Graphic: Dollars and Sense

Graphic: Dollars and Sense

This article was written in collaboration with DBS. Views expressed in the article are the independent opinion of DollarsAndSense.sg

Shoppers are spoilt for choices: We are able to compare prices from different retailers and online stores to get the best available deals.

Few people, however, pay attention to the method of paying for online purchases. We either just ignore this detail or tend to assume that we would be paying the quoted price regardless of how we pay.

This couldn’t be more wrong.

The irony of online shopping is that you could end up buying the same product from the same website at the same moment, and yet end up paying drastically different prices, depending on how you choose to pay.

To help derive the best way to pay for our overseas online shopping, we performed our own mini-experiment. We logged-on to ASOS, a UK-based website, and decided to buy the same product thrice on the same day, a few minutes apart, using three different payment methods. Here’s how much we had to pay via each method.

Buying The Same Pair Of Sneakers, THRICE

After a brief internal discussion, we decided that a pair of white Vans sneakers would be put to the best use post-experiment. On the ASOS website, we were each quoted £55.00 for the pair of sneakers. Since ASOS is a UK-based company, it made sense that prices were quoted in British Pounds.

* Even though we chose to purchase on the ASOS website and decided to buy a pair of Vans sneakers for this experiment, we want to stress that learning outcomes in this article are also applicable to other purchases via online sites and for other products.

Scenario 1: Paying With Our DBS Visa Debit Card, Which Is Linked To Our Multi-Currency Account (MCA)

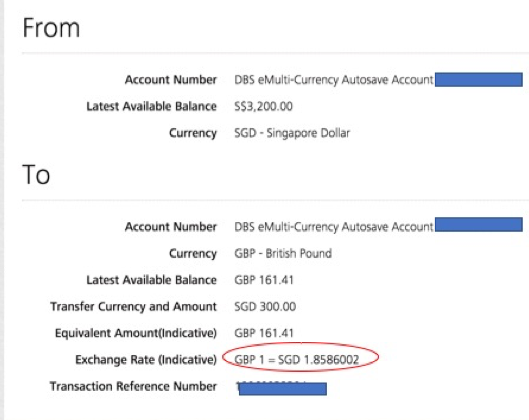

Our first method of payment was to use our DBS Visa Debit Card, which is linked to our DBS Multi-Currency Account (MCA). To pay using the DBS MCA, we first convert our Singapore Dollar (SGD) to British Pound (GBP) to store £55.00 in our account.

You can see from the screenshot above that we got a conversion rate of GBP 1 = SGD 1.8586. We then proceeded to purchase the sneakers with our DBS debit card.

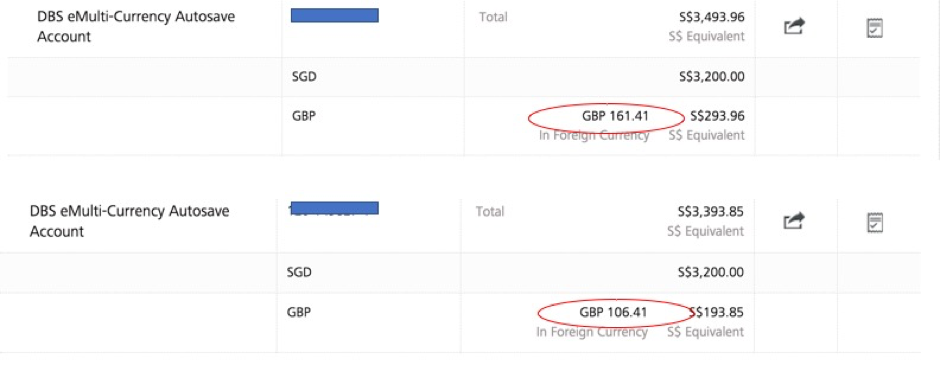

You can see the exact amount of £55.00 (from GBP 161.41 to GBP 106.41) being deducted from our DBS MCA.

You can see the exact amount of £55.00 (from GBP 161.41 to GBP 106.41) being deducted from our DBS MCA.

In other words, our first pair of Vans sneakers cost us S$102.22 (£55 X 1.8586).

