AmFraser Research starts coverage of Innovalues with 46.5-cent target

Analyst: Renfred Tay

Goh Leng Tse, executive chairman and CEO of Innovalues. Photo: CompanyWe initiate coverage on Innovalues with a BUY rating at a target price of S$0.465 based on 10x FY15F P/E. Singapore‐based precision metal components maker, Innovalues, has transformed itself from an office automation/hard disk drive supply chain player to now, an automotive parts supply chain player.

Goh Leng Tse, executive chairman and CEO of Innovalues. Photo: CompanyWe initiate coverage on Innovalues with a BUY rating at a target price of S$0.465 based on 10x FY15F P/E. Singapore‐based precision metal components maker, Innovalues, has transformed itself from an office automation/hard disk drive supply chain player to now, an automotive parts supply chain player. Booming automotive market. The automotive markets in China and US have rebounded and been growing steadily after the global financial crisis and are expected to continue growing. Notwithstanding new customer acquisitions, a recovery in the European automotive market and the recent M&A activities conducted by its existing key customers will also add a further boost to Innovalues in the coming years.

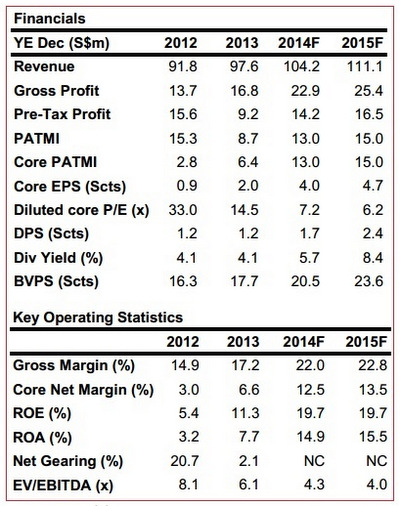

Strong bottom‐line growth through margin expansion. Although we are conservatively expecting revenue to grow at about 7% over the next 3 years, its resultant earnings is expected to grow at 3‐yr CAGR of 38% between FY13‐FY16F through margin expansion.

Source: AmFraser Securities.

Source: AmFraser Securities.

Higher dividends post balance sheet clean‐up. Innovalues has been progressively paying down its debt over the last 6 years, and has just turned net cash in 2Q14. Along with its strong FCF, the company is now in a position to increase dividends.

We expect total dividends for FY14 to be increased to 1.7 Scts (5.7% yield) vs. 1.2 Scts in FY13 and FY12, and continue to grow going forward.

We expect total dividends for FY14 to be increased to 1.7 Scts (5.7% yield) vs. 1.2 Scts in FY13 and FY12, and continue to grow going forward.

Positive insider activity. Recently, its directors, including Chairman/CEO Mr. Goh Leng Tse, have been buying up shares from the open market.

Over the last 2 months, about S$1m was spent by these directors to acquire 4.7m shares (ave. price of S$0.22) from the open market.

Over the last 2 months, about S$1m was spent by these directors to acquire 4.7m shares (ave. price of S$0.22) from the open market.

Clearly undervalued. Innovalues is currently trading at 7.2x FY14F P/E with an expected CAGR of 38% for the next three years.

Given its growth prospects, its high ROE, its transformation in sector focus, renewed balance sheet strength and higher prospective dividends, we believe it would be undemanding to value Innovalues at 10x FY15F P/E, which translates to a target price of S$0.465.

Given its growth prospects, its high ROE, its transformation in sector focus, renewed balance sheet strength and higher prospective dividends, we believe it would be undemanding to value Innovalues at 10x FY15F P/E, which translates to a target price of S$0.465.