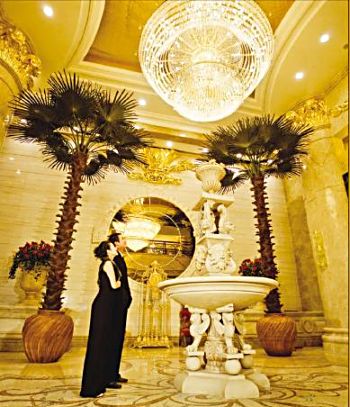

WE RECENTLY added Yanlord Group (YLLG SP) to our model portfolio. While 9M15 results were 16% lower yoy, the group’s outlook is positive, underpinned by solid pre-sales achieved to date.  Yanlord’s net gearing has declined sharply from 45.3% as at end-2014 to 22.8% on cash collections. Photo: CompanyFor 9M15, the group has achieved contracted sales of RMB20.3bn, above its full year target of RMB18bn. Coupled with subscription sales pending conversion as well as strong reception to its launches in Nanjing and Shanghai in November, full year sales is likely to hit RMB25-26bn. Yanlord’s net gearing has declined sharply from 45.3% as at end-2014 to 22.8% on cash collections. Photo: CompanyFor 9M15, the group has achieved contracted sales of RMB20.3bn, above its full year target of RMB18bn. Coupled with subscription sales pending conversion as well as strong reception to its launches in Nanjing and Shanghai in November, full year sales is likely to hit RMB25-26bn. While the group has yet to set its FY16 sales target, management is bullish on take-up rates given the responses to its recent launches in Shanghai, Nanjing and Tianjin. Gross margin is also expected to inch upwards as recent launch prices have been raised to reflect the strong demand, coupled with upcoming launches of new phases in existing projects which usually command better prices. Yanlord’s net gearing has also declined sharply from 45.3% as at end-2014 to 22.8% on cash collections. The group intends to landbank in cities where its sales have been strong, and in recent years have shortened its speed-to-market from land acquisition to project launch. Another potential catalyst is the refinancing of its USD-denominated 10.625% bonds with onshore bonds, lowering overall interest burden. At current price, the stock trades at a steep 50% discount to its NAV. |

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

YANLORD: trades at steep 50% discount to NAV

- Details

- Goh Han Peng (RHB Research)

You may also be interested in:

|

YANLORD: Another strong month of sales (Nov) |

|

YANLORD loses Aberdeen; STRACO & LMA, LIAN BENG boss grab more shares |

|

YANLORD, K-REIT: What Macquarie says now.... |