L-R: CFO Mr. Hu Ming Yang, Executive Director and CEO Mr. Yang Zhifeng and Executive Director Ms. Samantha Ko. Photo: Company

L-R: CFO Mr. Hu Ming Yang, Executive Director and CEO Mr. Yang Zhifeng and Executive Director Ms. Samantha Ko. Photo: CompanyCHINA WINDPOWER Group Ltd (HK: 182) saw its 2013 bottom line soar around 270% to 151 million hkd, thanks largely to improved operating results and 138 million hkd of "other gains" arising from the disposal, and partial disposal, of joint ventures.

Revenue jumped 71.2% to 1.88 billion hkd.

CWP is the only pure vertically-integrated clean energy power play listed in Hong Kong. The firm specializes in solar and wind power operations including power plant investments, and new energy services.

Electricity output generated by its wind power plants and solar power plants was 1,009.62 million kWh and 136.64 million kWh, respectively. In aggregate, this output, which was attributable to CWP, was 14.8% higher year-on-year.

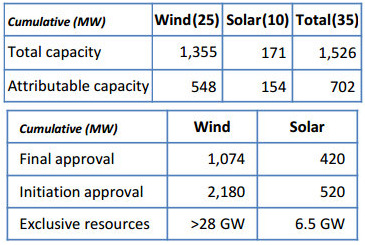

In 2013, four wind power plants (totally capacity of 194MW; attributable capacity of 87MW) and three wholly-owned solar power plants (71MW) were added to the Group, and began operation.

That boosted CWP’s total operational solar power plant capacity to 171MW.

Cooperative deals struck with new business partners including Guodian, Huadian and Huaneng all helped boost CWP’s scale of operation and prestige in the fast-growing green energy sector.

China’s exacerbating problem with air pollution, most notably in major cities like Beijing and Shanghai which are the political and de-facto financial capitals of the nation, have prompted government officials to put unprecedented efforts into cleaning up air quality.

And this is increasingly leading to enviable government policy support for China WindPower and its green peers.

“Favorable subsidies, tax rates, electricity tariff rate trends and overall cooperative local government support all helped our performance last year,” said CWP Executive Director Ms. Samantha Ko.

CWP first added solar plant operations to its wind power-focused business portfolio in 2010.

WindPower had 35 grid connected wind and solar power plants at end-2013 (upper table) with abundant wind power and solar power projects in the pipeline (lower table).As of end 2013, CWP’s wind resources amounted to over 28GW and solar power resources totaled 6.5GW, which the group believes will ensure its sustainable development going forward.

WindPower had 35 grid connected wind and solar power plants at end-2013 (upper table) with abundant wind power and solar power projects in the pipeline (lower table).As of end 2013, CWP’s wind resources amounted to over 28GW and solar power resources totaled 6.5GW, which the group believes will ensure its sustainable development going forward.In 2013, CWP continued to develop projects located in central and southern regions with favorable construction conditions and good grid connection.

CWP obtained 16 final project approvals (total capacity of 740MW) in 2013 from provincial energy authorities, including six wind power projects with total capacity of 300MW and 10 solar power projects with total capacity of 440MW, which are expected to generate good investment returns upon completion.

At the end of 2013, CWP possessed 1,074MW of wind power project approvals and 420MW of solar power project approvals, with these projects expected to be built within the next two years.

CWP chairman Liu Shunxing.“All these business segments delivered remarkable performance in the year,” said CWP Chairman Mr. Liu Shunxing on CWP’s website.

CWP chairman Liu Shunxing.“All these business segments delivered remarkable performance in the year,” said CWP Chairman Mr. Liu Shunxing on CWP’s website.In terms of project development and resources reserves, CWP signed 1,550MW wind power and 1,410MW solar power exclusive development right agreements in 2013.

Huadian Fuxin Energy takes 9.84% stake

On March 19, 2014, Huadian Fuxin Energy Corp Ltd completed subscription of 880,000,000 CWP new shares at 0.43 hkd per share.

The aggregate subscription price amounted to 378.4 million hkd and Huadian Fuxin now owns 9.84% of the issued share capital of CWP.

At least 850MW of wind power project cooperation is expected to develop, with CWP to conduct EPC activities and maintenance while Huadian Fuxin will arrange project financing.

“This is a perfect cooperation between CWP and Huadian Fuxin which leverages both parties’ advantages.

“CWP will be able to further develop its advantages in resources development, EPC and maintenance as well as seeing the obtained cash inflows help further accelerate the development of high-quality PV power generation projects,” said CWP’s Mr. Yang at the time of the announcement.

CWP’s directors do not recommend the payment of any dividend for 2013 (2012: Nil).

Huadian Fuxin (market cap: HK$33 billion) recently completed its subscription of a 9.84% stake in CWP, further enhancing analyst and fund manager interest in CWP. Photo: Company

Huadian Fuxin (market cap: HK$33 billion) recently completed its subscription of a 9.84% stake in CWP, further enhancing analyst and fund manager interest in CWP. Photo: CompanyEnhanced government support in 2014 and beyond “In 2014, China will continue to enhance support for wind and solar power generation. At the national energy conference held in January, China announced plans to install 18GW of wind power capacity and 14GW of solar power capacity during 2014, so renewable energy -- and the CWP -- will experience another bright and promising development period, said CWP Executive Director and CEO Mr. Yang Zhifeng.  China WindPower, which has a market cap of 5.5 billion hkd, has seen its Hong Kong shares trade within a 52-week range of 0.26 – 0.84 hkd, with a recent trailing P/E of 30.05x. China WindPower, which has a market cap of 5.5 billion hkd, has seen its Hong Kong shares trade within a 52-week range of 0.26 – 0.84 hkd, with a recent trailing P/E of 30.05x. Chart: Yahoo Finance |

For more information, view the company's financial statement at the HKEx website.

See also:

CHINA WINDPOWER: 2013 Profit Seen Higher On Green Energy Output, EPC Projects