| SUNNINGDALE TECH 1Q2016 | ||

| Revenue | Net Profit (exclude forex) | Gross profit margin |

|

S$161.25m +4.4% |

S$6.82m +14.8% |

13.6% +0.2 points |

SUNNINGDALE TECH's core business continued to grow in 1Q2016 with net profit (excluding forex losses) rising 14.8% y-o-y to S$6.8 million.

The automotive segment continued to be the key driver of growth with revenue surging 16.0% to S$58.7 million.

The mould fabrication segment grew 3.9% in revenue to S$31.2 million.

But revenue growth in these two segments of the manufacturer of precision plastic components was offset by marginal declines (3.5% and 2.9%, respectively) in contributions from both the consumer/IT and healthcare segments.

The Group’s bottomline was affected by foreign exchanges losses of S$3.2 million as the USD weakened against the SGD.

In comparison, there was a forex gain of S$1.1 million in 1Q2015.

| ♦ Ramping up production in 2H16 |

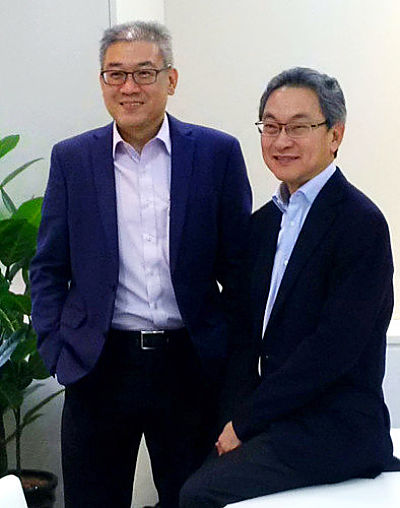

Sunningdale CEO Khoo Boo Hor (left) with non-executive chairman Koh Boon Hwee. Photo by Tok Chong Yap."In terms of business operations, the Group expects all business segments: Automotive, Healthcare, Consumer/IT and Tooling to remain stable in 2016. Sunningdale CEO Khoo Boo Hor (left) with non-executive chairman Koh Boon Hwee. Photo by Tok Chong Yap."In terms of business operations, the Group expects all business segments: Automotive, Healthcare, Consumer/IT and Tooling to remain stable in 2016. "Supported by our diversified blue-chip clientele base, sales backlog remains healthy. The Group expects to ramp up production in 2H16 for some automotive projects awarded over the last two years." |

The wide swing from a gain to a loss in forex exacerbated the net profit fall on a percentage basis.

Thus, 1Q net profit of S$3.6 million was down 49.3% y-o-y.

Reflecting investors' response (which appears overdone) to the bottomline, instead of considering the core business growth, the share price of Sunningdale has corrected 4.6%, or 5.5 cents, over the two trading days since the 1Q results were released on Monday evening.

(It, however, is up 26% since the start of the year, bolstered by a strong FY15 result. At $1.135 as of yesterday, the share price has arguably compelling valuations: trailing P/E of 5.2x, P/B of 0.6x, EV/EBITDA of 3.2, dividend yield of 4.4%.)

Touching on the forex matter, Sunningdale said: "The Group tries to achieve a natural hedge in its operations. We ensure that the terms and conditions of new project deals include forex fluctuation and raw material costs clauses. This allows the Group to renegotiate project terms during times of volatility in order to mitigate downside exposure, but this is usually lagged as there is a period of negotiation."

It added: "The Group focuses on what it can control, improving operational efficiencies internally in order to continue sustainable growth."

Specifically to improve utilisation levels of the Group’s Southern China plant, it made a strategic decision to restructure its plant in Zhongshan, China starting from the end of March.

CEO Khoo Boo Hor said: "Our core business continues to perform with a strong ability to consistently generate positive operating cash flows. This has strengthened our balance sheet as net cash position improved, bolstering resilience in a challenging business landscape.”

Operating cash flow was S$10.2 million, while Sunningdale's cash and short-term deposits amounted to S$123.4 million, resulting in a net cash position of S$6.3 million as at 31 March 2016.