Graphic: Kstudio / Freepik

Graphic: Kstudio / Freepik

This article was written in collaboration with the CPF Board. All views expressed in the article are the independent opinion of DollarsAndSense.sg.

Most developed countries in the world have some form of retirement scheme for its people. For us in Singapore, there is the CPF Lifelong Income For The Elderly (CPF LIFE) scheme.

CPF LIFE is a life annuity that provides Singaporeans and Permanent Residents with a monthly payout for life, which they can choose to start receiving from their payout eligibility age. This helps ensure that retirees have access to some form of basic income for as long as they live.

Here are some of the options and decisions that can be made with the CPF savings set aside for retirement under this scheme:

# 1 Setting Aside Your Retirement Sum

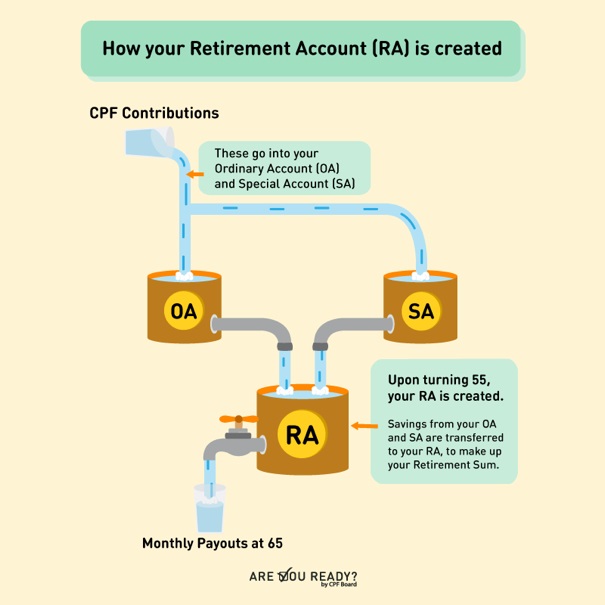

Upon turning 55, the savings from your CPF Special Account (SA) and/or Ordinary Account (OA) will be transferred to your Retirement Account (RA) to form your retirement sum. The maximum amount of savings that will be automatically transferred over to your RA is also known as the Full Retirement Sum (FRS), which is $171,000 for members turning 55 in 2018.

This retirement sum will provide you with a monthly payout from your payout eligibility age, which is 65 for members born in or after 1954.

The monthly payouts that CPF members will receive depend on the retirement sum set aside in their RA. In other words, the more you set aside in your RA, the higher your monthly payout will be.

To enjoy higher monthly payouts, you can set aside any amounts up to the Enhanced Retirement Sum (ERS), which is currently $256,500, by topping up your RA via a CPF transfer or cash. For instance, you can choose to set aside $200,000.

# 2 When to Start Your CPF LIFE Payouts

CPF members will receive monthly payouts from their payout eligibility age, which is 65 for those born in or after 1954.

Members who are still working after age 65 or have other sources of income can consider delaying the start of their CPF LIFE payouts up till the age of 70. For each year that they defer, their monthly payout will increase by up to 7%.

For example, a member who sets aside the Basic Retirement Sum of $85,500 at age 55 this year would receive a monthly payout of about $720 to $770^ starting from age 65. But if deferred to start at age 70, the monthly payout will increase to about $950 to $1,030.

^Payout figures are estimates, based on the CPF LIFE Standard Plan computed as of 2018.

#3 Choosing a Suitable CPF LIFE Plan

There are three CPF LIFE plans that members can choose from. They are the Standard Plan, the Basic Plan, and the new Escalating Plan. The Standard Plan provides a higher monthly payout, but a lower bequest to the member’s beneficiaries. On the flip side, the Basic Plan gives a higher bequest, but a lower monthly payout compared to the Standard Plan.

Read Also: Standard Or Basic Plan? What You Need To Understand About CPF LIFE Plans Before Deciding

The CPF LIFE Escalating Plan

|

|

The CPF Advisory Panel observed from its Focus Group Discussions that CPF members had concerns over the reduction in the purchasing power of payouts from the Standard and Basic plans as a result of rising cost of living.

To help address this concern, a third plan, the CPF LIFE Escalating Plan was introduced. Unlike the Standard and Basic plans which offer level monthly payouts for life, the payout under the CPF LIFE Escalating Plan will increase by 2% each year in return for a lower initial payout.

