Excerpts from analyst's report

Daiwa Securities analyst: Jame Osman

| Moulding a strong foundation ♦ Acquisition of First Engineering boosted top-line growth in 2015 ♦ Focus on key sectors, driving gross-margin improvement ♦ Healthy balance sheet and FCF; attractive dividend yield Background: Sunningdale Tech is a provider of customised precision plastic injection moulding solutions across 3 key business segments – consumer/IT (47.3% of 2015 revenue), automotive (43.0%) and healthcare (9.7%). Its broad customer base includes a diverse number of global brands – the company derives around 50% of its revenue from its top-10 customers. Sunningdale has 18 manufacturing facilities in 9 countries across Asia, Europe and the Americas. |

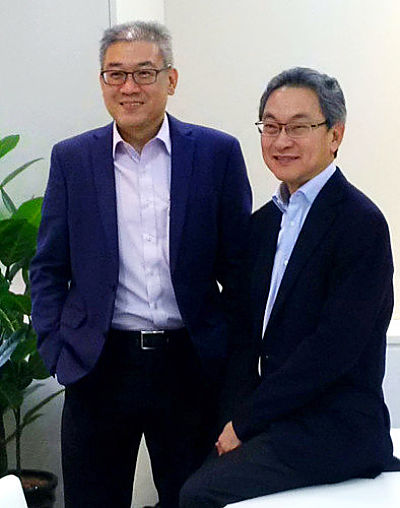

Sunningdale Tech CEO Khoo Boo Hor (left) and non-executive chairman Koh Boon Hwee. NextInsight file photo.Highlights: Sunningdale has driven steady business growth organically, as well as through acquisitions targeted at complementing its existing capabilities and expanding its geographical presence to service global clients.

Sunningdale Tech CEO Khoo Boo Hor (left) and non-executive chairman Koh Boon Hwee. NextInsight file photo.Highlights: Sunningdale has driven steady business growth organically, as well as through acquisitions targeted at complementing its existing capabilities and expanding its geographical presence to service global clients.

The company’s revenue increased by 42% YoY for 2015, boosted by the completed acquisition of First Engineering Limited (FEL) in November 2014 for USD80m (valuation of around 5x EV/EBITDA), which bolstered its automotive segment offering and provided the company access to the India market.

Looking ahead, management said it will expand on its 3 key segments (consumer/IT, automotive, healthcare) by focusing on more complex projects amid strong underlying industry demand (global automotive plastics market is expected to grow at a 9.5% CAGR over 2015-22, according to Grand View Research).

In addition, although 2015 net profit was boosted by a forex gain of SGD12.8m and a one-off tax credit of SGD5.9m, management believes near-term earnings growth could be driven by an improvement in margins arising from:

| ♦ Net cash, strong free cash flow |

"Sunningdale had a healthy net cash balance of SGD6.3m as at end-1Q16 and was strongly free cash flow positive in 2015 (SGD43.1m) following its FEL acquisition. Management expects capex levels of around SGD35m in 2016 (including maintenance capex of SGD5-6m). Although it does not have a stated dividend policy, the company has consistently paid out dividends since 2009 (2015: SGD5.0cents; up 25% YoY at a payout ratio of 22%)." "Sunningdale had a healthy net cash balance of SGD6.3m as at end-1Q16 and was strongly free cash flow positive in 2015 (SGD43.1m) following its FEL acquisition. Management expects capex levels of around SGD35m in 2016 (including maintenance capex of SGD5-6m). Although it does not have a stated dividend policy, the company has consistently paid out dividends since 2009 (2015: SGD5.0cents; up 25% YoY at a payout ratio of 22%)."-- Jame Osman (photo) |

1) business synergy from its FEL acquisition with the bulk of integration costs largely behind the company,

2) greater sales contribution from the higher-margin automotive segment and,

3) cost efficiency and improved utilisation from the ongoing restructuring of its plant in southern China.

Management also expects the completion of a plant in Chuzhou (targeting completion by 4Q16), where labour costs are observed to be 50% lower relative to Shanghai, to result in further cost savings.

Valuation: Sunningdale’s share price has increased by 30% YTD. Based on Bloomberg consensus estimates, the stock is trading at a 2016E PER and an EV/EBITDA multiple of 9.1x and 3.2x, respectively