Excerpts from analysts' report

Analysts: Ng Wee Siang and Ng Li Hiang, Maybank Kim Eng

Analysts: Ng Wee Siang and Ng Li Hiang, Maybank Kim Eng

|

SIBOR makes decisive march north

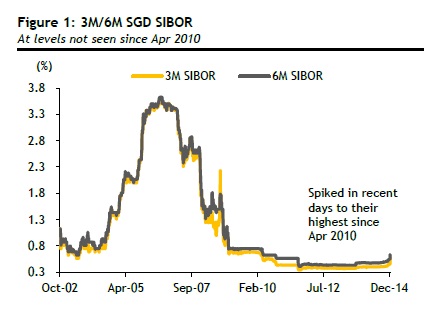

Ng Wee Siang, CFAIn just two days, 3M and 6M SGD SIBOR have surged by an average 15bps, breaching levels not seen since Apr 2010. Higher rates benefit banks as their liquid assets are mostly of short duration. Most loans, especially mortgages, are pegged to short-term rates. Ng Wee Siang, CFAIn just two days, 3M and 6M SGD SIBOR have surged by an average 15bps, breaching levels not seen since Apr 2010. Higher rates benefit banks as their liquid assets are mostly of short duration. Most loans, especially mortgages, are pegged to short-term rates.Credit quality should hold up, backed by banks’ safety nets and macro-prudential measures targeting the consumer sector. Housing-loan resilience during the 1998-2003 economic setbacks also comforts us. While SME loans, at 12.8% of system loans, are likely to be most at risk, 79% of these are secured lending. Main threats are major job losses and a sharp, say 3ppt, rise in interest rates at one go, staying high stubbornly.

|

All stand to gain; DBS the most

DBS stands to gain the most, in our opinion, thanks to its much stronger deposit franchise than UOB and OCBC. In terms of housing credit quality, we believe OCBC could be the most vulnerable as much of its housing loan growth came at the later stage of the last housing boom. DBS appears better-positioned considering its modest housing loan CAGR of 8.2% in the past nine years (UOB: +14.4%, OCBC: +12.7%). While UOB may be the most exposed to Sentosa, its saving grace is much of its mortgage growth occurred early in the property upcycle.

Maintain OVERWEIGHT

We expect banks to be re-rated further from continued earnings deliveries. DBS is our first choice, followed by UOB. Remain cautious on OCBC over its Wing Hang Bank integration risks.

Chart: Maybank-Kim Eng / BloombergInterest-rate drought over. Short-term rates on the rise.

Chart: Maybank-Kim Eng / BloombergInterest-rate drought over. Short-term rates on the rise.After years of depression, short-term rates made their decisive march north recently.

In just two days, the 3M and 6M SGD SIBOR have surged by an average 15bps, breaching levels not seen since Apr 2010 (Figure 1).

Reflecting an appreciating USD vs SGD, the 3M SOR, another benchmark rate, has surged at a faster 35bps since 17 Dec 2014 vs 17bps for 3M SIBOR (Figure 2).

With 3M SOR at about an 18bp premium over 3M SIBOR, the latter may play catch-up.

Historically, the difference between the two is negligible.

Chart: Maybank-Kim Eng / Bloomberg

Chart: Maybank-Kim Eng / BloombergEarlier-than-expected rise is good

These spikes came earlier than expected and reflect market expectations of higher rates.

Rising short-term rates are good for banks as most of their liquid assets are of short duration.

A big chunk of their mortgages is also pegged to SIBOR, while commercial loans are largely SOR-based.

Despite rising long-term rates since mid-2013, banks have kept the duration of their liquid assets short, in anticipation of rising short-term rates.

Despite rising long-term rates since mid-2013, banks have kept the duration of their liquid assets short, in anticipation of rising short-term rates.

Higher rates translate into higher lending rates and net interest margins (NIM), as interest-rate-sensitive assets tend to be repriced faster than liabilities. Earnings upswings can be powerful, after years of NIM compression.

The catch

Higher rates may cause a deterioration in asset quality as repayment ability is affected. This is because most industry housing loans are taken on floating rates. However, we believe the positives outweigh the negatives. We expect asset quality to stay strong even as rates rise, as:

>> The climb is expected to be modest and well-paced, giving the economy time to digest the change. Our house expects SGD SIBOR to rise to 1.0% by end-2015 and 2.0% by end-2016, from 0.46% as at end-2014.

>> Tight employment.

>> Effective macro-prudential measures targeting housing (73.5% of household debt), car (3.6%) and unsecured personal loans (3.4%). This should provide some protection against soaring interest rates and weaker economic prospects.

>> Decent corporate balance sheets.

SME loans most at risk

SME loans account for 12.8% of system loans and tend to be much more susceptible to default in bad times than larger corporate loans. This is because SME businesses are typically less diversified with smaller balance sheets to cope with economic challenges. On a positive note, banks’ proportions of unsecured SME loans have shrunk in recent years (Figure 12). Of the three Singapore banks, UOB is the largest SME lender, followed by OCBC and DBS.

When would we start worrying?

Based on our estimates, a 1ppt increase in SIBOR would raise households’ monthly housing repayment by 12%. We assume a SGD1m property value, an 80% LTV and a 25-year loan tenure. In our view, stress could start to show up when 3M SIBOR hits 3.5%, which is 3ppts higher than end-2014 levels. If this happens in one fell swoop, there will not be enough time for borrowers to adjust.

Borrowers with monthly debt-servicing burdens greater than 60% are deemed over-leveraged by MAS. Based on the latter’s 2013 estimates, this group could swell by 5ppts to 10-15% of all borrowers should mortgage rates rise by 3ppts.

Which lenders more at risk?

We believe OCBC would be most at risk, given its backend-loaded mortgage growth. DBS should be the least, thanks to its modest housing loan CAGR of 8.2% in the past nine years (UOB: +14.4%, OCBC: +12.7%). We believe UOB is the most exposed to Sentosa. But as much of its mortgage growth occurred during the early housing boom, its risks should be limited.