This article, written by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange), originally was published in SGX's kopi-C: the Company brew series in May 2016. The article is republished with permission.

This article, written by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange), originally was published in SGX's kopi-C: the Company brew series in May 2016. The article is republished with permission.

CNMC CEO Chris Lim at mine site. (Photo: Company) CNMC CEO Chris Lim at mine site. (Photo: Company)

Operating excavators and bulldozers, drilling and blasting rocks – this is the stuff of every boy’s dreams.

When this arrangement fell through, Lim, who is the chief advisor on Kelantan-China International Trade for the Malaysian state government, took Sokor private and CNMC began operations in 2006. |

A Rough Ride

Certainly, there was no shortage of hiccups and hurdles.

“We experienced a myriad of ups and downs – more downs than ups. Things we did not think would go wrong went wrong, and things we initially thought weren’t so bad became worse. But we pressed on.”

Life was tough and funds were scarce. “We had to do everything ourselves,” he said.

In the early days, Lim stayed in a rented hostel more than two hours drive from the mine, together with the geologists. They drove to the site every morning at the crack of dawn in a rickety, old vehicle, using logging tracks to navigate through the jungle.

“There was nothing but trees and rocks all around us, and I remember seeing tiger paw prints along the way,” he said.

CNMC has come a long way since.

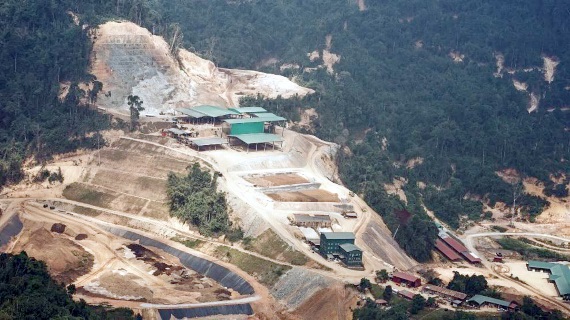

Today, the Sokor Gold Field is the Group’s flagship project, covering an area of 10 square kilometres with four identified gold deposits – Manson’s Lode, New Discovery, Sungei Ketubong and Rixen. The Group achieved its first gold pour on 21 July, 2010, and its output has been rising steadily, exceeding one metric tonne of bullion as of July 2014.

There are now staff hostels, a canteen, and even Internet access.

“And that’s the miracle of mining – creating something out of nothing, in the middle of nowhere,” Lim said.

CNMC has 3 leaching yards with an estimated leaching capacity of one million tonnes of ore per annum.

CNMC has 3 leaching yards with an estimated leaching capacity of one million tonnes of ore per annum.

The Sokor project is an open-pit, heap leach mining operation.

A combination of haul trucks and excavators are used, and in the leaching circuit, gold is extracted from a cyanide solution, before being deposited onto activated carbon, from which the metal is then chemically stripped.

The gold is melted into dore bars – which contain between 85% to 92% pure gold – before being shipped to a refinery where they are further processed.

As of 31 December 2015, the project had JORC-compliant gold resources (including ore reserves) of 13.81 million tonnes at a grade of 1.39g/t in the Measured, Indicated and Inferred categories for a total of 618,000 oz of gold.

The Australasian Joint Ore Reserves Committee (JORC) standard is an international public reporting code that classifies mineral deposits based on their geologic certainty, extractive feasibility and economic value.

| ♦ One Team, One Family | |

|

“The success of Sokor today is the success of the group as a whole – everyone in CNMC has put in effort over the years as a team, and as a family,” Lim said.

In October 2011, CNMC was the first gold producer to list on Catalist. Wilton Resources Corp followed suit in December 2013, while Anchor Resources Ltd made its debut in March this year. |

Building a Buffer

Nonetheless, resource depletion is one spectre that looms large. “There will come a time when the resource will be drawn down, so that’s why we need to go out and actively look for new concessions around the region,” Lim noted.

CNMC will focus on mining assets located in Malaysia and other parts of Asia.

“That’s because our crew is in Malaysia, we’re familiar with the country’s regulations, and can kick-start a new project fairly quickly when the time comes,” he added.

It’s unrealistic for CNMC to venture beyond the Australasian region because of size. And while other mining projects in Malaysia may offer good potential, the Group continues to be cautious and selective.

“We do not want to take on anything that we have no confidence of turning into a producing asset,” he said. Meanwhile, CNMC is exploring the feasibility of diversifying its earnings, building a second revenue stream as a buffer.

Dore bars. (Photo: Company)

Dore bars. (Photo: Company)

One non-mining but related business that could potentially be a good fit is plantations.

“Plantations require big plots of land, which we already have, and the equipment used in plantations is similar to what is on site – tractors, bulldozers and excavators,” Lim said. “But nothing is on the table at this point in time.”

What is certain, however, is the unpredictability of commodity prices, he noted.

“We were inspired by the collapse of oil prices 18 months ago to look for a safety net. That really underscored the fact that commodity prices are beyond anyone’s control,” he said.

“We are already one of the lowest cost gold producers in the world. But what happens in an unlikely situation where gold prices fall below US$500 an ounce? We don’t want to be in the same position as the oil & gas companies.”

| ♦ An Indomitable Spirit | ||||||||||||||

|

CNMC’s all-in cost for FY2015 – which includes the cost of mining operations, the capital spending required for exploration and production, and other costs not directly related to operations – stood at US$608/oz.

“One thing I learnt from Chairman – my dad – is that never-say-die attitude. If you want something, you need to pursue it relentlessly, regardless of how many times you fail,” he said. |

||||||||||||||

| Year ended 31 Dec (US$ 000) |

FY2015 | FY2014 | FY2013 | FY2012 |

| Net Revenue | 36,471 | 33,213 | 16,626 |

16,761 |

| Profit before Tax | 14,438 | 14,831 | 5,172 | 1,460 |

| Net Profit | 13,429 | 15,320 | 3,434 | 1,011 |

| Quarter ended 30 Jun (US$ 000) |

2QFY2016 | 2QFY2015 | YoY Change |

| Net Revenue | 12,624 | 9,376 | 34.6% |

| Profit before Tax | 5,971 | 4,542 | 31.5% |

| Net Profit | 5,852 | 4,429 | 32.1% |

| Outlook | ||

|

||

CNMC Goldmine Holdings Ltd

CNMC is the first Catalist-listed gold producer on SGX. The Company started trading on Catalist board on 28 October, 2011. Together with its subsidiaries, CNMC is principally engaged in the business of exploration, mining of gold and the processing of mined ore into gold dores. The Company is currently focused on the development of its flagship project – the Sokor Gold Field Project, located in the State of Kelantan, Malaysia.

The company website is: cnmc.listedcompany.com

Click here for the company's StockFacts page.

For second quarter financial results for the period ended 30 June 2016, click here.

The Kelantan Chief Minister had enough faith and trust to give us the Sokor project, so no matter what, we had to do it well, so as not to disappoint him and others who believed in us.

The Kelantan Chief Minister had enough faith and trust to give us the Sokor project, so no matter what, we had to do it well, so as not to disappoint him and others who believed in us.