A good turnout of shareholders at the EGM today.

A good turnout of shareholders at the EGM today. Time & date: 10 am, 23 Feb 2016

Time & date: 10 am, 23 Feb 2016

Venue: Suntec Singapore Convention & Exhibition Centre

Photos by Adrian Lee

THERE WAS elation among us investors when Sino Grandness announced (finally!) on 4 Feb 2016 an event that we had long anticipated -- an EGM in connection with the IPO of its subsidiary, Garden Fresh.

The next day, Sino Grandness issued a circular to shareholders and then a fierce debate began.

The fight among investors was over the profitability of Garden Fresh.

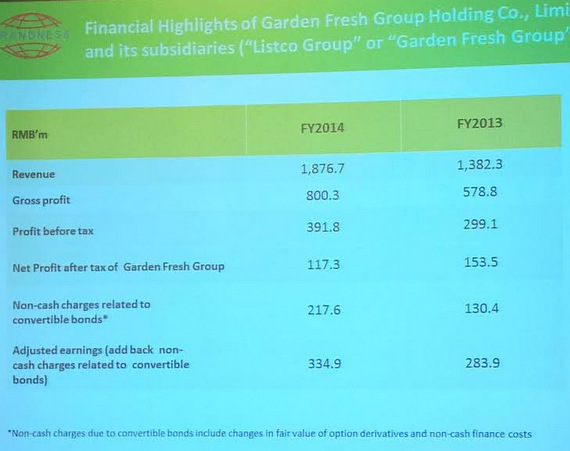

The circular, without elaboration, gave figures that seemed too low. Was the 2014 net profit, for example, only RMB117.3m?

| RMB m | 2012 | 2013 | 2014 |

| Revenue | 865.3 | 1,382.3 | 1876.7 |

| Gross profit | 366.1 | 578.8 | 800.3 |

| Profit before tax | 203.2 | 299.1 | 391.8 |

| Profit | 103.4 | 153.5 | 117.3 |

But how could the circular be wrong? That was the start of a debate in Valuebuddies.com, and it spawned various interpretations on the valuation that Garden Fresh might fetch during its IPO.

On 11 Feb, Loquat Fan contributed an article to NexInsight, asserting that instead of the profits shown in page 12 of the 5 Feb circular, 'adjusted profits' should be the profitability measure of Garden Fresh. (See: SINO GRANDNESS: How to estimate the IPO valuation of Garden Fresh?)

There were non-cash expenses due to convertible bonds which had led to the lower profits being reported in the circular.

Loquat Fan derived the non-cash expenses from Sino Grandness' 2014 annual report, and worked out the following adjusted profits of Garden Fresh:

| RMB m | 2013 | 2014 |

| Profit as shown in 5 Feb circular | 153.5 | 117.3 |

| Difference due to CBs | 130.4 | 217.6 |

| Adjusted profit | 283.9 | 334.9 |

He was vindicated at today's EGM.

Sino Grandness produced the following Powerpoint slide showing that Garden Fresh's adjusted profit for 2013 and 2014 were indeed RMB 283.9m and RMB 334.9m respectively.

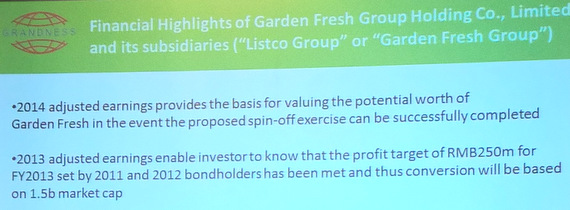

Another slide explained that

(1) "adjusted profit" provides the basis for valuing the potential worth of Garden Fresh; and

(2) the 2013 RMB 250m profit target was exceeded by a good margin; and holders of CB1 and CB2 had adopted the maximum valuation of RMB 1,500m for conversion of the bonds into Garden Fresh shares (resulting in a collective 23.4% stake in the beverage company).

Sino Grandness also emphasised that for the proposed spin-off, the offer price of Garden Fresh shares would be based on price-earnings ratio rather than NAV.

The latter (NAV) was used in the EGM circular purely for illustrative purposes.

Mr Huang Yupeng, Sino Grandness' Chairman, also reiterated the intention to sell some Garden Fresh shares it now owns to raise cash for a special dividend to reward shareholders.

@ EGM: Chairman of Sino Grandness Huang Yupeng (holding microphone) and his board.

@ EGM: Chairman of Sino Grandness Huang Yupeng (holding microphone) and his board.

Mr. huang and his right hand man will appear in the sponsored program "informal talks" this Friday nite live on Hubei satellite channel..

http://www.hbtv.com.cn/zb/201504/t20150410_1241175.html

1) Management has confirmed the use of adjusted profits as described by portuser and myself to calculate the IPO valuation of Garden Fresh

2) The IPO valuation will be based on Garden Fresh's 2015 adjusted profits and 2016 forecast.

3) No firm date was given, but shareholders should look out for certain milestones which will be announced when reached. They are a) submission of draft prospectus and b) approval by the exchange

4) Sino Grandness intends to redeem a small portion of the CB's prior to IPO.

5) There will be dividends for this year and the intention to give out a special dividend upon IPO is still there.

6) Garden Fresh still has a long growth trajectory and management has plans for its other businesses.

The potential for long term growth is there and the future looks bright.