"Crubs" contributed this article to NextInsight

|

|

|

Stock price |

48.5 c |

|

52-week range |

27.8 – 48.5 c |

|

PE (ttm) |

9.7 |

|

Market cap |

S$81 m |

|

Shares outstanding |

161.1 m |

|

Dividend yield |

3.7% |

|

Year-to-date return |

39.1% |

|

Source: Bloomberg |

|

Income Statement:

Ellipsiz's FY ends on 30 June so the latest results are for 2Q ended Dec 2016. In 1HFY17, they did $57.3 m of revenue and $3.8 m in profit excluding one-offs, which is a 41% increase Y-Y. For its last full year in FY 2016, it did $9.6 m and $8.2 m after excluding one-offs.

This translates into an ex-cash and financial assets PE of 2 - 2.5 for the business. On a rolling 12-month basis, the PE is cheaper. The business is dirt cheap at current prices.

Business Overview:

Ellipsiz is involved in 2 businesses, the manufacturing of probe cards and the distribution of semiconductor equipment. The distribution business achieves low margin and contributes very little to the bottom line so I'll leave this segment out. It is not in the red but the growth driver is the probe card business.

What is a probe card and which part of the semiconductor value chain is it in?

The manufacturing of chips involve the following steps:

1) Manufacturing of a silicon wafer

2) Manufacturing of semiconductor chips on a single wafer

3) Testing of semiconductor chips to ensure they are working ---> This is where Ellipsiz operates

4) Cutting the wafer into individual chip

5) Packing them into individual microchips

6) Testing the packaged microchips

Testing (step 3) involves a machine called a wafer prober and a probe card serves as a connection between the wafer to be tested and the wafer prober. Imagine how a multi plug converter is needed to connect some household appliances to power sockets. This is a consumable item and must be replaced so there is recurrent revenue.

The Industry:

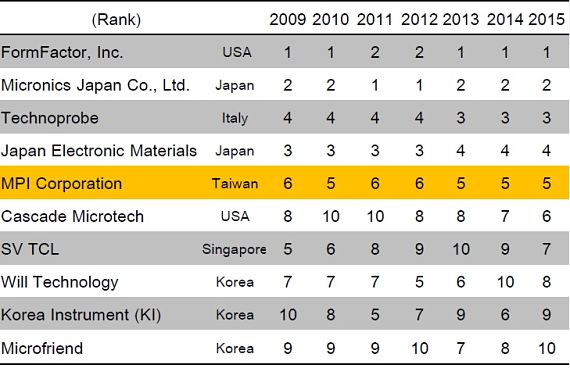

Some technical expertise is required in this business but it is competitive with many players. The competitors are:

These are the top 10 largest probe card manufacturers from 2009 - 2015 and SV TCL, which is Ellipsiz, has been gaining market share in recent years, after the purchase of Tokyo Cathode Laboratory.

The industry is thriving on consumer demand for electronic goods. The more electronics, the more chips are manufactured and more probe cards are needed to test the wafers. After a lull in 2015 and 1H 1H2016, demand for semiconductors started to increase and solid growth is expected to carry on into 2017. This is reflected in the order books of many listed semicon players, and Ellipsiz's own order book for 3Q has grown 12% Q-oQ and 15% Y-o-Y.

Valuation (Industry Transactions)

Apart from the low PE as described above, some recent industry transactions (although not an apple- to-apple comparison) might also indicate the value of Ellipsiz.

1) Ellipsiz disposed of its 40% associate Kita Manufacturing on 6 Jan 2017 for $8.3m, valuing Kita at $21m. On top of that, $3.6 m of debt was assumed and $4.17 m of earn - out depending on profitability. This takes the total potential purchase consideration to $28.77 m. In Ellipsiz's FY2016 report, Kita did $20.8 m in revenue and $2.05 m in profit, therefore the acquirer paid anywhere between 10x - 14x for Kita. (Exchange rate 1USD:1.39SGD)

2) In 2016, FormFactor bought Cascade Microtech for USD $352 m. Cascade Microtech made USD $17.9 m in FY 2015.

Brief Ownership History

Ellipsiz used to be owned by founder Chong Fook Choy and Chan Wai Leong. In March 2015, Mr. Chong sold his stake to Mr. Chan, exiting the business. In April that same year, Mr. Chan sold a majority of his stake to David Lum (who is linked to the Lum Chang family) at a post consolidated price of $0.47 a share. He has continued accumulating the stock since then and recently made a general offer after hitting the 30% threshold.

The offer price was $0.38 and shareholders of 21.92% of the issued shares accepted the offer. Together with on-market purchases, David Lum's stake has risen to 59.53% to date. Since the acquisition of shares mostly took place at $0.47 and $0.38, I estimate his average total cost to be around $0.4, about 18% below current prices.

People have questioned David Lum's involvement, his intentions and the absence of relevant experience of the Lum family, who are property developers.

|

Top vendors in 1998 |

|

|

PC market = $359 M |

|

|

1 |

Cerprobe |

|

2 |

Japan Micronics Corp |

|

3 |

Japan Electronic Materials |

|

4 |

Tokyo Cathode Laboratories |

|

5 |

Wentworth Laboratories |

|

6 |

FormFactor |

|

7 |

Probe Technology |

|

8 |

Cascade Microtech |

|

9 |

ESJ |

|

10 |

Upsys |

|

11 |

Microprobe |

|

12 |

SV Probe, Inc |

|

13 |

Tokyo Electron Limited |

|

14 |

Hugle Electronics |

|

15 |

UPC |

The only link I could find was David Ong, a former director at LCD Global Investments company -- a company which Lum Chang once had a stake in -- used to be a director at Tokyo Cathode Laboratory (Singapore).

Interestingly, Ellipsiz bought Tokyo Cathode Laboratory in 2013 for USD $3.5 m after the Japanese company entered bankruptcy. Tokyo Cathode Laboratories was one of the top probe card manufacturers many years back.

|

Delivering Value After David Lum became the new controlling owner in 2015, there were signs that the company was taking the path to delivering shareholder value. As an example, the company sold Kita Manufacturing, a non-core asset, at a good valuation and distributed part of the sales proceeds to shareholders via dividends. |