Lian Beng and KSH are jointly buying Prudential Tower, which is a five-minute walk from the Raffles Place Interchange and Telok Ayer MRT stations.

Lian Beng and KSH are jointly buying Prudential Tower, which is a five-minute walk from the Raffles Place Interchange and Telok Ayer MRT stations. Photo: Keppel REIT1. Lian Beng – OSK-DMG’s latest report talked about Lian Beng’s purchase of Prudential Tower with 3 other parties.

Based on its projected piecemeal sale price of $2,600 psf compared to the purchase price of $2,219 psf, it is estimated to earn Lian Beng $23.3m if the whole tower is sold (or $5.1m if it is kept for rental). Assuming this is pre-tax, the net EPS due to Lian Beng is about 3.6ct if 100% sale is achieved.

2. KSH – Company is a partner in the Prudential Tower purchase. Based on the same OSK figures, KSH’s share (28% stake) of profit is $20.3875m. Again assuming this is gross profit, net will be $16.7m or about 4.4ct per share. The EPS from this deal attributable to KSH is higher than that to Lian Beng.

KSH is due to report full year earnings, like Lian Beng, next week. I expect an EPS of about 11-12ct, giving the stock a PE of 4-5 times. Lian Beng could report about the same EPS, but its PE will be higher due to its higher stock price.

KSH has quite a bit going on for itself, with good sales from its various JV projects (main ones: Boutiq, Sky Green, KAP, Newest, 3 Flora projects) giving very good earnings visibility for the next 3 years.

In addition, it is launching (soon or in the process) 2 commercial projects which should be quite profitable: Trio at Sam Leong (100% shops) and Hexacube (100% retail and office).

Its recent venture overseas (Cambodia and Malaysia) as well as its good sales in a China project and another potentially huge JV near to Beijing (Oxley is a partner) provide the company with an out-of-Singapore exposure.

OCBC covers the stock, setting a target of 72ct based on SOTP, as the company has a construction arm. My own figures show a RNAV of above $1, taking into account only its development projects and ignoring its construction business. I continue to like KSH and am also keeping an eye on Lian Beng.

3. Fraser Centrepoint – I had meant to write a bit about this counter, but the stock has run up quite a bit over the past week, so I hesitated because I am cautious about a pullback.

The recent rise is in part due to 2 brokerages (including CLSA) starting to cover the counter. You may want to read the analysts’ reports instead as my research on the company is rather scanty at the moment.

Nevertheless, I like Fraser for its ability to monetize its assets, its fantastic execution in the Aussie market (especially Sydney), the imminent listing of its hospitality REIT, and its string of completed and under-construction projects which could later be injected into its baby REITS. In particular, I like its 2 big projects in Yishun and Tanjong Pagar.

4. Heeton – Just a little note here on its Top 20 shareholders: Kim Seng Holdings upped its stake in the company from 15m to 18m shares in 2013, owning now 6.7% in the company. Kim Seng Holdings is a vehicle of Tan Kim Seng of Ezion/Ezra/Swissco fame.

Perhaps they also see the $2 RNAV of Heeton that I am attracted to.

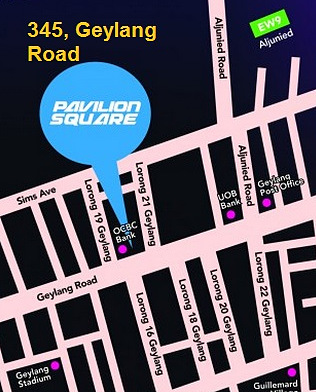

Pavilion Square: Nice address -- 345, Geylang Road -- and nice $30m gross profit to come.5. Pollux – I saw an ad in the Straits Times on Saturday for its Mayfair project, indicating that there are only 3 units remaining unsold. This seems to be a big improvement from 11 that were unsold at end-April.

Pavilion Square: Nice address -- 345, Geylang Road -- and nice $30m gross profit to come.5. Pollux – I saw an ad in the Straits Times on Saturday for its Mayfair project, indicating that there are only 3 units remaining unsold. This seems to be a big improvement from 11 that were unsold at end-April.The company’s 3 East Coast projects (the others are Berkeley and Garden Park) have managed to sell steadily this year, and this is positive.

The problem with this counter has always been liquidity, so hopefully the full year results due this month will lead to a bit more volume traded.

I am hoping that profits from its various projects will start to kick in more meaningfully this financial year, especially with the gradual recognition of possibly $30m gross profit from Pavillion Square (shops and residential) alone.

This compares with its current market cap of only $44m.

Recent story: @ AGM of Bonvests and Hotel Grand Central: Discovering opposites