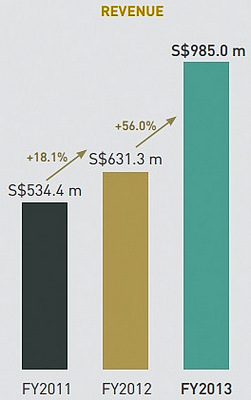

Sales of land parcels totalling S$302 million boosted revenue last year.SINARMAS LAND, listed on the Singapore Exchange and controlled by the Widjaja family, arguably deserves more investor attention than it currently gets.

Sales of land parcels totalling S$302 million boosted revenue last year.SINARMAS LAND, listed on the Singapore Exchange and controlled by the Widjaja family, arguably deserves more investor attention than it currently gets.

Its $252.5-million net profit attributable to owners of the company in 2013 was a record high, and places it among the most profitable companies on the SGX.

It has by far the largest landbank -- 10,000 hectares -- among property developers in Indonesia.

This was one of the key takeaways from our recent meeting with its executive directors Robin Ng and Ferdinand Sadeli, who also is its CFO (based in Jakarta).

Others:

1. S$1.8 billion equity stakes > market cap of Sinarmas Land: Sinarmas Land's 49.87% subsidiary, PT Bumi Serpong Damai Tbk, is the largest property company on the Indonesian Stock Exchange with a market cap of US$2.4 billion.

Sinarmas Land owns an effective 44.16% of another listco, PT Duta Pertiwi Tbk, which has a market cap of about US$720 m.

Sinarmas Land's equity stakes in the 2 companies are worth about S$1.8 billion -- which is even more than Sinarmas Land's S$1.6 billion market cap. That means the rest of Sinarmas Land, as described in the next par, is "free".

That means the rest of Sinarmas Land, as described in the next par, is "free".

2. Diverse and valuable assets: Sinarmas Land is the master developer of BSD City, a satellite city just 25 km southwest of Jakarta.

The township contributes about 63% to its revenue last year (with slightly more than 2,000 residential unit sold).

But Sinarmas Land is more than just about property development.

It has interests in, among other things, hotels and industrial property projects in Indonesia, China property development projects, investment properties in Orchard Towers, Singapore, and an 800-acre freehold resort (Palm Resort Golf and Country Club) near Senai airport in Johor.

And just last year, Sinarmas Land acquired New Brook Buildings, a freehold office building in West End London, for 84 million sterling pounds.

The initial annual yield is close to 6%, the building is 100% tenanted, and the weighted average lease expiry is about 12 years, said Mr Ng.

3. Huge landbank: But "what makes Sinarmas Land stand out is its landbank," said the CFO, Mr Sadeli.

Sinarmas Land has land use rights for 6,000 hectares -- equivalent to 10% of Singapore's land area -- in BSD City in Serpong, the fastest growing suburb of Jakarta.  Robin Ng, executive director, Sinarmas Land.

Robin Ng, executive director, Sinarmas Land.

NextInsight photoOf the 6,000 ha, currently 2,000 ha has been developed since 1984 from rubber plantations, providing housing for about 250,000 people.

"The remaining 4,000 ha can conservatively last 20 years before it's fully completed," said Mr Ng. "The pipeline is long -- the second largest developer in Indonesia would not even come close to us."

Other than in Serpong, Sinarmas Land has another 4,000 ha of landbank, of which 3,000 ha are with the Kota Deltamas project whose planned IPO --- which would have accorded a valuation said to be US$1-billion or thereabouts post-IPO -- has been postponed from last year.

It's next to impossible now to secure landbank of such magnitude, said Mr Ng. "We have entrenched ourselves as the leader in terms of landbank."

Adding to the landbank last year, Sinarmas Land clinched prized freehold land of 6.5 hectares -- previously a golf driving range - in Jakarta CBD next to a site where the tallest building in Jakarta will be constructed by another developer.

Sinarmas Land plans to launch the sale of the residential portion of the development possibly this year but will retain the office section for recurring income. Ferdinand Sadeli, executive director and CFO of Sinarmas Land. NextInsight photoThat ties in with the group's revenue breakdown currently, whereby about 80% is from property development sales and the rest from recurring income (from its office buildings in Jakarta, Medan and Surabaya, 2 hotels in Indonesia, strata-titled units in Orchard Towers in Singapore, etc).

Ferdinand Sadeli, executive director and CFO of Sinarmas Land. NextInsight photoThat ties in with the group's revenue breakdown currently, whereby about 80% is from property development sales and the rest from recurring income (from its office buildings in Jakarta, Medan and Surabaya, 2 hotels in Indonesia, strata-titled units in Orchard Towers in Singapore, etc).

The latest asset to join the portfolio is the office building in London.

4. Unlocking value:One day, Sinarmas Land would like to package its assets into a REIT.

In the shorter-term, it would like to sell off on a regular basis some land parcels.

This was what it did last year when it sold S$302 million worth of land in BSD City to 3 joint ventures.

"This is how it is beneficial to us -- we recognise profit from the portion of the land sold to our JV partners and, later on, the profits when residential units are launched and sold," said Mr Ng.

The gross margin on the land sales to JV partners for co-development was about 85% on the book value.

As at end-2013, Sinarmas Land recorded its land for development at cost (from the 1990s) of about S$801 m. Certainly, the land is worth many times over today.

The company continues to seek landbank.

Given its cash holding of S$688 million as at end-2013, it has ample scope to gear up for acquisitions. Sinarmas Land (53 cents) trades at a trailing PE of 8.9X, dividend yield of 0.94%, and sports a market cap of S$1.6 billion. Chart: FT.com

Sinarmas Land (53 cents) trades at a trailing PE of 8.9X, dividend yield of 0.94%, and sports a market cap of S$1.6 billion. Chart: FT.com

I didn't vest in it as I do not want over exposure to Indonesia, given that I already owned Lippomalls and golden Agri. But given its structure, one possible catalyst is the abundant of opportunities to "financially engineer" to unlock value by selling left hand to right hand. Another bugbear is the low dividends. Currency risk exists, but given IdR is already at a low... So...