Excerpts from Lim & Tan Securities report

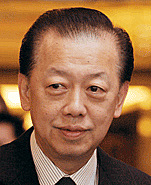

Tan Sri Quek Leng Chan “Magician” Tan Sri Quek Leng Chan (QLC) has pulled another rabbit out of his hat, having sold Guocoland ($2.04, down 6 cents) China’s integrated mixed-use development (DZM Project) for a “stunning” RMB10.5bln (comprising RMB4.563bln for the DZM Project Rights and RMB5.936bln for the DZM Project Liabilities) to China Cinda Asset Management Co Ltd.

Tan Sri Quek Leng Chan “Magician” Tan Sri Quek Leng Chan (QLC) has pulled another rabbit out of his hat, having sold Guocoland ($2.04, down 6 cents) China’s integrated mixed-use development (DZM Project) for a “stunning” RMB10.5bln (comprising RMB4.563bln for the DZM Project Rights and RMB5.936bln for the DZM Project Liabilities) to China Cinda Asset Management Co Ltd.

With the net book value of the DZM Project recorded at RMB8.46bln (S$1.72bln) on Guocoland’s book as at end June’15, the transaction is expected to reap a bonanza RMB1.56bln of profit (after transaction costs) or a significant S$480mln.

RMB9.45bln is expected to be paid upon the signing of the agreement and the balance payable on the last day of the 18th month from the date of the agreement or dealt with in accordance with the tax provisions in the agreement.

"We do not currently have a rating on Guocoland, but believe the transaction will be very positive for the stock. More importantly, we are praying that “Magician” QLC can also help Guocoleisure’s shareholders to sell non-core assets such as Molokai Island, Clermont Club, Bass Straits Oil and Gas Royalties so as to allow his newly installed CEO Mike Denoma to focus on the transformation of the hotel division (which has done well, with 9 month to Mar’15 operating profit up a "We do not currently have a rating on Guocoland, but believe the transaction will be very positive for the stock. More importantly, we are praying that “Magician” QLC can also help Guocoleisure’s shareholders to sell non-core assets such as Molokai Island, Clermont Club, Bass Straits Oil and Gas Royalties so as to allow his newly installed CEO Mike Denoma to focus on the transformation of the hotel division (which has done well, with 9 month to Mar’15 operating profit up a  significant 61% yoy). significant 61% yoy). -- Lim & Tan Securities |

The net proceeds from the transaction will be used for general working capital (including repayment of debts) of GLL group.

We believe the sale of DZM Project is financially significant as the gross proceeds of RMB10.5bln (S$2.13bln) would boost Guocoland’s cash holdings by 6 fold from $439mln to $2.57bln versus debts of about S$5bln, putting them in a much stronger financial position as the global interest rate cycle starts to turn up. Net gearing assuming the transaction is completed would improve significantly from 1.5x to 0.7x.

More importantly, not too long ago, Guocoland was in a controversial court case against the former owners to even prove of their actual ownership of the DZM Project even though the project represents a significant 20% of their total asset base.

And the sale is coming at a time of great distress in China from the devaluation of the RMB and recent sharp sell-down of the Chinese stock markets.

The last time QLC managed to stun the market was when he off-loaded Dao Heng Bank to DBS at close to 3x book (in 2000) before DBS had to take significant write-downs on their acquisition when Hong Kong and Singapore suffered significant economic deterioration due to the SARS epidemic.