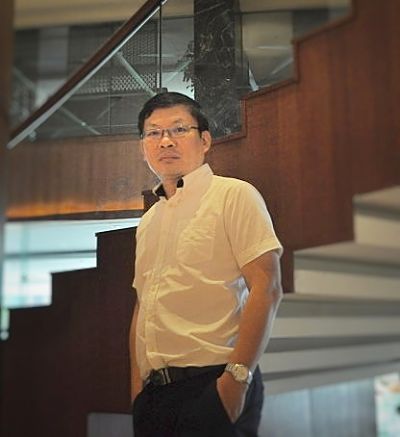

Regal International listed on the mainboard of the SGX through a reverse takeover about two years ago. We recently caught up with its executive chairman and CEO, Dominic Su, to learn more about its beginnings in Sarawak and about his own life story.

| Headquartered in Kuching, the capital of Sarawak, Regal International currently has 24 property development projects mainly in the West Malaysian state. Their completion will stretch to 2019 and are estimated to have a gross development value of about RM1.7 billion. Over lunch, I asked Dominic Su, when he was in town recently, about the early days of Regal, which he started after being a building contractor.

"We built this company through competiting in the market. We got energetic people to join us. We have succeeded through sheer determination and innovation." Regal's very first property development project 11 years ago was to build nearly 30 single-storey terrace houses. The challenges were plenty: How to win buyers' confidence? And suppliers' confidence? How to achieve quality? Regal didn't have the cash to acquire the land and, instead, acquired development rights by pledging several to-be-built houses to the land owner. This barter trade of sorts would become a signature way of doing things for Regal. "About 35% of my project costs are typically bartered off. If you barter with me, I will take care of your interest. My products can sell, and most of the time, I will sell the houses for you." If a house had risen in value when sold, the partner got to keep all the upside. Now, that's an enticing deal for him. |

Dominic Su's father and grandfather left strong impressions on him.

His father was an honest person. The trait cost him a Colombo Plan scholarship as it was withdrawn from him after he clarified that he was born in China, not Malaysia.

Mr Su senior was devoted to Chinese education, resigning from a government teaching post in the riverine town of Sibu to teach in a Chinese independent school in the outskirts.

He stayed on during a Communist insurgency even though, owing to a dwindling student population, he received practically no salary for four years.

"My mother and father planted vegetables to survive on. The students paid their school fees with rice, fruits, vegetables when they had harvests. I remember times when they gave us durians, rambutans....gunny sacks of them."

Adds Dominic: "My father was very stubborn and insisted on keeping the school open, so the government could not take back the operating licence. The school is still around, one of only 82 Chinese independent schools in Malaysia. So, my father had this influence on me: 'If you believe in something, you just do it.' "

Dominic's grandfather was far better off, as he was a wholesaler of rice and flour in Sibu.

"I liked visiting him because he had everything. The family could afford even grapes," says Dominic.

It was grandpa's big-heartedness towards the less fortunate that Dominic remembers.

"I will always remember that he took us out to have a meal of noodles. He would look for the stall that had the least business. He said: 'We must support him.'

After that, they would go for a movie. For supper, they would go to a pasar malam and grandpa would look for the guy with the most bao (Chinese bun) left.

"He would buy all the bao. Yes, everything, which maybe could feed more than 20 people sometimes. Grandma would later scold him for buying so much."

Continues Dominic: "I will remember this forever -- when grandpa passed away, so many people came to his house. Our family didn't know so many of the visitors who stayed for half an hour, or an hour, and cried for my grandpa."

(Time to connect the dots from those years to Regal today. Under Dominic’s directive, Regal has been supporting orphanages, homes for the elderly, the Salvation Army and schools in Kuching since 2010. Regal has sponsored lunches for the needy at Salvation Army and elderly homes on a monthly basis, and handed out hongbaos or necessities to the less fortunate during Chinese New Year ad Christmas.)

As a student, Dominic achieved academic success so much so that "my name and photos would appear in the newspapers."

He won an ASEAN scholarship from the Ministry of Education of Singapore to study in top-notch Raffles Junior College.

But he did not have a great start. "It was the first time I had flown in an aeroplane, and I vomitted all the way. I was air-sick."

And student life in Singapore somehow didn't suit him, so after a year he headed for Australia for further studies. The air ticket consumed virtually all the money he had.

"I landed in Australia with about A$46. I took a taxi to a friend's apartment. The ride cost A$20, and I felt like crying as I had little money left."

The two-bedroom apartment was his home, which he shared with 25 other students. It was so crammed "I slept sitting in a chair."

After two months, Dominic took up alternative accomodation, paying the rent by working assidiously while juggling high school and, later, university, studies.

"I did 28 different jobs in my 6-7 years in Australia. In my early days there, I worked on farms, picking all kinds of fruit -- oranges, apricots ... The worst experience was picking onions because it was out in the open field and the temperature was 40-44 degrees and sometimes the wind blew sand into my face," recalls Dominic.

He traded the farms for an air-conditioned office when he landed a job as a part-time stockbroker's assistant. He helped in trades involving cotton futures on the Chicago and New York exchanges. It was a job few wanted as it meant sacrificing sleep at night when the US stock exchanges were open.

"I worked from 11 pm to 7 am five days a week. I could put up with little sleep as I was young, and I skipped classes sometimes.

Of course, the money was good for the four years he worked there. "I made a lot of money, so much so that I could support my sister when she came over to Australia for her accountancy degree course.

"I could have made it big in Australia. In 1986, I applied for a bank loan to help me buy an apartment near the University of Sydney for A$28,000. I was rejected because I was from overseas. I was planning to buy a few properties. I was attracted to this idea because the rental I could get was A$300 per week or $1,200 a month, or A$14,000 a year. Yes, yes, it was so good.

"At that time, an Australian named Henry Triguboff started buying properties. Today, he is the biggest property tycoon in Australia. And you know, the A$28,000 apartment I wanted to buy is now worth A$900,000 - A$1 million."

Deprived of an opportunity to invest in properties, Dominic channelled his savings into Australian stocks. But soon came the market crash of 1987, and he lost most of his investments as some companies went broke.

Graduating with a double degree -- Bachelor of Science and Bachelor of Engineering in Electrical Engineering -- from the University of Sydney, he returned to Sarawak to an engineering job.

Before long, he was in Singapore, working and studying part-time at the National University of Singapore, which awarded him a Master's degree in Building Science in 1996.