Source: http://www.lme.com/

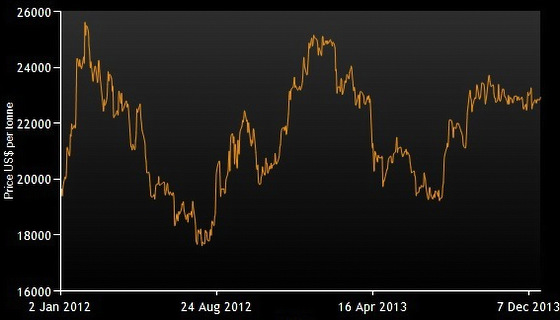

Source: http://www.lme.com/ ABOVE IS THE price movement of tin in the past two years. Since July 2013, the metal has been recovering -- from just above US$19,000 per tonne to almost US$23,000 currently.

The outlook, based on supply and demand, is positive, according to Mohamed Yakub Ismail, chief operating officer of Malaysia Smelting Corp, the second-largest producer of tin in the world.

He pointed out a shortfall in the global tin supply while global demand stayed stable at current levels.

"Hence, tin price is expected to improve gradually over the coming years. In fact, the tin price has already started to improve, since the beginning of this month," Yakub said in August 2013 at the Asian Mining and Energy Investment (AMEI) Forum in Kuala Lumpur in August 2013.

Tin venture agreement: Executive Chairman of CNMC, Prof Lin Xiang Xiong, with Aminudin Hashim, CEO of MB Inc. Photo: CompanyThe price uptrend and, more importantly, the prognosis for the future of the metal spell good news for CNMC Goldmine Holdings, which is listed on the Singapore Exchange.

Tin venture agreement: Executive Chairman of CNMC, Prof Lin Xiang Xiong, with Aminudin Hashim, CEO of MB Inc. Photo: CompanyThe price uptrend and, more importantly, the prognosis for the future of the metal spell good news for CNMC Goldmine Holdings, which is listed on the Singapore Exchange.On 6 December, CNMC announced that its subsidiary, MCS Tin Holdings Sdn Bhd, has entered into a joint venture agreement with Menteri Besar Incorporated (Perak) and its wholly-owned subsidiary, Amanjaya Natural Resources Sdn Bhd.

Menteri Besar Inc is a state investment arm of Perak.

MCS shall hold 80% stake in a joint venture company to be set up to explore and mine potential tin resources in 700 acres of land in Perak, Malaysia. ANR will hold the remaining 20% stake.

Chris Lim, CEO of CNMC Goldmine Holdings, is the son of the chairman, Prof Lin. The latter owns a direct and deemed stake of 30.4% in CNMC. NextInsight file photoCNMC "is optimistic about the outlook for tin. With the projected rising global demand for the metal and a shortfall in supply, tin prices are expected to be relatively robust," said CNMC in its press release.

Chris Lim, CEO of CNMC Goldmine Holdings, is the son of the chairman, Prof Lin. The latter owns a direct and deemed stake of 30.4% in CNMC. NextInsight file photoCNMC "is optimistic about the outlook for tin. With the projected rising global demand for the metal and a shortfall in supply, tin prices are expected to be relatively robust," said CNMC in its press release. The tin venture is coming about at a time when CNMC has started to ramp up production of gold in its Sokor Project in Kelantan.

“This JV agreement fits the growth strategy of CNMC and marks the Group's next phase of strategic business development. Our commitment in the Sokor Project in Kelantan has given potential partners in the mining industry much confidence in us as a responsible and competent mining group in Malaysia," said Chris Lim, the CEO of CNMC.

One can derive insights into the tin industry's dynamics and prospects by referring to recent presentation materials of Yakub of Malaysia Smelting Corp.

Yakub said:

4. In 2012, an estimated 70,000 tonnes of crude tin (not refined tin) were produced and exported by private Indonesian tin smelters. This export is being significantly reduced by the implementation of a ban by the Indonesian Government. Only the export of refined tin is allowed from 1 July 2013.

One can derive insights into the tin industry's dynamics and prospects by referring to recent presentation materials of Yakub of Malaysia Smelting Corp.

Yakub said:

1. The present and future of tin mining is the mining of deep seated deposits by underground mining methods which will be at higher costs, to be balanced by higher grades of these deposits, in order to be viable.

2. At current tin prices, most future potential tin deposits worldwide are not economical to be mined.

3. In Malaysia, there is an estimated potential tin resource of about 900,000 tonnes valued at USD 18 billion (@ USD20,000 per tonne).

3. In Malaysia, there is an estimated potential tin resource of about 900,000 tonnes valued at USD 18 billion (@ USD20,000 per tonne).

4. In 2012, an estimated 70,000 tonnes of crude tin (not refined tin) were produced and exported by private Indonesian tin smelters. This export is being significantly reduced by the implementation of a ban by the Indonesian Government. Only the export of refined tin is allowed from 1 July 2013.

5. The consumption of tin is expected to be maintained at the average level of the past 6 years, which is about 350,000 tonnes of refined tin metal per year.

6. New, large scale hard rock mine projects will take several years to come on-stream. Hence, tin price is expected to improve gradually over the coming years.

6. New, large scale hard rock mine projects will take several years to come on-stream. Hence, tin price is expected to improve gradually over the coming years.

Tin mine of Rahman Hydraulic Tin, a subsidiary of Malaysia Smelting Corp (MSC) which produces about 2,100 tonnes of tin metal per year, or about 60% of Malaysia’s total tin production. Photo: MSC

Tin mine of Rahman Hydraulic Tin, a subsidiary of Malaysia Smelting Corp (MSC) which produces about 2,100 tonnes of tin metal per year, or about 60% of Malaysia’s total tin production. Photo: MSCTo view Yakub's Powerpoint materials, click here.