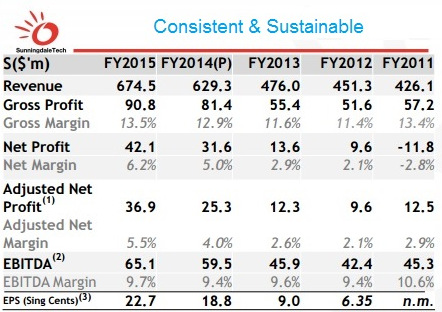

CEO Khoo Boo Hor in a presentation of the FY15 results to analysts and fund managers: "We manage our business in a steady and predictable manner. We emphasise stable and sustainable growth." Photo by Leong Chan TeikSUNNINGDALE TECH, after several years of keeping a low profile in the investment community, has emerged with an appealing story backed by a strong set of earnings results for FY2015. CEO Khoo Boo Hor in a presentation of the FY15 results to analysts and fund managers: "We manage our business in a steady and predictable manner. We emphasise stable and sustainable growth." Photo by Leong Chan TeikSUNNINGDALE TECH, after several years of keeping a low profile in the investment community, has emerged with an appealing story backed by a strong set of earnings results for FY2015.It is no flash in the pan -- the precision plastics engineering company has a track record of steady, resilient growth with solid metrics (see table below). No doubt manufacturing is always a challenging business, but Sunningdale CEO Khoo Boo Hor pointed to the company's well-earned robustness which is underpinned by its world-class engineering capabilities, economies of scale, and a diversified business. Add to that, a wide customer base of blue-chip global companies and a global footprint (18 manufacturing locations in 9 countries).

"As for our footprint, we have factories in Europe, Mexico and Asia. If a customer wants to launch a project-- say, a car -- in three regions, the logistics of shipping parts from one region to another can be high. "We have an advantage by being able to produce for the customer in three regions. Today, in fact, some of our projects are like that." |

Notes: FY2014 (P): Proforma (1) Excluding impairment on goodwill, transactions costs, one of major tax credit, write back of contingency consideration and gain on disposal of Buildings (2) EBITDA = Gross Profit less G&A add depreciation and one-off SG&A expenses excl JV profit/loss (3) Post 5:1 share consolidation |

Sunningdale achieved a record S$42.1 million net profit, up 52.1% yoy for FY2015, with contributions from the integration of First Engineering which was acquired in Nov 2014.

Excluding acquisition expenses, negative goodwill, gain on disposal of non-current assets held for sale and foreign exchange gains, net profit amounted to S$29.4 million for FY2015 and S$21.4 million for FY2014.

Sunningdale demonstrated again its ability to generate strong positive operating cash flow yearly, recording S$67.1 million for FY2015. This moved the company into a net cash position of S$1.1 million from being S$33.9 million in net debt largely arising from the acquisition of First Engineering.

Khoo Boo Hor joined Sunningdale in 2005 when it was the No.3 Singapore player in its industry in terms of revenue. Today, it is No.1 by far. In fact, Sunningdale can count among the Top 12 North American injection moulders. Photo by Leong Chan TeikAsked about the impact of any slowdown in a business segment such as automotive, Mr Khoo said: "We have customers in different geographic regions, and we have three major business segments -- automotive, consumer/IT and healthcare, which is unique compared to our competitors.

Khoo Boo Hor joined Sunningdale in 2005 when it was the No.3 Singapore player in its industry in terms of revenue. Today, it is No.1 by far. In fact, Sunningdale can count among the Top 12 North American injection moulders. Photo by Leong Chan TeikAsked about the impact of any slowdown in a business segment such as automotive, Mr Khoo said: "We have customers in different geographic regions, and we have three major business segments -- automotive, consumer/IT and healthcare, which is unique compared to our competitors.

"This makes us less vulnerable to a slowdown in any one particular segment. For 2016, we expect our three business segments to be stable. Our sales backlog remains healthy. While we are cautiously optimistic, we know that there is market uncertainty and volatility."

Questioned about pricing pressure from customers, he said that that is a constant challenge but Sunningdale continued to drive its operational excellence and improve productivity. It also seeks complex jobs that yield higher margins and tap on its top-notch engineering capabilities. Soh Hui Ling has been CFO of Sunningdale Tech since 2008.

Soh Hui Ling has been CFO of Sunningdale Tech since 2008.

Photo by Leong Chan Teik"Over the years, the industry has gone through many challenges. Our performance has been steady despite rising costs in China, etc. That means internally, we had to do a lot of things compared to competitors which have reported more volatile performance," said Mr Khoo.

"We have never stopped optimising the company. It's on-going, the moment we stop doing that, we are on the way to becoming obsolete as the industry changes all the time.

"We have gone through a lot of restructuring. In Singapore, for example, we used to have 1,500 employees, now we have fewer than 500 and we keep the high-value jobs here."

Sunningdale has a big name on its board -- Koh Boon Hwee, its non-executive chairman. He has been buying shares of the company and now holds a 8.24% stake worth about S$17.3 million.

|

Here are excerpts from the Q&A session: CEO Khoo Boo Hor: In some cases, we are bidding against global suppliers and some against local competitors. If we are up against a German competitor, for example, we sometimes have an advantage with our presence in China. This is something that foreign suppliers do not always have. CEO Khoo Boo Hor: I cannot say that we are the only one in the world who can produce a certain type of product. We try to go into products that only a certain percentage of top tier plastics suppliers are able to enter. We do not have any particular patents. In our medical segment, we supply products of high precision and high quality that have been qualified over a long period of time and have been backed by our strong track record. CEO Khoo Boo Hor: We do not see huge growth numbers. Overall, we still see stable growth as we have a very diverse customer base. Things can change overnight and we cannot control the world. We will remain cautious and ensure that we continue to build a solid business model. Q) Is your conduct of this first results briefing an indication of confidence in the future? CEO Khoo Boo Hor: If you look at our history, we are very stable and steady. Our customer profile and diverse spread further emphasise our stability. We do not have a high concentration of customers, which makes us less susceptible to large fluctuations in our revenue. |

James Bywater contributed to this article.