Scenario 2: Paying In GBP Using A Credit Card

In previous articles, we have written about how you should always opt to pay in foreign currency when using credit cards overseas, instead of allowing the merchants to charge you in SGD using what is called a Dynamic Currency Conversion (DCC).

This applies not just when you are using your credit cards on trips where you are physically overseas, but also when you are shopping online on overseas websites.

For our second purchase, we paid using a Singapore credit card. Similar to our first purchase, the price of the shoe was £55.00.

However, the disadvantage with this method is that we are not able to know the price of the sneaker (in SGD) at the point of purchase. We had to wait till our credit card statement arrived to know how much we were charged for this second method of purchase. ![]()

The image above was taken from our credit card statement and it shows us that the price we paid for the sneaker was S$105.52. This is higher by S$3.20, or slightly more than 3.1%, compared to our first purchase via our DBS MCA.

Scenario 3: Paying In SGD Using A Credit Card

The third scenario we opted to “pay in local currency”. This is a function many online portals and even physical stores offer, charging your credit card in SGD rather than the foreign currency for our convenience.

This is an option many Singaporeans unwittingly believe is beneficial when shopping online.

Here’s a simple online shopping hack. If you are purchasing a product on an overseas website, and you see the prices being quoted to you in SGD, actively search for an option that allows you to pay in foreign currency, instead of SGD.

Otherwise, you will usually end up paying more for the same product when you allow the merchants to do the currency conversion for you via DCC.

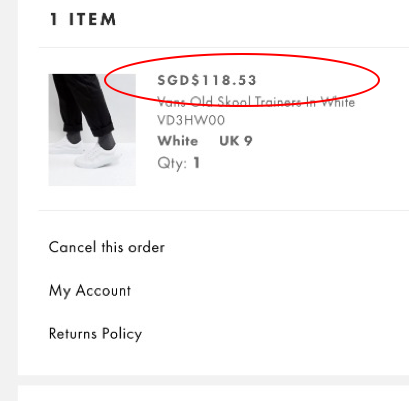

For this payment method, we ended up paying S$118.53 for the product.

This wasn’t even the end of it. Having already been quoted in SGD, many people may think this is the final price they would be paying. This is incorrect.

Even when you opt to pay in SGD, most credit card companies still charge an additional fee for a transaction that is processed overseas, even it is effected in Singapore Dollar.

The final bill that was charged to our credit card was $119.72, which is over than 17.1% more than using the DBS MCA.

Final Price Comparison

|

Method Of Paying |

Final Price (In SGD) |

Difference (In SGD) |

|

DBS MCA + Debit Card |

S$102.22 |

Best Price |

|

Regular Credit Card, (Price Quoted In GBP) |

S$105.52 |

+ S$3.20 |

|

Regular Credit Card, (Price Quoted In SGD Through DCC) |

S$119.72 |

+ S$17.50 |

While we suspected the MCA would give us the best price, we were still surprised by the big price difference, of S$17.50 or over 17.1%, between using our MCA-linked debit card, and being quoted in SGD and paying using a regular credit card.

This difference is even more remarkable when you consider that we purchased the same product from the same store on the same day, just minutes apart, with the only difference being our payment methods.

This experiment is a good reminder that even as we go online to search for the best shopping deals, we need to be smart in choosing our payment methods. Otherwise, any effort spent looking for a better deal might end up being for nought.

| ♦ Be A Smart Online Shopper By Using The DBS Multi-Currency Account |

| Aside from remembering to pay in foreign currency for any overseas purchases, another method to reduce cost would be to simply open a DBS Multi-Currency Account, and to link it to your DBS Visa Debit Card. By doing so, we can convert our SGD to the foreign currencies that we need, and pay for the purchases directly in our foreign currency balances. This allows us to know the conversion rate that we will be receiving, and also allows us to skip any foreign currency transaction costs incurred if we used a credit card. Opening an MCA and applying for a DBS Visa Debit card can be done easily and conveniently. For existing DBS/POSB customers, you can open an MCA online. |

This article is republished with permission from Dollars and Sense.