Excerpts from analyst's report

LIM & TAN Singapore Team

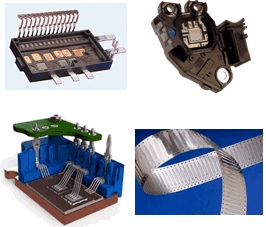

Offer price of 82 cents reasonable Interplex provides advanced application development and manufacturing solutions for complex precision mechanical and electro-mechanical components and assemblies. Photo: CompanyInterplex Holdings, formerly known as Amtek Engineering, has received a takeover offer by The Baring Asia Private Equity Fund VI. Interplex provides advanced application development and manufacturing solutions for complex precision mechanical and electro-mechanical components and assemblies. Photo: CompanyInterplex Holdings, formerly known as Amtek Engineering, has received a takeover offer by The Baring Asia Private Equity Fund VI.

The offer price of S$0.82 exceeds the highest closing price of the shares in the last four years and represents a premium of: |

The offer is subject to the fulfilment or waiver of certain preconditions. These include: Interplex CEO Daniel Yeong. Photo: Company

Interplex CEO Daniel Yeong. Photo: Company

i. Necessary governmental and regulatory agency approvals having been received, and relevant filings made, in the United States of America, the People’s Republic of China, and the Republic of Poland,in compliance with their respective anti-trust and anti-monopoly laws;

ii. No government or regulatory body preventing or restricting the Offer;

iii. Consent being obtained from the holders of the S$200 million, 6.9% notes due 2019 issued pursuant to Interplex’s S$500 million multicurrency medium term note programme to

(i) amend the terms of the notes to provide Interplex with the option to redeem the outstanding notes when the Off er turns unconditional

(ii) waive certain terms of the notes;

iv. No occurrence of any material adverse event, where Interplex’s net asset value declines to an amount below US$157 mln.

We believe the offer represents an opportunity for Baring to acquire control in a precision engineering company with a strong track record, global manufacturing footprint, and diversified customer base. Subject to normal business considerations, Baring does not intend to make changes to the management team of Interplex and is unlikely to introduce any major changes to the existing business and employment contracts of Interplex, or redeploy its fixed assets.

Note that the Offer will not be made unless and until the pre-conditions are fulfilled or waived by the Offeror on or before 5:00 p.m. on 30 June 2016 or a later date, which the Offeror may determine in consultation with the SIC of Singapore, and as agreed by the Undertaking Shareholders.