This annual 2% increase in payouts under the Escalating Plan helps members to preserve the purchasing power of their monthly payouts throughout retirement. That is, if they do not have an immediate need for higher starting payouts.

How It Works:

Under the CPF LIFE Standard plan, a male CPF member who set aside $100,000 when he turned 55 in January 2018 will be able to start receiving a CPF LIFE payout of about $825 – $905 from age 65, for the rest of his life.

If this male CPF member chooses the new CPF LIFE Escalating Plan, he would receive a lower initial monthly payout of $649 – $718 at age 65. However, in return for the lower initial monthly payout, he will enjoy a 2% per annum increment in his CPF LIFE payout for the rest of his life.

The table below is a simple comparison of how the monthly payout differs between the Escalating Plan and the Standard Plan, based on the above member’s example of having $100,000 in his Retirement Account at age 55:

|

Age |

Monthly Payout* (Standard Plan) |

Monthly Payout* (Escalating Plan) |

|

65 |

$825 – $905 |

$649 – $718 |

|

75 |

$825 – $905 |

$791 – $876 |

|

85 |

$825 – $905 |

$964 – $1,067 |

|

95 |

$825 – $905 |

$1,176 – $1,301 |

*Payout figures are estimates, based on the CPF LIFE Standard Plan and CPF LIFE Escalating Plan. Payout figures are computed as of 2018.

You can use the CPF LIFE Payout Estimator to estimate your monthly payouts under the CPF LIFE plans.

CPF LIFE Escalating Plan: Taking Less Today In Order To Have More For The Future

|

|

The pros and cons of the Escalating Plan are pretty straightforward. In order to enjoy an annual increment of 2%, members must be comfortable with accepting a lower initial monthly payout.

The advantage though is that they will enjoy an annual increment for as long as they live.

In case you are wondering, for a male member who has a Retirement Account balance of $171,000 at age 55 this year and starts his payouts at age 65, age 78 is the year when the monthly payout for the Escalating Plan becomes equal to the Standard Plan. In the years to come following that, the difference in payout between the two will widen.

Today, about 1 in 2 adults in Singapore aged 65 are projected to live beyond age 85. So from a purely financial standpoint, members who want higher payouts at later ages could benefit from choosing the CPF LIFE Escalating Plan.

Similar to other CPF LIFE plans, members can increase their starting payout by

1) topping up the amount in their Retirement Account, or

2) deferring the age at which payout starts.

Your Personal Circumstances Should Dictate The Plan You Choose

It’s easy to simply go along with what everyone else is doing. But like all personal finance decisions, you should be opting for the plan that suits you best, and not what’s most popular.

The CPF LIFE Escalating Plan may be an option for you if you continue to work or have additional sources of income in your early retirement years and can manage with a lower monthly payout initially. The 2% yearly increase in monthly payouts would offer you with some flexibility in your budget to cope with a potential increase in the cost of living over the years of your retirement.

On the other hand, it may not be so relevant for you to opt for the CPF LIFE Escalating Plan if you, for instance, have a private annuity plan that provides a payout indexed to inflation. Or if you have rental income from properties and a well-diversified portfolio of stocks and bonds that will help you preserve your purchasing power.

| ♦ Sounds Like An Option Worth Considering? |

| This CPF LIFE Escalating Plan is available from 1 January 2018. If you are an existing CPF LIFE member and wish to switch to the CPF LIFE Escalating Plan, you may apply to do so between January and December 2018. Do you think the new CPF LIFE Escalating plan is a preferred option that you or your parents would opt for? |

This article is republished with permission from Dollars and Sense.

Under the CPF LIFE Standard plan, a male CPF member who set aside $100,000 when he turned 55 in January 2018 will be able to start receiving a CPF LIFE payout of about $825 – $905 from age 65, for the rest of his life.

Under the CPF LIFE Standard plan, a male CPF member who set aside $100,000 when he turned 55 in January 2018 will be able to start receiving a CPF LIFE payout of about $825 – $905 from age 65, for the rest of his life.

Your questions are best answered by CPF, rather than by any of us who are not experts in this matter.

There are several ways to reach CPF, which you can find out at this link:

https://www.cpf.gov.sg/Members/contact/email-us

Can l join CPF Life escalating plan this year 2018? If l topup my RA to $100000 and begin payouts this year what will l receive each month?