Jimmy Pun, China New Town’s General Manager of Corporate Finance, meeting with investors in Shenzhen. Photo: Aries Consulting

Jimmy Pun, China New Town’s General Manager of Corporate Finance, meeting with investors in Shenzhen. Photo: Aries ConsultingCHINA NEW TOWN Development Company Ltd (HK: 1278; SGX: D4N) management told investors in Shenzhen that now is the perfect time to invest in the PRC land market given ongoing urbanization and a domestic consumption drive.

And as it is dual-listed in Singapore and Hong Kong, the firm is touting itself as an ideal conduit to China’s land market for non-local investors.

Jimmy Pun, China New Town’s General Manager of Corporate Finance. Photo: Aries Consulting“Now is the best time to invest in China’s land market.

Jimmy Pun, China New Town’s General Manager of Corporate Finance. Photo: Aries Consulting“Now is the best time to invest in China’s land market.“Investing in China New Town is investing in the future of China’s land resources, and we represent a unique offshore platform for direct exposure to the country,” said Mr. Jimmy Pun, China New Town’s General Manager of Corporate Finance.

He was speaking to investors on January 10 at the Aries Consulting-organized “3rd Scaling New Heights – Asia Investment Forum 2014.”

Mr. Pun said that the historic transformation of China a few years ago from a predominantly rural to a majority urban populace, alongside a need to tap into the 1.3 billion-strong domestic market amid a global slowdown, means that China New Town is poised to see its business in the PRC take off.

“Domestic consumption has been considered to be the most important national economic policy while urbanization is the best tool to boost domestic consumption.

“The national leadership has clearly stated that to shift the economy from export-driven to domestic consumption-driven is of the highest priority.”

Limited Policy Shift Concerns

Some investors – both domestic and otherwise – were a bit skittish about investing in China’s real estate market of late for fear of anti-speculative macroeconomic measures from Beijing meant to control housing price inflation.

But CNTD believes some of these policies actually help the dual-listed firm to a certain extent.

“The strict curbing policies have helped to constrict the cost for primary development of land parcels at a reasonably low level,” Mr. Pun said, referring to China New Town’s primary focus on the property industry chain.

He added that the year 2011 represented the period of the toughest curbing policies in the history of China’s real estate sector, and such measures are likely to continue for “a while.”

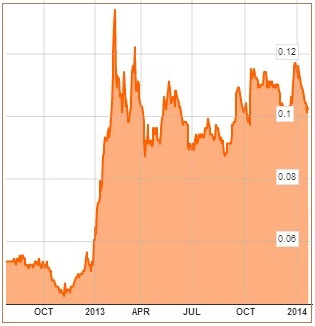

China New Town stock has bounced around in a tight range in the past year or so. Its recent market cap is S$459 million and it has a trailing PE of 35.

China New Town stock has bounced around in a tight range in the past year or so. Its recent market cap is S$459 million and it has a trailing PE of 35. Chart: Bloomberg“However, this all helps to constrict relocation and farmer resettlement costs and major development costs for new towns to reasonably low levels.

“This means a good profit margin in the future.”

China New Town focuses on the planning and development of large-scale, integrated New Town projects in the undeveloped suburbs of some of the PRC’s largest cities, including Shanghai.

Contracts include both management and operational tasks, with commercial property assets also involved.

Given that much of the firm’s properties are developed from agricultural or quasi-agricultural use land assets, the government’s policy on farmer resettlement costs are of especial importance to China New Town.

“The macro-curbing policies have forced real estate companies to take conservative strategies on acquiring lands, but China’s urbanization cannot be slowed.

“Therefore, now is the prime time to enter the land market of the PRC,” Mr. Pun said.

China New Town believes that the fundamental scarcity of land resources in China has not been overly impacted by recent macro measures, which means now is “excellent timing” to enter the market.

This was in line with one of the firm’s mottos: “From bare farmland to a prosperous new town, and to China’s future.”

And given that the dual-listed property developer takes a long-term approach to investing, there was no immediate short-term risk from shifting macro policy or economic downturns expected.

“New Town Development’s business typically takes 5-10 years to complete, spanning 1-2 economic cycles.

“Investors can therefore overcome short-term uncertainty in the economy and benefit from the long-term growth of China.”

China New Town Development currently owns three projects in Shanghai, Wuxi and Shenyang, covering a total area of over 36 square kilometers.

As of end-June 2013, land development for sale totaled 4.9 billion yuan and properties under development stood at 1.6 billion.

In October, China Development Bank International Hldgs (CDBIH) agreed to subscribe for over 5.3 billion newly issued shares of the group for 0.27 hkd per share.

Upon completion, CDBIH becomes a controlling shareholder with 54.32% of the enlarged total issued shares of the China New Town.

See also:

CHINA NEW TOWN Q3 Revenue Surge