Khoo Boo Hor with non-executive chairman Koh Boon Hwee. NextInsight file photoSunningdale – BUY (Yeo Hai Wei)

CEO Khoo Boo Hor with non-executive chairman Koh Boon Hwee. NextInsight file photoSunningdale – BUY (Yeo Hai Wei)

• Oversold. The stock has retraced 33% from its recent high and is currently trading at 0.7x P/B and at 7.7x 2018F PE, which is significantly cheaper than its peers, including Memtech.

• Hoping for a better 2Q18 to provide relief. Investors have been shaken by a weak 1Q18, exacerbated by forex losses.

We expect a seasonally better 2Q18 and the potential for a forex gain in 2Q18 as the US dollar has gained 1.9% vs the Singapore dollar.

|

Sunningdale |

|

|

Share price: |

Target: |

• Price currently below major shareholder’s last purchase. After the price retracement, Sunningdale is trading at an 18% discount to the last acquisition price of S$1.71 (13m shares) by its chairman Koh Boon Hwee.

Share Price Catalyst

• Event: Recovery in 2QFY18 earnings and gains from disposal of its non-core asset.

• Timeline: 3-6 months

CSE Global – BUY (Yeo Hai Wei)

• High entry barriers. The group has a 32-year track record in a business with high entry barriers. CSE is one of the few qualified system integrators in the region for O&G and communication infrastructure industries. • Potential synergies from new shareholder. Serba Dinamik, a Malaysian-listed company, recently bought a 25% stake in CSE at S$0.45/share. We see potential synergies as it could open up new markets for CSE such as Malaysia and Middle East. Share Price Catalyst • Event: New contract wins and continued recovery in earnings. |

||||

Full report here.