Sino Grandness achieved RMB2.27 billion in sales of beverages, canned vegetables and fruits in 2013.

Sino Grandness achieved RMB2.27 billion in sales of beverages, canned vegetables and fruits in 2013.Montage: Annual report 2013IN ITS 2013 full-year results announcement dated 26 Feb 2014, Sino Grandness provided the gross profit, but not the net profit, of its main subsidiary, Garden Fresh.

This was disappointing to investors like me who are looking to estimate the IPO value of Garden Fresh using its 2013 result.

As background, in 4Q last year, Sino Grandness engaged professionals, including investment bankers and lawyers, to start work on the listing of Garden Fresh on the Hong Kong Stock Exchange.

Garden Fresh, which produces loquat and other fruit juices, had issued convertible bonds in 2011 and 2012, and bond holders are likely to convert their lendings into Garden Fresh shares when the listing is secured.

For minimum dilution -- ie, 25% of the shares of Garden Fresh to be issued to the bond holders -- Garden Fresh had to achieve net profits of RMB 70m in 2011, RMB 140m in 2012 and RMB 250m in 2013.

Sino Grandness has indicated that the three profit targets have been met but did not publicise the figures.

Investors of Sino Grandness have been hoping that the Hong Kong listing will unearth the real worth of Garden Fresh.

The IPO valuation will be based on its projected net profit in 2014 which, in turn, will derive to a great extent from its 2013 net profit.

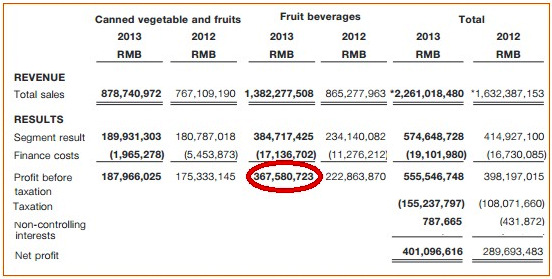

Fortunately, page 106 (see below) of the just-released 2013 annual report provides the pre-tax profit of Garden Fresh: It was RMB 367.6 m in 2013 and RMB 222.9 m in 2012.

| ♦ Garden Fresh stake worth S$ 729 m? |

|

Given that the tax rate of group profit of Sino Grandness in 2013 was 28%, applying this same rate to Garden Fresh's pre-tax profit will give rise to a net profit of RMB 264 m. |