Excerpts from analysts' reports

UOB Kay Hian: Stocks for action in 2H2014.

Modest year-end target of 3,400. Our target suggests a limited 3% upside for the market as we impute a 10% discount to long-term P/B and PE valuations on below-trend ROE.

We adopt a bottom-up strategy and look to benefit from selective themes.

UOB Kay Hian: Stocks for action in 2H2014.

Modest year-end target of 3,400. Our target suggests a limited 3% upside for the market as we impute a 10% discount to long-term P/B and PE valuations on below-trend ROE.

We adopt a bottom-up strategy and look to benefit from selective themes.

√ Mixed signals but earnings recovery likely to gain momentum in 2015. Global growth, geopolitical risks and the eventual rise in interest rates are to dictate sentiment, but we expect Singapore’s earnings recovery to gain momentum, particularly in 2015.

Driving earnings are likely banking, telecommunications, plantation and aviation.

Driving earnings are likely banking, telecommunications, plantation and aviation.

√ M&A fever to run high. We reckon M&A will remain in play for the rest of the year as valuations remain inexpensive.

Sectors such as E&P, oil services, healthcare devices and deeply-valued stocks may enjoy trading interest.

Sino Grandness is trading at 3.9x 2014F PE, a huge discount to Hong Kong-listed peers’ 25.0x. Photo: Company

Sino Grandness is trading at 3.9x 2014F PE, a huge discount to Hong Kong-listed peers’ 25.0x. Photo: Company

Sectors such as E&P, oil services, healthcare devices and deeply-valued stocks may enjoy trading interest.

Sino Grandness is trading at 3.9x 2014F PE, a huge discount to Hong Kong-listed peers’ 25.0x. Photo: Company

Sino Grandness is trading at 3.9x 2014F PE, a huge discount to Hong Kong-listed peers’ 25.0x. Photo: Company √ Themes to consider in 2H14. Despite a limited 3% upside for the broader market, we see performance upside from several themes including:

a) M&A and asset monetisation, b) energy proxies, c) riders of regional growth, d) winners and losers of e-commerce, and e) easing regulatory regulations.

a) M&A and asset monetisation, b) energy proxies, c) riders of regional growth, d) winners and losers of e-commerce, and e) easing regulatory regulations.

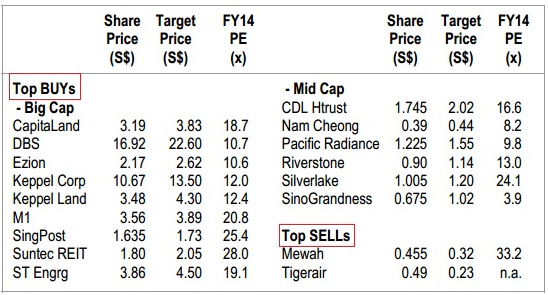

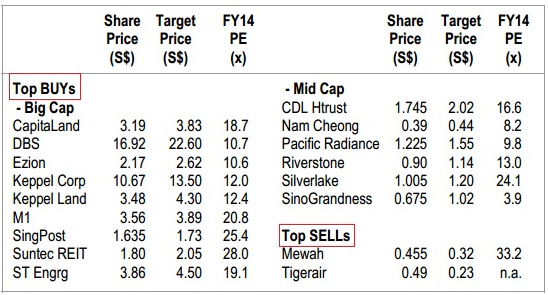

√ Stocks for action. Large-cap BUYs include DBS, Keppel Corp, Suntec REIT, CapitaLand, Keppel Land, Ezion, ST Engineering, M1 and SingPost.

Mid-cap picks include Silverlake, Pacific Radiance, Nam Cheong, Riverstone, Sino Grandness and CD REIT.

Key SELLs include Tigerair and Mewah.

The full UOB Kay Hian report here.

Recent stories:

Mid-cap picks include Silverlake, Pacific Radiance, Nam Cheong, Riverstone, Sino Grandness and CD REIT.

Key SELLs include Tigerair and Mewah.

The full UOB Kay Hian report here.

Recent stories: